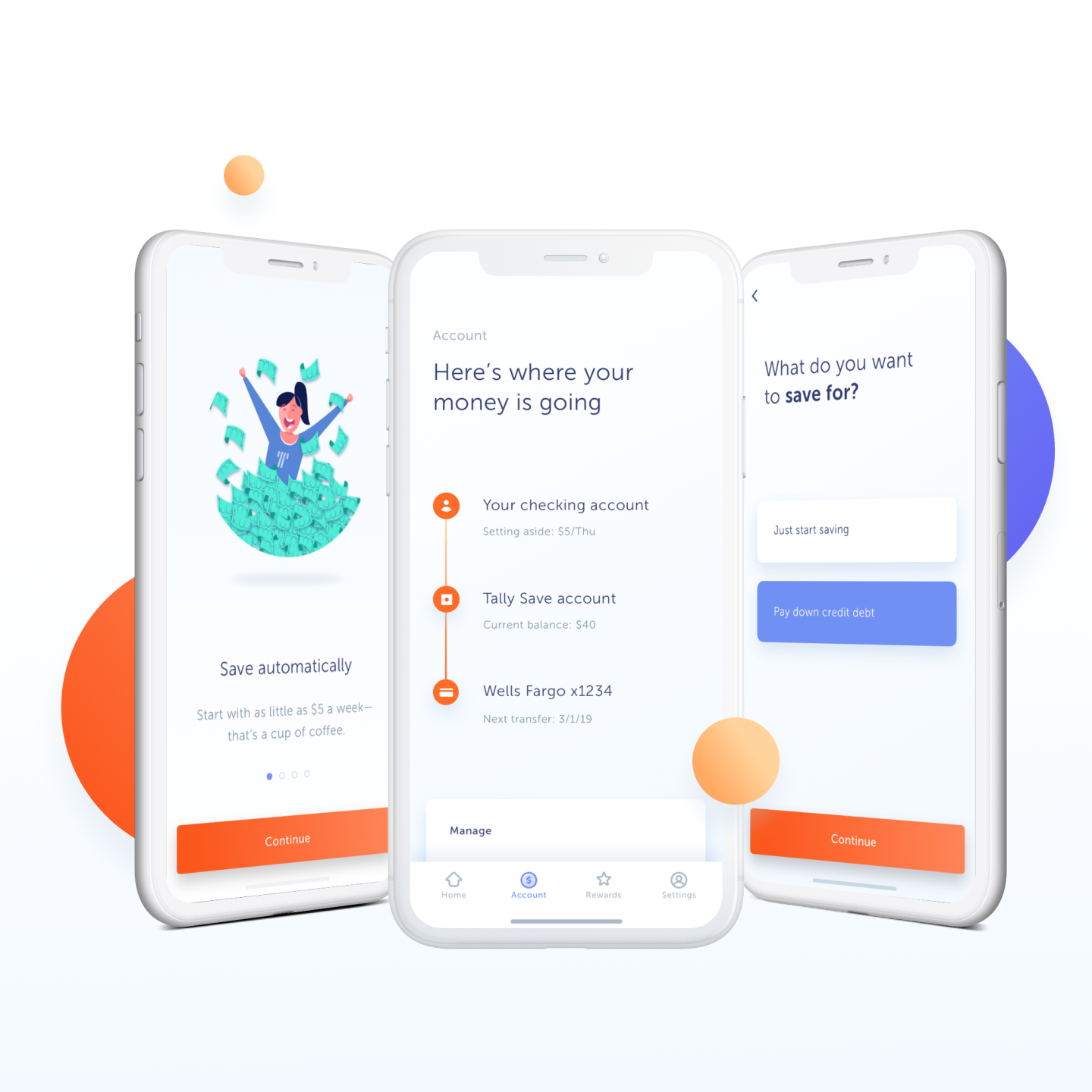

Tally, a financial technology startup based in San Francisco, is debuting a service that it claims is “the only free automated savings service” for consumers.

The 4-year-old startup, known for automating people’s credit card debt payments, is expanding beyond its initial product, which debuted last year, into one that automatically transfers a pre-set amount of money from consumers’ checking accounts into a savings account each week. Tally will not pay customers interest on the new accounts, which are held by FDIC-insured bank partners, says Jason Brown, Tally’s cofounder and CEO.

“It’s actually reasonably expensive to provide this service to people,” Brown says. “Because we have a strong revenue model,” he adds, “it allows us to give away some of the automation for free.”

Tally’s existing business model involves loaning funds to credit card debtors based on their credit scores, bundling these loans into asset-backed securities, then selling the bundles to investors. The company makes money by charging customers interest on the loans, though at a lower rate than banks charge on credit card debt.

Brown projects the automatic debt payment service, which is available in 28 U.S. states plus Washington, D.C., will save people on average $5,000 in total interest on their debt repayments.

Tally’s new savings service, while free for consumers and available everywhere in the U.S., will cost the company. Brown says that between bank transfer fees and engineering support for integrations with banks, Tally will lose money on each customer, but “not so much that we’re going to ever need to charge for it.”

Brown declined to reveal how much money the company would lose per customer.

Many banks and so-called fintech upstarts are debuting fee-less, automatic savings accounts as well. But unlike Tally, which says it is compatible with any bank or credit union in the U.S., competitors often require customers to choose and stick with one particular bank.

Bank of America, for instance, offers one such automatic savings service through its “keep the change” app, while Clarity Money, scooped up by Goldman Sachs’ consumer bank Marcus last year, offers another. Chime, a startup privately valued at $1.5 billion after a recent venture capital fundraising round, offers yet another service challenging the stalwarts.

Tally’s other rivals, including Digit and Qapital, support a wider variety of banks, but they charge fees. Robinhood, an upstart brokerage that announced plans to roll out a “checking and savings account” service that would pay customers 3% interest on deposits, put the program on ice last year after facing regulatory heat.

Tally has raised $42 million in three fundraising rounds to date, the latest of which was led by Kleiner Perkins, a Silicon Valley venture capital firm. Brown and his cofounder, Jasper Platz, Tally’s president, had previously cofounded Gen110, née Solmentum, a solar energy financing startup that was acquired in 2013.

Brown describes his ultimate ambition as fully automating customers’ financial lives. He aims to accomplish with technology what he says teams of financial advisors, money handlers, and tax lawyers based in Greenwich, Conn., provide to wealthy clientele: “completely outsourcing financial decision-making and work,” he says.

Adds Brown, “We’re now in a sprint to full financial automation.”