The Canadian government’s decision to buy the Trans Mountain Pipeline and expansion project for 4.5 billion Canadian dollars has left many wondering: What is Prime Minister Justin Trudeau thinking?

All around the world, decisions to drill new oil wells; frack for gas; mine new coal; and build pipelines, ports, and fossil-fueled power stations are attracting determined opposition from scores of ordinary citizens.

People are mobilizing to protect local land, water, and air from pollutants and demand good governance in the face of opaque processes and corrupt corporate-government deals. They are increasingly invoking an emerging principle that connects these projects to climate change: In a world facing catastrophic global warming, new fossil fuel projects are morally wrong. To this moral message is added a prudential one: As the transition away from fossil fuels gathers pace, new fossil fuel projects become economically risky propositions.

The Trans Mountain expansion project typifies all of these concerns. It has attracted vociferous opposition from a broad coalition in Canada, the U.S., and beyond. To the project’s proponent, Texan multinational Kinder Morgan, the multiplicity of concerns and the groups voicing them represent risks to the project’s profitability. So crippling were these risks that Kinder Morgan refused to proceed with the project unless it could offload them onto third parties.

Enter Trudeau.

The Trudeau government thinks it can manage these project risks and turn a profit, or at least break even, from the expanded pipeline. If the Canadian government profits, it will be at the expense of trampling on First Nations’ land rights and exposing communities to oil spills. (The recent Kinder Morgan spill in British Columbia was 48 times larger than first reported.) Even if the government successfully finds a buyer for the pipeline, it will more than likely need to sell it at a steep discount, leaving Canadian taxpayers on the hook.

Furthermore, profiting from this pipeline would mean the world has failed to carry out the clean energy transition within the timeframe set by the Paris climate agreement.

The expanded pipeline is intended to carry oil from new tar sands projects, which is estimated to have a break-even price at around US$60 a barrel. Yet achieving the Paris agreement goals requires global oil demand to peak very soon and rapidly decline, which would lead to a falling oil price. As a 2015 paper published in Nature concluded, “any increase in unconventional oil production,” including from Canada’s tar sands, “is incommensurate with efforts to limit average global warming to 2 degrees Celsius.”

If any or all of these valid concerns cause the Trans Mountain project to fail, then Canadian taxpayers will be on the hook for the commercial liabilities of a dud investment. It’s lose-lose for Canadians.

The Trudeau government’s pipeline purchase is strikingly at odds with its own domestic climate policy. The government has embraced demand-side measures that seek to reduce the burning of fossil fuels within Canada, with plans for a national carbon price and to phase out coal-fired power stations. But demand-side measures are insufficient without efforts to tackle the production of fossil fuels. As with efforts to control tobacco, lead in petrol, asbestos, ozone-depleting gases, and a host of other toxic products, successful strategies involve “cutting with both arms of the scissors”: demand and supply. But worse than neglecting the supply-side arm, Trudeau’s support of tar sands development will grow the very stock of carbon dioxide in the atmosphere that its demand-side policies are supposed to cut.

Far from investing in oil pipelines, Canada should at minimum join other leading countries—such as France, New Zealand, Ireland, Belize, and Costa Rica—to ban new fossil fuel supply projects. As well as preventing new sources of emissions growth, the symbolic power of such bans helps build global anti-fossil fuel norms. These norms help increase the reputational cost to politicians who support fossil fuel expansion—just like bans on nuclear testing helped relegate that practice to the status of “rogue state” activity.

Trudeau cannot deny the power of leadership by example on fossil fuel supply. Canada and the United Kingdom co-founded the Powering Past Coal Alliance, whose members commit to encouraging peers to abandon coal production.

In truth, the world needs to power past all fossil fuels. Canada’s pipeline purchase is part of the problem and makes this crucial task more difficult.

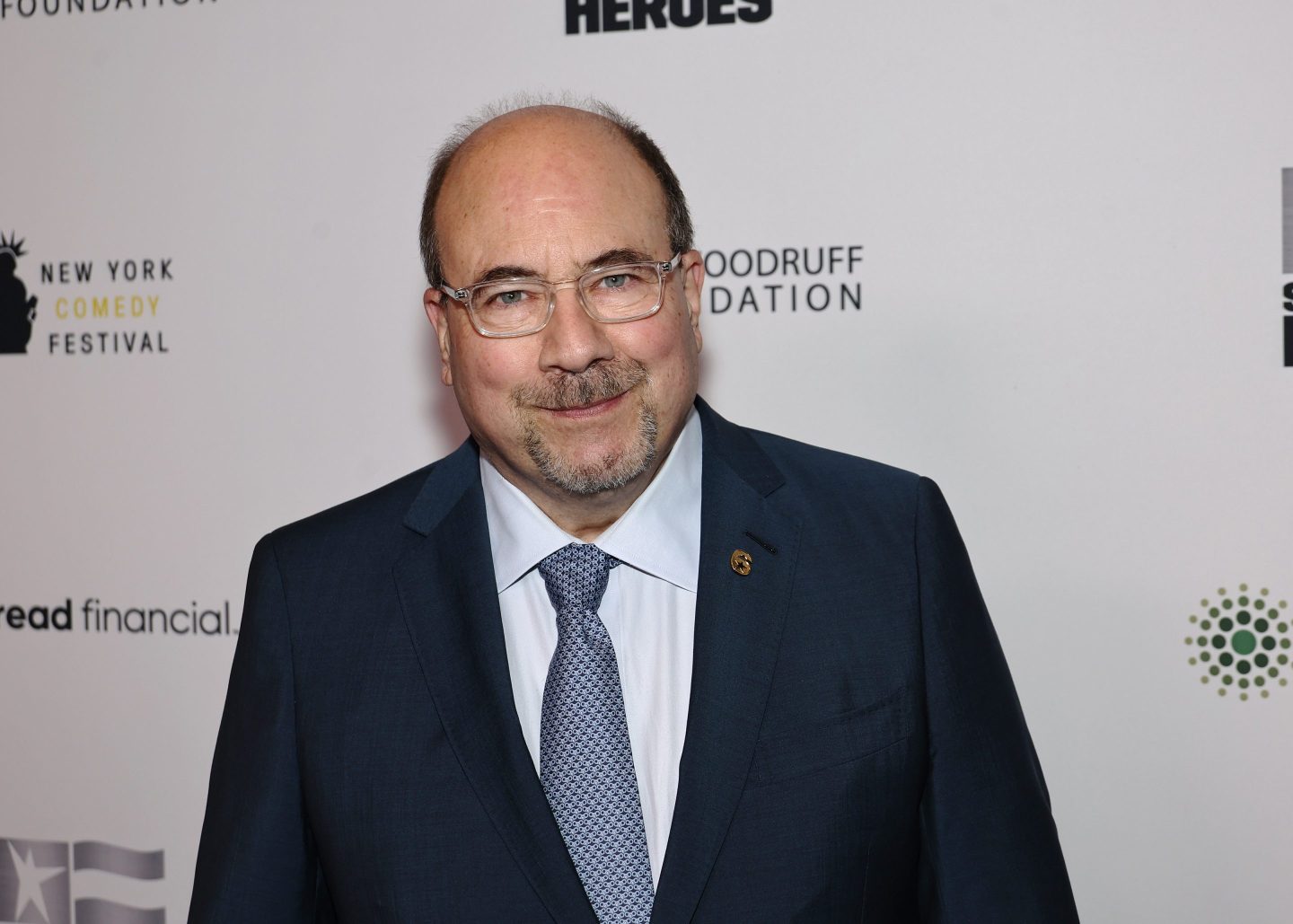

Richard Denniss is the chief economist at the Australia Institute. Fergus Green is a researcher at the London School of Economics and Political Science. They co-authored “Cutting With Both Arms of the Scissors: the Economic and Political Case for Restrictive Supply-Side Climate Policies,” published in the academic journal Climatic Change.