Despite being one of the wealthiest countries in the world, the U.S. does not impress when it comes to basic knowledge of personal finance. Several studies have concluded that the average American does not know enough about how to best handle everyday financial decisions. This lack of knowledge might be due to poor financial planning — or it might be because most people don’t understand simple finance terms and concepts.

GOBankingRates conducted a survey that measured respondents’ knowledge of fundamental financial terminology and concepts in personal finance to get a better feel for the average American’s level of financial literacy. The questions included:

- Which of the following describes a 401k?

- What does a CD offered by a bank stand for?

- What is net worth?

- What does HELOC stand for?

- Which of the following does not impact your credit score?

- What are the three major credit bureaus?

Across all questions, roughly half to two-thirds of respondents answered correctly, meaning there is a sizable minority of people who never learned some basic money skills. In what ways were respondents tripped up by these questions? To start, check out what Americans think describes a 401k.

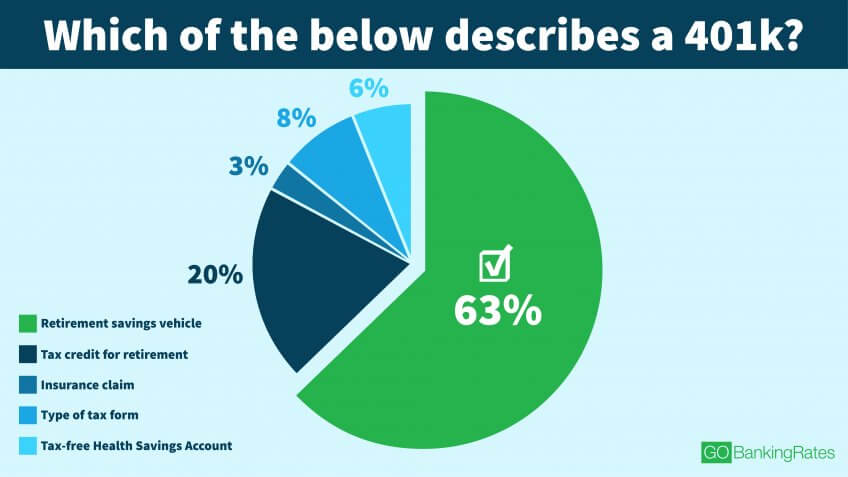

Nearly 40% of Americans can’t describe a 401k

Results for the question, “Which of the following describes a 401k?” were encouraging in that nearly two-thirds (63 percent) selected the correct answer for this basic finance term: “Retirement savings vehicle.” Twenty percent of respondents answered “Tax credit for retirement.” While not correct, this answer indicates that respondents at least knew that 401ks are related to retirement.

With just 63 percent answering correctly, that means nearly two-fifths of respondents were incorrect. Here’s a closer look at how different age groups answered.

- People ages 55 to 64 had the most correct answers, with 76 percent choosing “Retirement savings vehicle.”

- More than 60 percent of respondents aged 25 and older (five age groups total) answered correctly.

- The age group with the fewest correct answers was the 18- to 24-year-old group (43 percent).

The furthest away from retiring, it might be understandable that young millennials (ages 18 to 24) would know the least about a retirement vehicle like a 401k. But still, for every age group — excluding 55- to 64-year-olds — at least one-fifth incorrectly selected “Tax credit for retirement” as the answer.

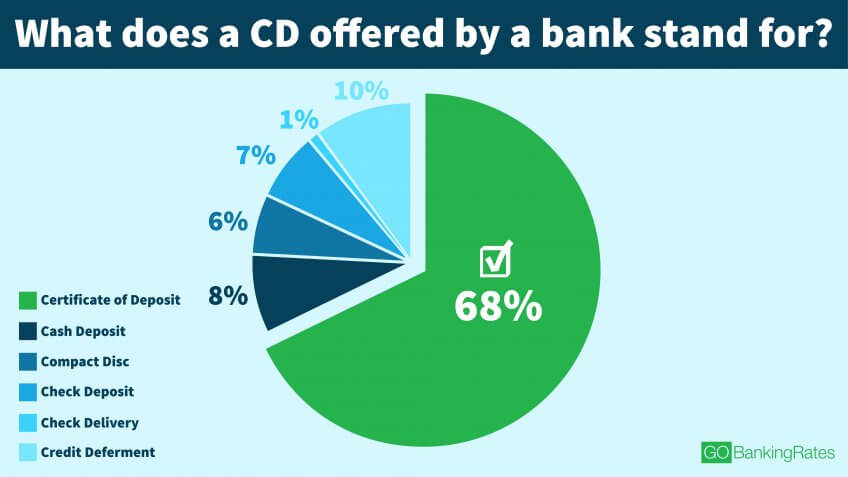

Most young millennials don’t know what CD stands for

Survey question two asked, “What does a CD offered by a bank stand for?” Of all the survey questions, this one garnered the most correct responses. Sixty-eight percent of respondents correctly selected “Certificate of Deposit.”

Women had a higher percentage of correct answers than men (71 percent vs. 65 percent). However, the age breakdown reveals larger gaps about what a certificate of deposit is.

- Only 36 percent of young millennials (18- to 24-year-olds) answered correctly.

- 60 percent of correct responses — the second-lowest percentage — came from older millennials (25- to 34-year-olds), followed by younger Gen Xers (35- to 44-year-olds) with 71 percent correct.

- 80 percent or more of respondents aged 45 and older answered correctly.

A CD account is a basic type of bank account — alongside savings and checking accounts — and tends to have higher annual percentage yield (APY). Not knowing about CDs could mean missing out on an easy way to grow your wealth.

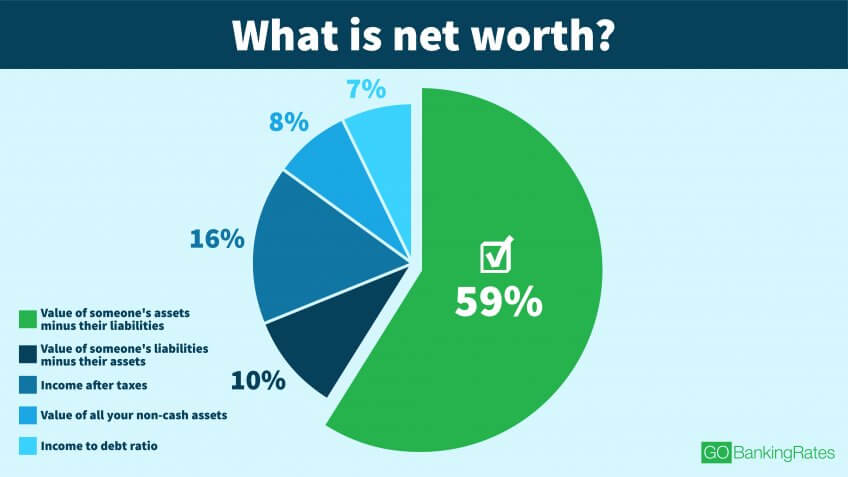

Net worth has uncertain meaning across all age groups

The question “What is net worth?” evoked a lot of incorrect answers. In fact, only 59 percent of respondents selected “Value of someone’s assets minus their liabilities,” the correct formula to calculate your net worth.

- The incorrect response with the most answers was “Income after taxes.” Sixteen percent of respondents thought this answer defined this basic finance term.

- More men answered the question correctly than women (64 percent vs. 56 percent); however, both genders had sizable portions tripped up by the answer “Income after taxes” (15 percent male vs. 17 percent female).

- People ages 45 to 54 had the fewest correct responses (55 percent), followed by 18- to 24-year-olds (56 percent). Fifty-nine percent of people ages 35 to 44 and 65 and older answered the question correctly.

Perhaps what was tripping respondents up was the word “net,” because net income after taxes (NIAT) is an established accounting term. Like net worth, NIAT is an important concept to know, and you should be making efforts to increase your take-home income.

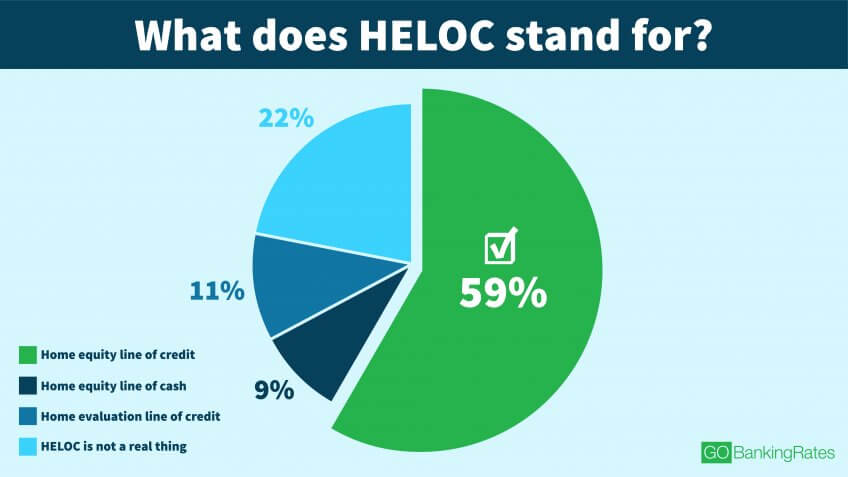

More than a fifth of Americans think HELOC is a made-up term

The fourth survey question — “What does HELOC stand for?” — tied with question No. 3 for the most incorrect responses. More than one-fifth (22 percent) of respondents chose the answer “HELOC is not a real thing.” In reality, home equity lines of credit (HELOCs) are very real.

Unlike some of the other questions, there wasn’t as clear a correlation between ages and financial knowledge for this question.

- The age group that most often selected the correct answer was 35- to 44-year olds (68 percent), followed by 55- to 64-year-olds (63 percent) and 18- to 24-year-olds (60 percent).

- The age group with the highest percentage incorrect were people aged 65 and older, with only 52 percent answering correctly. This group was followed by 25- to 34-year-olds (55 percent) and 45- to 54-year-olds (57 percent).

- More males than females got this correct (63 percent vs. 55 percent). For both, the most popular incorrect answer was “HELOC is not a real thing.”

What is most interesting about the age breakdown is the high percentage of retirement-age respondents who answered incorrectly. Not only were barely half of these respondents correct, almost a third incorrectly chose “HELOC is not a real thing.” This could reflect an increasing popularity in the use of HELOCs in recent years compared to the past.

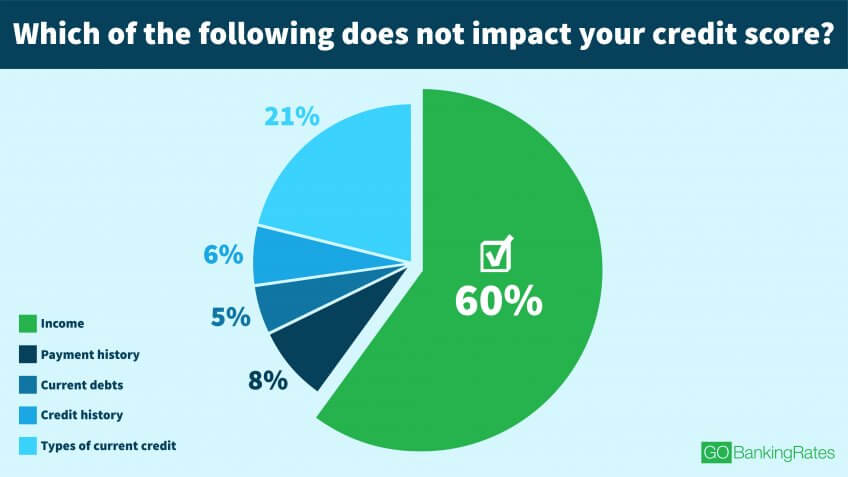

Gen Xers know what impacts credit scores, Boomers worst

Like question No. 4, the survey question, “Which of the following does not impact your credit score?” did not break down neatly along demographic lines. Only 60 percent of respondents selected the correct answer of “Income,” meaning two-fifths of people might not know all the factors that can impact their credit score.

- More females than males answered this question correctly (64 percent vs. 56 percent), with nearly a quarter of men incorrectly choosing “Types of current credit” as not having an impact.

- The age group with the fewest correct responses was people aged 65 and older (55 percent), followed by 55- to 64-year-olds (57 percent) and 18- to 24-year-olds (59 percent).

- The age group with the most correct responses was people aged 35 to 44 (73 percent), followed by 25- to 34-year-olds (65 percent) and 45- to 54-year-olds (63 percent).

- Two age groups — people aged 65 and older and 55- to 64-year-olds — had more than a fifth wrongly choose “Types of current credit,” with nearly 30 percent of people ages 55 to 64 selecting this answer.

It is understandable “Types of current credit” garnered the highest percentage of incorrect responses because this factor accounts for a mere 10 percent of credit score points. That said, knowing all the factors that impact your credit score is essential to building and maintaining a good credit score.

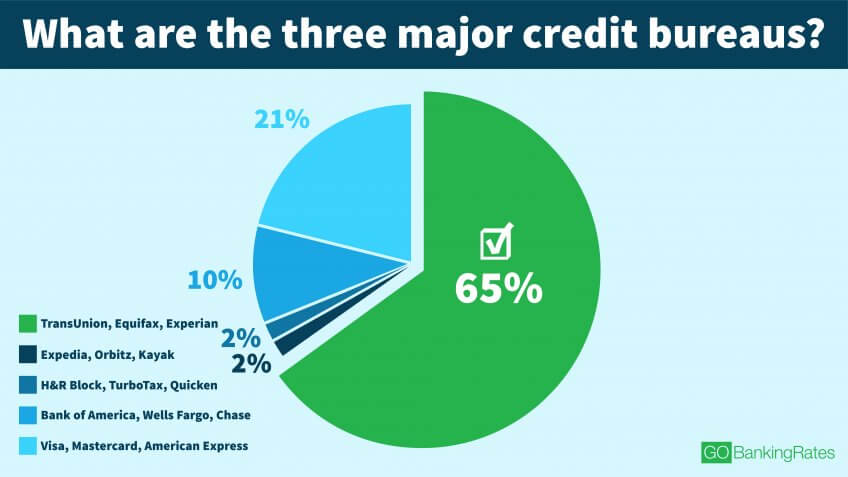

Not even a third of young millennials know the major credit bureaus

Most respondents (65 percent) correctly identified TransUnion, Equifax and Experian as the three major credit bureaus in the U.S. There was only single percentage difference between men and women respondents for this question. However, once again, the breakdown of respondents by age revealed far more:

- For the five age groups consisting of people 25 years and older, more than 60 percent answered correctly.

- Older Gen Xers (45- to 54-year-olds) answered correctly most often at 85 percent.

- A mere 29 percent of 18- to 24-year-olds answered correctly, the lowest percentage of correct answers in the whole survey. Twenty percent of this group answered, “Bank of America, Wells Fargo and Chase” and 46 percent wrongly chose “Visa, Mastercard, American Express.”

Why do nearly half of young millennials think Visa, MasterCard and American Express are the major credit bureaus? Perhaps it’s because they have had fewer situations that require pulling their credit scores, such as applying for an apartment lease or home mortgage. Or perhaps its because it’s easy for 18- to 24-year olds to get approved for credit cards.

What is known is that much of a person’s knowledge of finance terms is learned through life experience. Getting your financial education started early is essential to make up for that lack of experience.

This article originally appeared on Gobankingrates.com