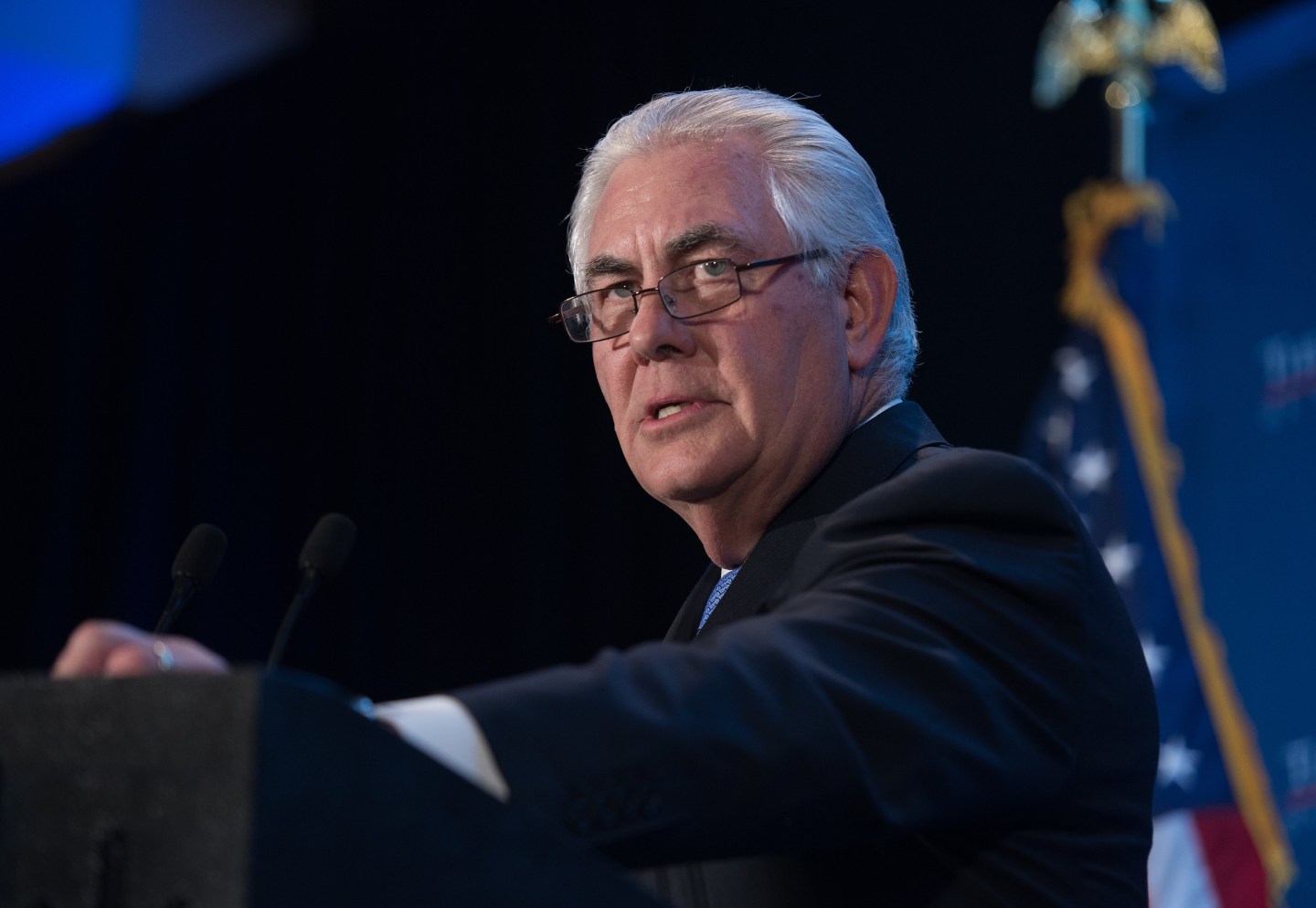

Given all the candidates he considered, President-elect Donald Trump apparently had a tough time deciding on whether to pick Rex Tillerson, the CEO of oil giant Exxon Mobil, for Secretary of State.

Now, Tillerson’s soon-to-be ex-board members may have an even tougher call to make when it comes to what to do with his nine-figure bundle of Exxon Mobil (XOM) shares.

Normally, Trump’s State Department pick would be looking at an enormous windfall, no strings attached. He took the lead job at Exxon in 2006, after joining the company 41 years ago. It’s the only company Tillerson has ever worked for. Over that time, he’s amassed just over 2.6 million shares of the oil giant, which—at Exxon’s current price of $92.75—are worth just under $245 million.

That fortune locked up in Exxon stock could now become, as they say on Wall Street, liquid. The appointment would allow Tillerson to sell those shares to prevent conflict of interest issues, and he could do so without the normal stigma of a CEO ditching his own company’s stock.

What’s more, Tillerson could at least temporarily avoid an eight-figure tax bill. Back in the early 1990s, George H.W. Bush’s administration added a loophole to the tax code that allows political appointees to defer any capital gains taxes they would have to pay on investments they have to divest. The main requirement is that you reinvest the money immediately into a diversified mutual fund.

So Tillerson, who was facing mandatory retirement early next year anyway, could get a new job, the ability to diversify his portfolio away from just owning one stock—Exxon—and defer as much as $61 million in taxes. Seems like an easy career move.

The problem: Because of the way Exxon has set up its compensation plan, the bulk of Tillerson’s shares don’t actually qualify for the government divestiture tax loophole. What’s worse, Exxon, unlike Goldman Sachs and nearly every big bank, never set up a policy for what to do to when a top executive leaves for public office.

The result: Either Tillerson walks away from as much as $190 million in stock, or he keeps the giant windfall but ends up ponying up tens of millions in taxes immediately. Either way, Exxon faces big questions about the depth of its commitment to long-term thinking and its shareholders.

“It’s sort of a perfect storm,” says Alan Johnson, who is one of the country’s top executive pay consultants. “You have a well-constructed compensation plan that, in this case, is making everything worse.”

None of the options, unless someone bends the rules, look all that good. Exxon and Tillerson declined to comment for this story. Here are three ways this could play out:

Rex Doesn’t Sell

Tillerson holds just over 2.6 million Exxon shares. But he actually only technically owns 611,087 outright, or nearly $57 million worth. The rest are so-called restricted stock units. He holds the shares, and even collects the dividends they pay out, but he doesn’t technically own the shares, and it would be a while until he can.

Just over 1.3 million of those shares don’t vest—meaning fully become Tillerson’s property—until 2025. That’s a problem logistically, but also for the divestiture rules. The tax loophole that allows individuals taking government jobs to defer capital gains taxes only applies to stock that you fully own. RSU, on the other hand, are taxed as income when they vest, which Tillerson can’t avoid paying even if he rolls the shares into a mutual fund.

What Tillerson May Do: Sell what he can now, and pledge to sell the rest when he can, knowing that there will likely be more than a hundred million dollars of Exxon stock waiting for him after he exits the State Department.

The Upside: It’s the best plan for Tillerson’s bank account. He would be able to defer as much as $14 million in taxes from the stock sales that do qualify for the government’s divestiture rule, and he would be able to move $57 million of his assets into a diversified mutual fund, which is better for financial planning purposes than holding one stock.

He would have to pay taxes and sell some of his Exxon RSU when they vest, but only 450,000 shares, or less than a quarter of his remaining bounty—$42 million at current prices—are set to vest in the next four years. That means Tillerson would have to pay roughly $16 million in taxes. The rest of his shares could eventually be taxed at the lower capital gains tax, but that could be years from now. Rex exits with: $228 million.

The Downside: A huge conflict of interest remains. Tillerson will know that roughly 1.3 million shares of Exxon’s stock will be waiting for him after he leaves the State Department. And few companies could be helped or hurt more by the State Department than Exxon. Every modern secretary of state has spent a good portion of time and effort in the oil-rich Middle East.

What’s more, there are certain countries where payments from Exxon serve as the biggest source of government revenue. Tillerson would probably have to recuse himself, not just from any decision that impacts Exxon, but any decision that affects the oil industry in general. “That would make it all but impossible to do the job,” says Jordan Libowitz, a spokesperson for nonprofit Citizens for Responsibility and Ethics in Washington.

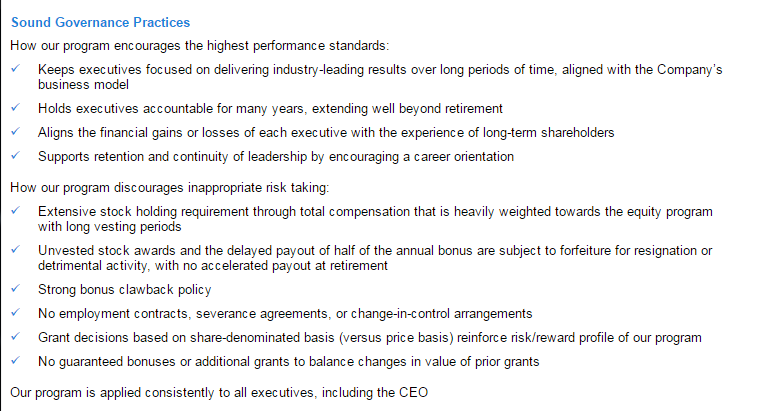

Exxon’s Board Lets Rex Fully Cash Out

Exxon prides itself on how it does executive compensation, which gets high grades from consultants. Stock awards are paid over a decade. No golden parachutes. No severance agreements. No immediate vesting on retirement. Leave the company before retirement? Kiss your unvested stock goodbye. No exceptions. “Our program is applied consistently to all executives, including the CEO,” says the company in its annual proxy statement.

What the Board May Do: Despite the rhetoric, Exxon might still make an exception this time. Compensation consultant Alan Johnson says leaving the conflict intact will bring unwanted scrutiny not just to Tillerson, but to Exxon.

Remember the publicity Halliburton got after former CEO Dick Cheney became vice president? In fact, the proxy statement says that while early retirement puts an executive at risk of forfeiting their unvested stock bonuses, the compensation committee could approve a retention of awards.

Still, there’s no provision in the proxy for vesting restricted stock early, which is what the Exxon board would have to allow Tillerson in order to cash out without giving up a huge chunk of his net worth. Despite what it says in the proxy, Johnson says corporate boards can basically do whatever they want when it comes to compensation, including making rules that apply to one executive, one time only.

The Upside: It would remove a big conflict of interest for Tillerson and Exxon. Promising to fully divest his shares would also likely make it easier for Tillerson to get approved by Congress.

The Downside: Exxon would lose some of its credibility, especially after the whole “no exceptions” thing. It would become harder for the company to say no to other exceptions, undermining its pay structure. And it also doesn’t totally remove Tillerson’s conflict of interest, as Exxon’s exemption for him would lead some to believe that he would have to try to repay the company somehow. Even though Tillerson wouldn’t lose the options, he would still face a big tax bill of nearly $75 million, given that the RSU would be taxed as income. In this scenario, Rex exits with: $171 million.

Rex Rejects $190 Million

It’s plausible that Tillerson may actually care more about serving his country and Exxon’s reputation than his bank account. If that’s the case, he could announce that in taking on the job of secretary of state, he would forfeit his restricted stock and walk away from the nine-figure Exxon stock holding that he’s taken four decades to build. (Also, pigs may fly.)

The Upside: Tillerson wouldn’t have any financial interest in Exxon, and there would be no perception that he owed the company a favor. The move would likely make it much easier to get approved by Congress, taking the conflict of interest issue out of the story. Exxon would save face by not having to make an exception to its policy when it said it wouldn’t.

The Downside: Tillerson’s bank account would end up much smaller than it otherwise would be. But for the rest of us, that doesn’t change much. Other political appointees might have to do the same. Rex exits with: $57 million, and a clean conflict bill.