The Federal Reserve’s interest-rate setting committee on Wednesday said that it would raise interest rates by a quarter of a percentage point to between 0.50% and 0.75%. It is only the second time the U.S. central bank has raised interest rates since 2006, when the economy was yet to be hit by the financial crisis.

The move was widely expected, as a falling unemployment rate and rising wages signaled to the Federal Open Market Committee (FOMC) members—the Fed’s interest rate policy-making body—and the market that overall price increases would soon meet and potentially surpass the central bank’s goal of 2% per year. Markets in particular have begun to change their minds on the topic of inflation. The election of Donald Trump has convinced many that deregulation of business and higher government deficits will lead to faster growth and rising prices.

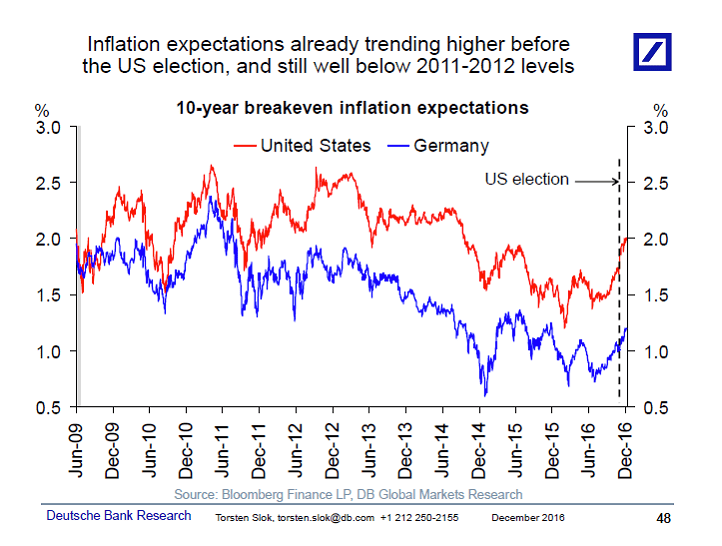

As the chart above shows, differences between the yields on U.S. government bonds and inflation-protected bonds indicate that investors believe higher inflation will soon be on the way. That said, inflation expectations remain well below historical norms, and even below levels seen a few years ago when the economy was weaker. This reinforces the Fed’s slow approach to further increases. “The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate,” the Fed’s statement reads. “The federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.”

The decision to raise rates was unanimous, indicating that Janet Yellen has been successful in satisfying both FOMC members who want rates to go up faster to blunt inflation and those who believe interest rates should be kept low to nurse the convalescent economy.

Though the Fed appears to still want to take things slow, there were signs it could move faster if the economy continues to improve. Data released along with the Fed announcement showed that the majority members of the FOMC now forecast three rate hikes in 2016, up from two in September. Shortly after the meeting, bond yields rose on the prospect of faster rising interest rates in 2017.

On the other hand, stock markets fell shortly after the decision, underscoring the general uncertainty among market participants as to whether the Fed is striking the right balance between heading off inflation and providing adequate stimulus for the economy.