The sun could start setting on the “Hydrocarbon Age” within a decade if the world gets serious about implementing the Paris Accord on limiting climate change.

That’s not the dream of eco-warriors wishing away the realities of global energy trends. That is the opinion of the Organization of Petroleum Exporting Countries, as expressed in its latest outlook for the world oil market.

The forecast underlines how the development of new technologies and the political constraints of pollution-choked emerging markets have turned on its head worries about “peak oil” that dominated thinking barely a decade ago. Whereas concerns once centered on the exhaustion of a finite resource, they are now focused on how quickly new and cleaner technologies will substitute it.

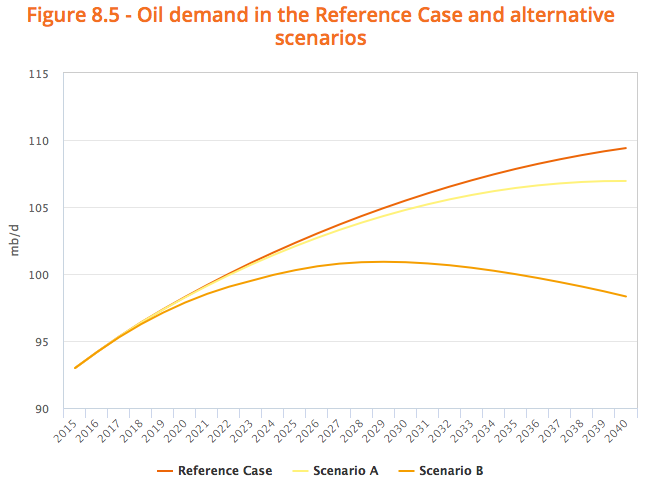

Admittedly, it’s still not the base case scenario for the cartel that accounts for over a third of world oil supply. That still sees oil demand still on a rising trajectory (if only just) at a little under 110 million barrels a day of crude by 2040. That compares to global demand of an estimated 94.2 million b/d this year.

But in two “alternative scenarios,” the Vienna-based group expects demand to peak earlier, as countries around the world invest both in saving energy and in getting it from other, more environmentally friendly sources. In the most aggressive scenario, which assumes an accelerated timeframe for the adoption of electric vehicles and other alternative fuels, demand peaks at 100.9 million b/d

Although it wouldn’t admit it, OPEC’s figures belie the bitter current dispute over its strategy, the latest installment of which is due at the end of the month when ministers will supposedly meet to agree to their first coordinated output cuts since 2009. For the last two years, Saudi Arabia has pressed its partners into accepting lower prices, warning that if they try to squeeze prices back to boom-era levels, then new technologies will eat their lunch faster than you can say “bankrupt petrodollar state.”

OPEC isn’t even the most alarmist in terms of Peak Oil Demand: Simon Henry, chief financial officer of Europe’s largest oil and gas producer Royal Dutch Shell plc (RDS-A), said last week that oil demand may peak “between five and 15 years hence.” But Shell, too, has its agenda: its forecasts owe much to the fact that it expects oil to be superseded in many parts of the world economy by natural gas, a resource it has an awful lot of–especially after its massive bet on acquiring BG Group last year.

The forecasts thus have very clear real-world implications for oil and gas companies, including in the U.S. One of the reasons that the Securities and Exchanges Commission and the New York Attorney General are investigating ExxonMobil Inc. (XOM) is that they suspect it of valuing its assets–mainly oil and gas still in the ground–on assumptions that don’t take into account how quickly policy priorities in both the advanced and developing worlds are changing.

In a world where the long-term trajectory for oil consumption is ever-upward and the cheapest oil is being produced first, there’s nothing unreasonable in assuming that reserves more expensive to develop are still economic. But if even OPEC, the truest of true believers in oil, is doubting that scenario, then that assumption looks less safe. Last Friday, the U.S.’s biggest oil and gas group took its first step to admitting as much, saying it could write down its reserves by as much as 4.6 billion barrels of oil equivalent.