A group of U.S. senators is now urging federal regulators for executive clawbacks if managers fail to properly supervise divisions in which the misconduct occurred.

On Wednesday, 15 Democratic senators, including Wall Street critic Elizabeth Warren (D-Mass.) and led by Bob Menendez (D-N.J.), sent a letter to federal regulators, calling for clawback rules that would force companies to pull back pay even if the fraud or misconduct was not deliberate or orchestrated by the executive.

“Citing Wells Fargo’s failure to properly align sales goals with customers’ interests, the senators asked regulators to strengthen requirements so major financial institutions are required to enforce policies that reclaim executive’s compensation connected to misconduct and fraudulent activities,” Menendez’s office wrote in a press release.

They noted that current laws are not clear about whether clawbacks can be triggered over “failures in risk management or culpable negligence in employee oversight,” and called for those weaknesses to be addressed.

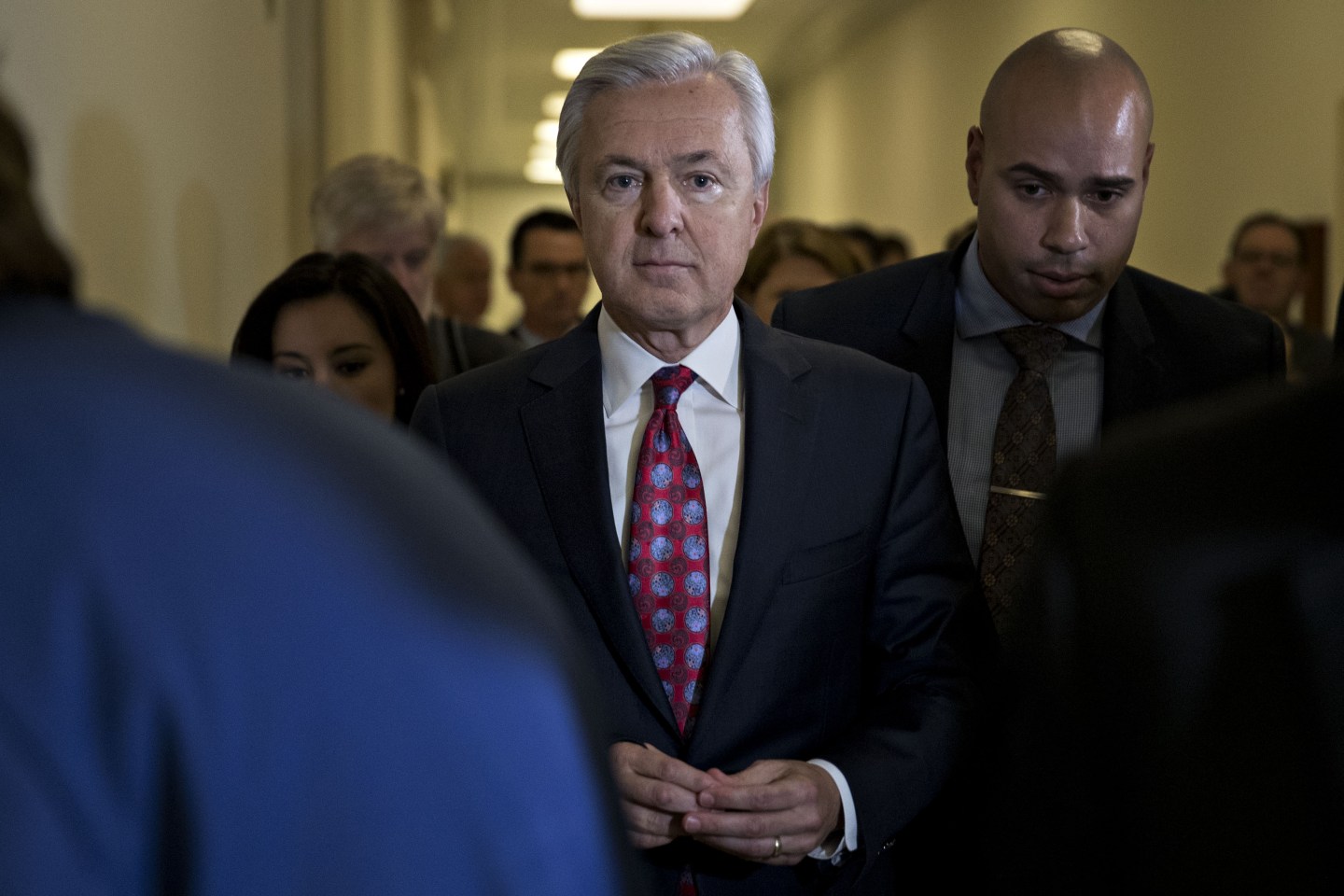

The former CEO of Wells Fargo, John Stumpf, and the former head of Wells’ community banking division, Carrie Tolstedt, gave up a combined $60 million in unvested stock amid public outrage about the 2 million deposit, and credit card accounts the bank opened without consumer consent. Stumpf then retired on Oct. 12.

But those clawbacks came only after Stumpf had fanned public outrage for a few weeks by first blaming the scandal on a few bad employees, and then by failing to hold executives accountable for the fraud—at least at first.

Now the senators are hoping to strengthen the clawback rules pursuant to the Dodd-Frank Act by requiring, rather than suggesting, that executives have their pay clawed back if “misconduct or inappropriate risk-taking has clearly occurred. The clawbacks the senators are proposing would apply to executives who had a managerial position over the sector where the improper activity occurred.

If the proposed rules go through, it could make waves in the banking world. Current regulations only force clawbacks in the case of deliberate fraud, and for the most part, leave the decision whether to claw back pay to the company. But company boards often do not use those provisions.