Hedge funds across the globe are cutting their management fees as they struggle to attract investors in the face of weak returns, industry data shows.

U.S.-based Caxton Associates this week became the latest firm to tell investors it would reduce its fees, joining the likes of Och-Ziff Capital Management and Tudor Investment, which have also cut charges this year.

These recent, high-profile examples are not isolated cases though, and reflect a wider global trend in place for several years, data compiled from more than 2,600 funds in Europe, the Americas and Asia shows.

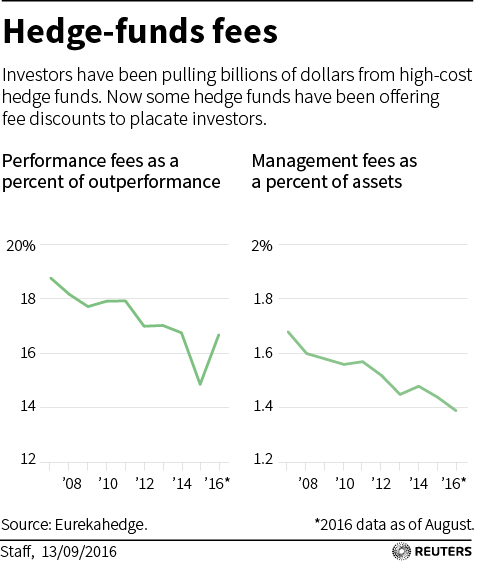

The average annual management fee charged by these funds has fallen to 1.39% of the value of a client’s assets, from 1.44 in 2015 and 1.68 about a decade ago, according to the data from industry monitor Eurekahedge.

The move by Caxton and its peers to cut fees this year coincides with a sharp slowdown in the growth of assets under management. The hedge funds in the Eurekahedge data have added a total of just $14.7 billion so far this year, compared with $108.7 billion in 2015 as a whole and $343 billion in 2007.

The figures illustrate how many funds are struggling to prove their worth and how the balance of power is increasingly tilting from managers towards investors.

“There isn’t a manager out there who isn’t thinking about lowering fees,” David Saunders, Chief Executive Officer of K2 Advisors – which has about $10 billion invested with hedge funds on behalf of its clients – told Reuters on the sidelines of the Alpha Hedge West conference in San Francisco last week.

The industry’s average return on investment so far this year is up slightly from the 2015 average, to 2.6%, but is still a far cry from the returns of more than 13% recorded a decade ago, the data showed.

Hedge funds were traditionally known for a ‘2 and 20’ fee model before the financial crisis – an annual management fee of 2% plus a 20% cut of any profits. But those days have gone for most funds which, like others across the financial industry, have seen returns hit by the impact of low interest rates.

Funds have also cut performance fees, from an average of 18.77% across the global industry in 2007 to 16.69% today, said Eurekahedge, an independent research firm which provides databases for funds and investors.

World’s Wealthy

Caxton wrote to investors on Tuesday to say it was cutting fees from the beginning of next year, on a sliding scale depending on how much money a client had invested with them.

It came weeks after directors of BlackRock’s UK Emerging Companies Hedge Fund said in a stock exchange filing that they had reduced the fee payable on its institutional share class to 1% from 1.75%.

Others to cut management fees this year include $39 billion U.S.-based fund firm Och-Ziff Capital Management, which cut fees in its multi-strategy funds by 25 basis points for existing clients, a source with knowledge of the matter said

Tudor Investment, which has $11.6 billion of assets under management, lowered the 2.75% management fee and a 27% performance fees on its flagship Tudor BVI fund to two separate lower-fee classes, said a source with knowledge of the matter: to 2% and 25% for institutions, and 2.25% and 25% for other investors.

In a sign of the struggle the industry faces to attract and retain money, several big pension schemes, most recently New Jersey’s state pension fund, have flagged plans to scale back investments in hedge funds. The world’s wealthy individuals and families – the other big capital pool for funds – are also showing signs of frustration.

The average proportion of total investments allocated to hedge funds by “family offices” – firms that oversee the investments of wealthy families – fell 0.9% in 2015 and was likely to fall further, a survey of 242 family offices by Campden Wealth and UBS (UBS) published this month showed.

“A lot of people invested in hedge funds … and they’ve all been rather disappointed about the performance,” said Oliver Muggli, partner at multi-family office Mandorit, which advises on investments of more than 1.5 billion euros.

“It’s an asset class which probably will face more challenge and more outflows in the next one or two years.”