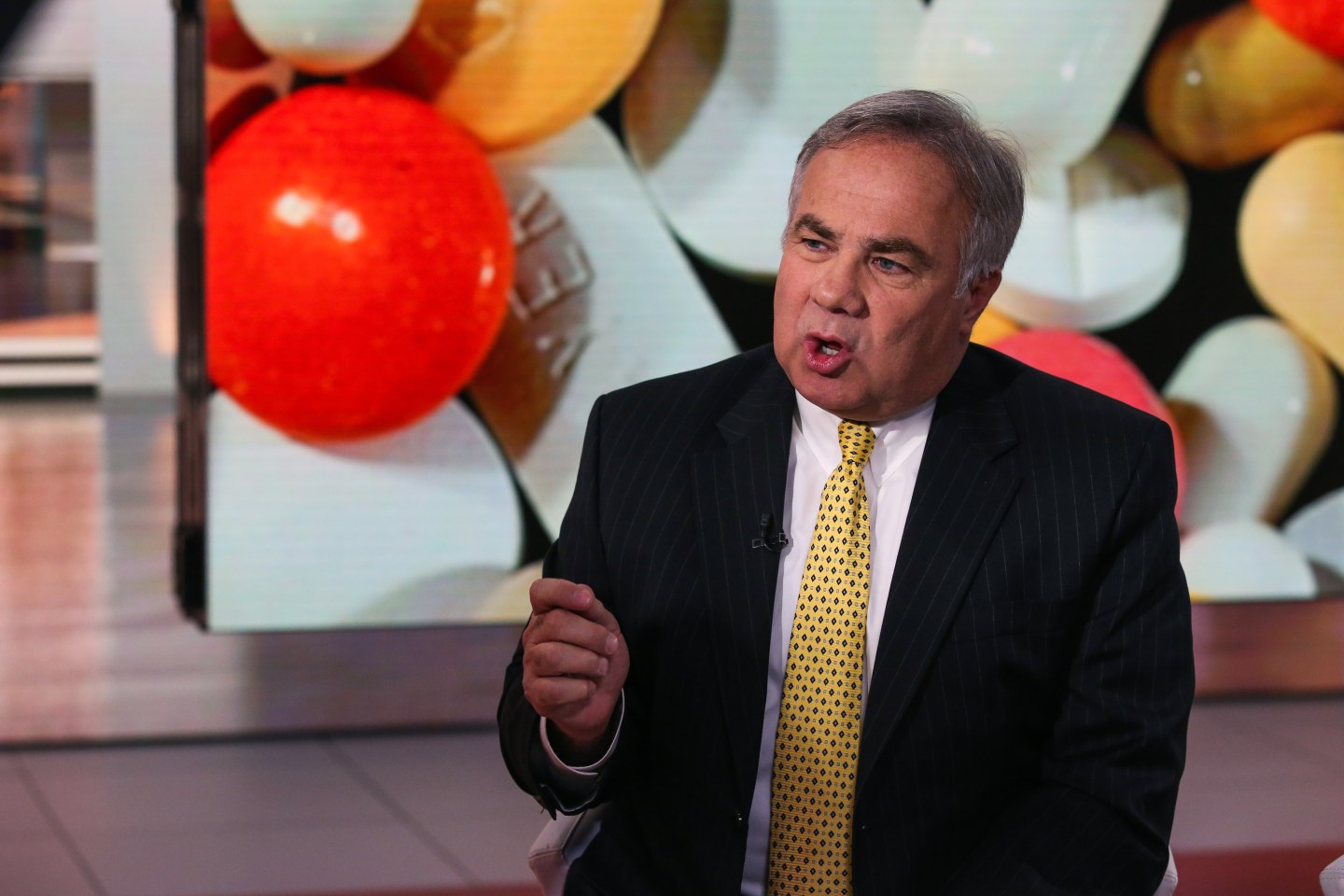

Valeant Pharmaceuticals International (VRX) has received unsolicited interest for its core assets, although the company is not actively shopping them, CEO Joe Papa said on Tuesday.

Earlier in the day, the Laval, Quebec-based company said it would sell billions of dollars in noncore assets to pay down debt. Valeant shares jumped 19.4% to $26.75 in midday N.Y. trading.

Valeant also maintained its earnings forecast for the year, to the relief of investors, although its second-quarter results missed expectations.

Papa stressed to analysts on a conference call that Valeant was focused on selling pieces that are not central to its business. But in an interview he said he would not rule out going further.

“I have had some inbound interest expressed in some of our core and noncore assets,” Papa told Reuters. “We have to think about any alternative in front of us as we look to improve shareholder value. We’re going to take anything that we get, from an offer or unsolicited bid, very seriously.”

Papa declined to comment on whether he had received interest in a takeover of Valeant since assuming the helm in May.

Valeant has labeled its Bausch + Lomb eye care, dermatology, Salix gastrointestinal and consumer over-the-counter businesses as core. Papa would not say if Valeant received interest in Bausch, which he said is “one of the most valuable assets we own.”

The company has identified noncore assets representing $2 billion in annual sales that could realize an estimated $8 billion if the company sells them, and has hired banks and advisors to evaluate options.

“These products are good products, have good growth rates, and we believe will yield a very effective price point,” Papa said, declining to identify specific assets.

Valeant received unsolicited bids for more than one-third of the noncore assets the company is considering selling, he said.