Affirm, a San Francisco-based startup best known for providing small loans to its customers as a credit card alternative, is beginning to expand into personal finance management.

On Wednesday the company revealed it has acquired Sweep, a small startup that last fall released a mobile app that helps users track and manage their bills, spending, and savings. Most of Sweep’s team is joining Affirm’s and its app will be shut down on May 26, the company said. Terms of the deal were not disclosed, though Affirm did acquire Sweep’s technology as well.

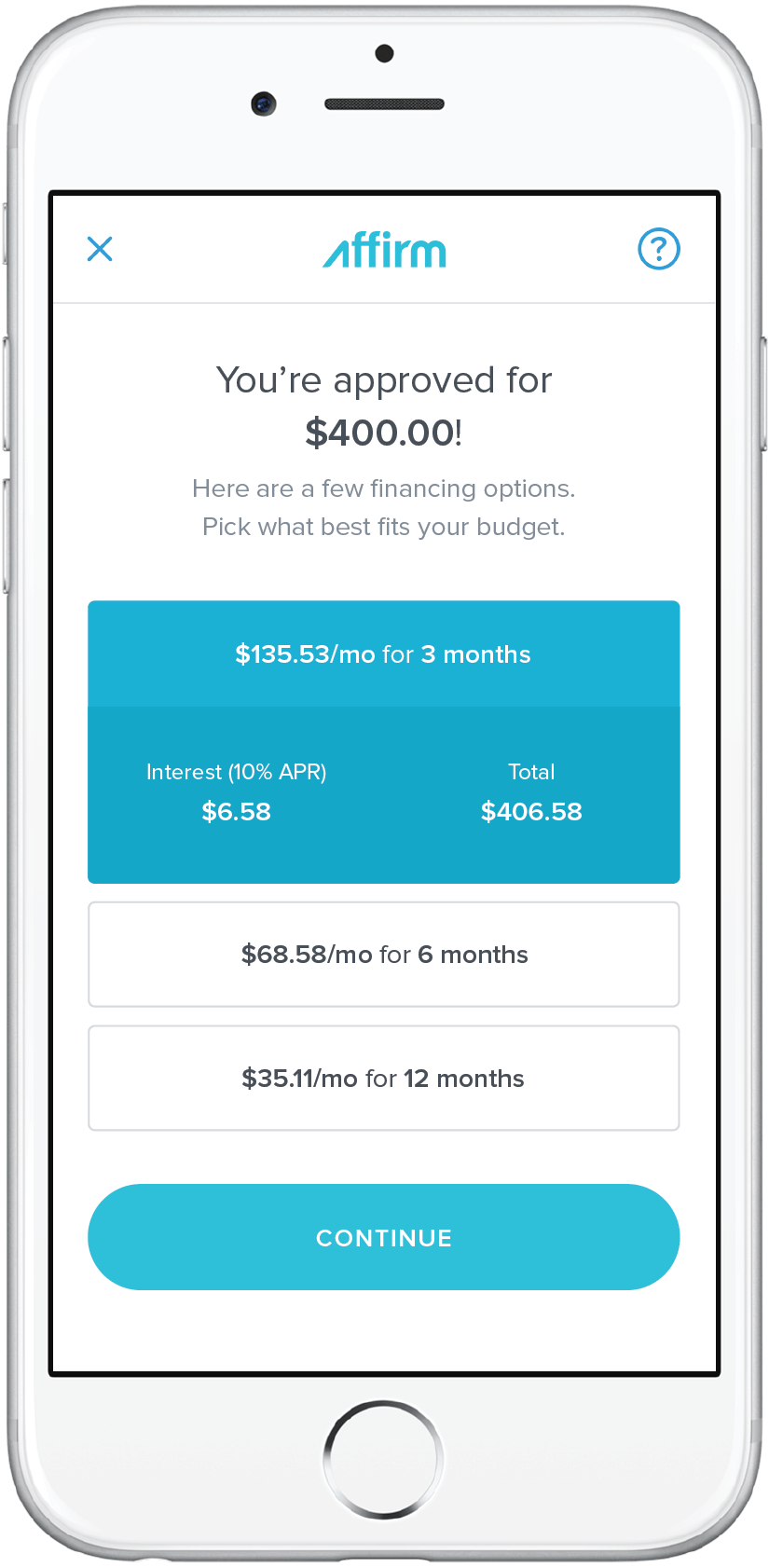

Founded in 2012 by PayPal co-founder Max Levchin, Nathan Gettings, and Jeff Kaditz, Affirm started out by providing small loans to customers seeking to make a purchase from a retailer online, later adding brick-and-mortar stores. As an alternative to using a credit card, Affirm’s loans are calculated using both traditional and nontraditional data like social media presence, and come with up-front fixed terms the customer can review before accepting the loan. Affirm currently works with 700 merchants. According to the company, 36% of customers whose first loan was for less than $250 have used the service again.

“The ambition of the company is beyond that,” Affirm VP of growth and new markets Brad Selby told Fortune, adding that it’s “creating this new financial institution that helps people manage their finances and live the life they want to live.”

Get Data Sheet, Fortune’s technology newsletter.

Affirm had been exploring cash flow management over the past year and eventually connected with Sweep, whose founders initially approached the company about a possible partnership. “We always knew we wanted to connect people with a fair credit product,” Sweep co-founder and CEO Jackson Gates told Fortune.

Sweep’s acquisition is also part of Affirm’s plan to invest more into its mobile app, according to Selby, which so far has been fairly basic. Currently, customers can use the app to apply for a loan and use it at a handful of retailers, but personal cash flow management tools will presumably start to appear in the near future.

For more, watch:

So does Affirm want to become a bank?

Not according to Selby, who instead describes Affirm as a “financial services company.” If anything, Affirm is focused on providing the financial services it finds consumers most care about, regardless of whether they’re part of the traditional retail banking model.

Naturally, that has also meant that not all of Affirm’s experiments have worked out as planned. For example, the company began to offer loans last year to students attending so-called “coding bootcamps”—short-term full-time programs that teach students the basics of coding. However, Affirm eventually found it wasn’t a great business and is now shifting its focus to other areas in the education market where it could be of help.

And of course, it will continue to focus on its core lending services. “My baby is always going to be the merchant point-of-sale lending,” laughed Selby. In addition to providing loans for online shopping, Affirm partnered last fall with First Data, whose modern-day cash register Clover can now let merchants accept Affirm loans.

To date, Affirm has raised a total of $425 million in debt and equity financing from investors like Founders Fund, Lightspeed Venture Partners, Spark Capital, Khosla Ventures, Andreessen Horowitz, and Jefferies, among others.