In theory, demand is evergreen in the restaurant business: We all have to eat. But during the past year many restaurant stocks have taken the kind of plunge that makes fainthearted investors lose their lunch.

Worries about China’s slowdown have buffeted Yum Brands (YUM)—parent of KFC and Pizza Hut—which plans to split off its China business to localize the contagion. Chipotle Mexican Grill (CMG) has grappled with bad publicity from multiple E. coli and norovirus outbreaks, which have helped lop 33% off its stock price. And Shake Shack’s (SHAK) shares have fallen back to earth, plummeting below $35 from over $90, as investors realized that the small burger chain’s growth couldn’t justify its Mars-orbit valuations.

Throw in an uncertain economic outlook and industrywide pressures to increase the pay of fast-food workers, and restaurants have looked like an increasingly unappetizing stew to investors—making their stocks among the biggest losers in this year’s market dip. Nicole Miller, managing director and senior restaurant analyst at Piper Jaffray, says that even after a recent rally, the 25 names she covers trade at an average of 10 times Ebitda (earnings before interest, taxes, depreciation, and amortization). Over the past few years they had floated between 12 and 15 times Ebitda.

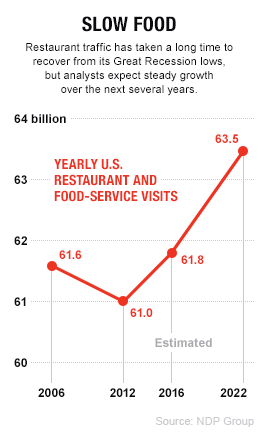

To some investors, those falling valuations signal an overreaction—one that, Miller says, has made many stocks “fairly attractive and very investable.” The bulls believe that American consumers will remain healthy and hungry enough to keep restaurant revenues growing—especially since unemployment is below 5% and cheap gas is leaving more cash in their pockets. While cheaper fuel hasn’t translated to more spending in many consumer sectors, restaurants have been an exception. Total sales for 2015 edged upward by 3%, to more than $700 billion, and market research firm NPD Group forecasts that Americans will make 61.8 billion visits to restaurants and food-service outlets in 2016—which would be the highest figure since before the Great Recession.

Admittedly, those figures don’t represent explosive growth. “It’s still a challenging environment, with fierce battles for market share,” says Bonnie Riggs, NPD’s restaurant industry analyst. “But there are some real winners in the industry.” Among the dominant trends, says Riggs: anything hot and spicy (think sriracha, ghost peppers, and jalapeños); morning meals, such as McDonald’s (MCD) all-day breakfasts; and healthier menus that break the pizza-and-cola mold.

Given the tough competitive landscape, analysts and investors are being selective. Brian Vaccaro, senior restaurant analyst at Raymond James, says that although many stocks he watches have flirted with “close-your-eyes-and-buy-it levels,” his favorite stocks are even cheaper than the norm. (They also do business almost exclusively in the U.S.) One of Vaccaro’s top picks: Red Robin Gourmet Burgers (RRGB). A sit-down eatery along the lines of Applebee’s (DIN), with 500 locations, it’s trading at a mere seven times Ebitda, Vaccaro says. But Colorado-based Red Robin has been gaining market share in the past several years, and Vaccaro believes it has plenty of room to grow in areas like to-go orders and alcohol sales—categories where it currently lags behind its competitors.

Vaccaro also likes a relatively under-the-radar name, Dallas-based Fiesta Restaurant Group (FRGI), which operates the chains Pollo Tropical (a Caribbean-cuisine purveyor) and Taco Cabana; together they have roughly 400 locations. With its stock trading at $32, not far off its 52-week lows, Vaccaro calls Fiesta “undervalued and underappreciated.” He thinks that increased ad spending and popular new promotions will fuel a rally for the stock.

For more on retail, watch this Fortune video:

Piper Jaffray’s Miller, meanwhile, favors a more familiar name: Starbucks (SBUX). “It has great liquidity, solid global growth, and a phenomenal balance sheet,” she says. While known for its core coffee business, its ace in the hole is its rapidly expanding food sales. For the most recent quarter, food revenue was up 20% year over year, the company reports. (Breakfast-sandwich sales, in particular? Up 40%.) Miller expects such growth to continue, making the company a good buy even at its relatively high valuation of 26 times fiscal 2017 earnings.

If the idea of betting on one horse makes you antsy, there are funds that let investors play the industry more broadly. There’s only one restaurant-specific ETF, and it just launched in November (with the cheeky ticker symbol BITE). A better-established fund option is Fidelity Select Leisure Portfolio. The fund owns stocks in hotels and other leisure companies, but almost 60% of it is made up of restaurant stocks—top holdings include Starbucks, Yum Brands, and McDonald’s. It boasts a five-year average return of 13.2% and has been rebounding smartly from February lows.

Miller says restaurant stocks could be a safe haven even if the U.S. economy proves to be in, or close to, another downturn. Having reviewed past recessions, she believes consumers tend to keep eating out even in challenging times. After all, publicly traded restaurant chains generally offer meals in the affordable-splurge category—we’re not talking about Thomas Keller’s Per Se and its $325-per-person tasting menu here. “In bad times, the group does just fine,” Miller says. “And in good times, it does even better.”

A version of this article appears in the April 1, 2016 issue of Fortune with the headline “Burgers, Fries, and Good Buys.”