The private equity markets have begun experiencing a major slowdown in new deal activity, due to a contraction in the market for high-yield debt. More specifically, banks are having a tough time placing such bonds, which even has caused some already agreed-upon deals to be delayed and/or restructured (e.g., The Carlyle Group’s purchase of data storage business Veritas from Symantec).

Now, things might be about to get even worse.

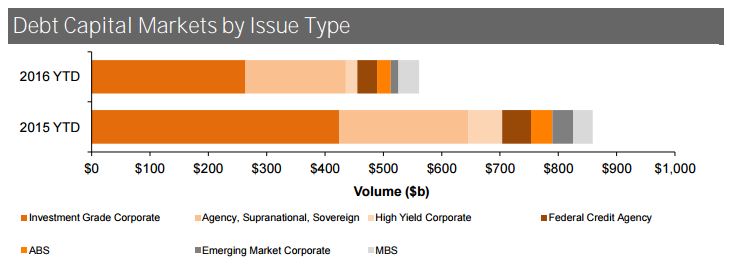

Thomson Reuters on Friday published data showing that the credit crunch isn’t limited to high yield. Instead, U.S. marketed investment grade debt issuance is down 19% compared to the same period in 2015, despite a massive $45.6 billion loan package to support Anheuser-Busch InBev’s (BUD) pending purchase of rival brewer SAB Miller. Moreover, the actual number of new issues is off 45% year-to-date, making it the slowest start to any calendar year since 1996.

Given all of this, it should be interesting to see pricing and maturity specs when banks begin pitching a $4.7 billion debt package related to Apollo Global Management’s (APO) proposed $7 billion buyout of ADT (ADP), which was announced earlier today.

Another debt-laden deal to keep an eye on is Dell Inc.’s $67 billion merger with EMC, which was agreed upon before the credit markets really began to crunch.