Three major U.S. shale oil companies have slashed their 2016 capital spending plans more than expected in a bid to survive $30 a barrel oil prices, with one of them saying prices would need to rise more than 20% just to turn a profit.

The cuts on Monday from Hess Corp (HES), Continental Resources (CLR) and Noble Energy (NBL) ranged from 40% to 66%. This marks the second straight year of pullbacks by a trio of companies normally seen as among the most resilient shale oil producers.

The cuts were steeper than expected. Analysts at Bernstein Energy had forecast an average 2016 cut for the sector of 38%.

The reductions show budgets may shrink more this year than they did last year, when spending fell between 20% and 50%. Output at some companies may fall for the first time ever.

“It’s very rare to have spending decline two years in a row,” said Mike Breard, oil company analyst with Hodges Capital Management in Dallas. “Any budget you see published now is going to be much lower than last year.”

But last year many operators managed to lift output as they devised new ways to coax more oil from rock, a feat that seems unlikely to be repeated.

In a sign that a reckoning has come, Continental admitted it will pump about 10% less oil this year as it can no longer innovate and sell more oil at depressed prices.

The U.S. government projects domestic crude output will fall by about 700,000 barrels a day by the end of this year to around 8.5 million b/d, a development that would help ease oversupply in the global oil market.

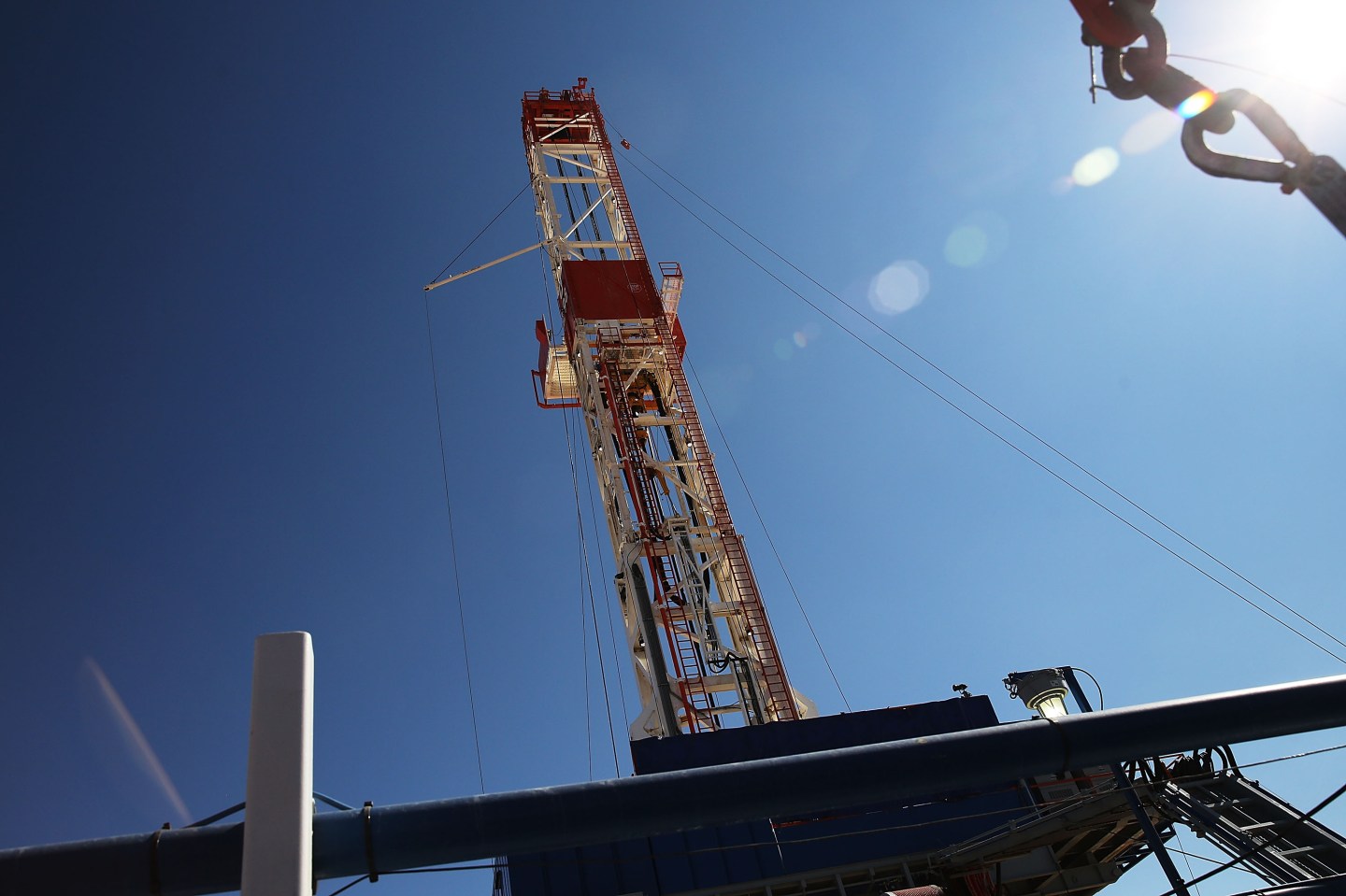

Depressed spending typically means fewer drilling rigs. All three companies said they would cut the number of rigs boring new wells in U.S. shale oil fields across Texas, North Dakota and elsewhere.

“If you cut your budget 60%, you may drill 40% fewer wells and your production is going to drop a considerable amount,” said Breard.

Continental, North Dakota’s second-largest oil producer, said it would slash its 2016 capital budget by 66%. The company made the risky move of getting rid of hedges in the fall of 2014, leaving it fully exposed to the swing in crude prices. By contrast, many producers had profited from locking in high prices up to 12 months forward just before a change in Saudi Arabia’s policies took the floor out from underneath the market.

Led by billionaire wildcatter Harold Hamm, Continental plans to spend $920 million this year, down from $2.7 billion in 2015.

Oklahoma City-based Continental said it will not become profitable until oil prices return to $37/bbl. U.S. oil prices haven’t traded at that level at all so far this year, and closed Tuesday at $31.45/bbl.

Meanwhile, New York-based Hess plans to spend $2.4 billion in 2016, down 40% from $4 billion last year. Noble cut its quarterly dividend 44% and said it will cut spending about 50% this year.

On the other end of the spectrum, Pioneer Natural Resources (PXD), known for its aggressive hedging program, said this month it would spend between $2.4 billion and $2.6 billion this year. Though Pioneer will fund its 2016 budget in part from a $500 million asset sale, the modest increase from $2.2 billion in 2015 makes the company a relative outlier at a time when most companies are trimming capex by amounts similar to last year’s drastic cutbacks.