Shares of Apple (AAPL), the largest U.S. company by market value, are set to finish the year in the red on notable weakness for a stock that had largely been impervious to pain for several years.

The stock is on track to finish the year down 4%, its first negative year since 2008. Shares have shed about a fifth of their value since touching a high of $134.54 on April 28, and are down 17.5% since the inclusion of the stock in the Dow Jones industrial average in March.

Declines this year have wiped out about $57 billion in Apple’s market capitalization, about as much as fellow Dow component DuPont (DD) is worth. Apple is currently worth about $590 billion.

Headed into the last day of trading, the S&P 500 was up 0.22% for the year-to-date. Excluding Apple, the index would be up 0.31%, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

Longer term, Apple remains a boost for the index. For 2014, the S&P rose 11.39%. Without Apple it would have risen only 10.59%. Since the bear market low on March 9, 2009, the S&P is up 204.99%, but losing Apple would mean it would have gained just 197.63%, Silverblatt said. During its six-year run of gains, the stock has risen by at least 25% in five of those years.

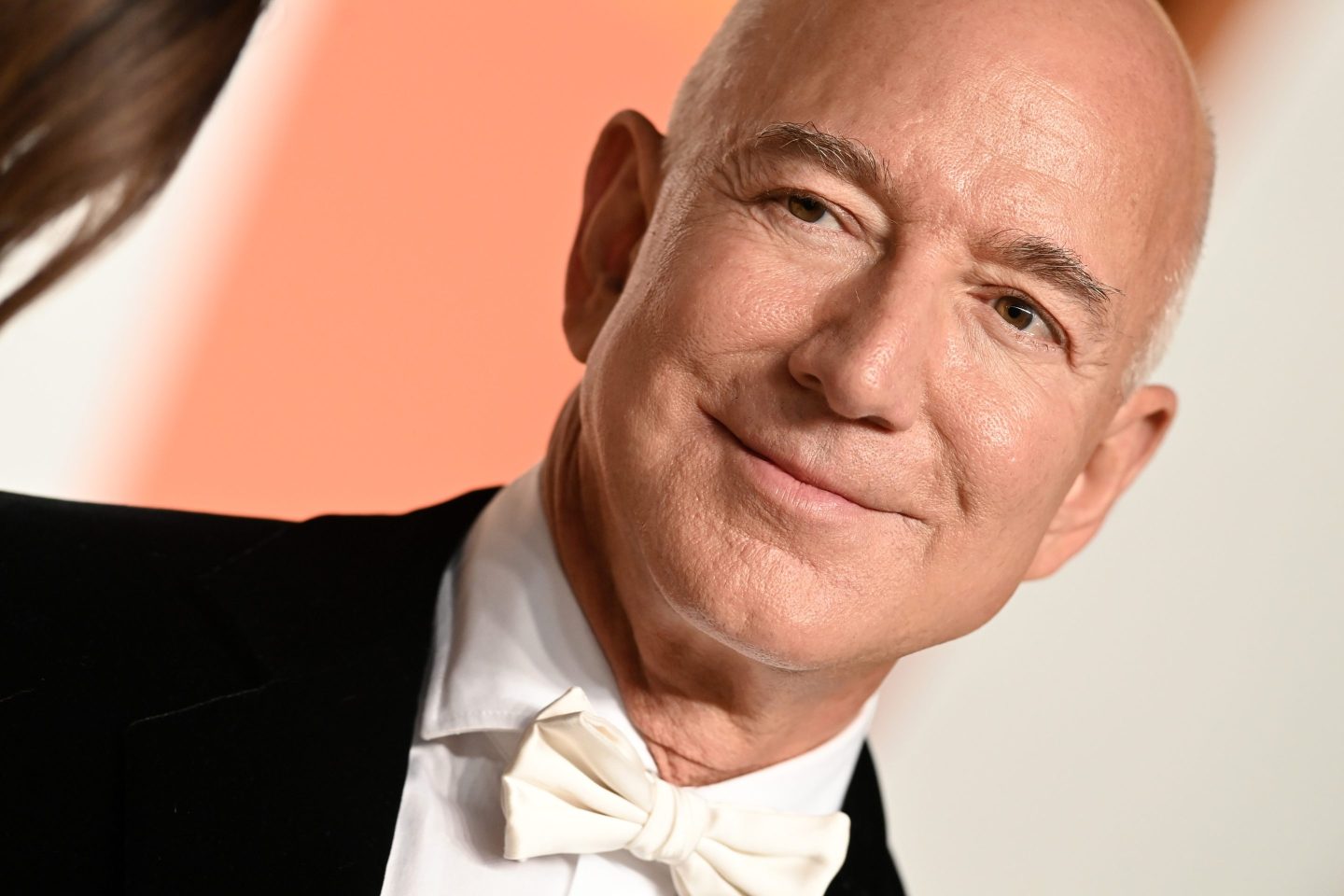

Billionaire activist investor Carl Icahn, who first disclosed a significant stake in Apple in August 2013, owned about 52.76 million shares as of Sept 30. On that day, the stake was worth $5.82 billion.

Despite this year’s drop, Wall Street analysts still love the stock. Of 49 brokerages, 41 have a positive rating and none hold a “sell” rating. Analysts have a median price target of $145—implying a gain of nearly 40% from current levels.