As the annual Fortune Investor’s Guide went to press this week, the S&P 500 was up about 1.5% for 2015, not including dividends. Only one other time in the past 25 years had the stock market been that close to flat for a calendar year, according to Vanguard.

But 2015 sure hasn’t felt flat. Startled by oil, ISIS, China’s funny-money stock market, and a host of other emotional triggers, investors detonated several noisy stock selloffs—including a drop of more than 10% in August, the first U.S. correction since 2011. Yes, optimists swooped in to buck up the market after each dip. Yet none of those mini-rallies felt like the rebirth of a bull market. Weak earnings and a shaky global economic outlook meant that every celebration came with a one-drink maximum and a 7:30 p.m. last call.

Still, there’s a lot to be learned from a flat year—and, in full disclosure, from some of our own missed calls. (Our 2014 picks were down 7%, hurt by premature bets on oil and mining.) It’s an ideal time for investors to recommit to smart principles and fine-tune their portfolios accordingly. In the stories in our 2016 Guide, Fortune looks at the year ahead from dozens of angles—reporting on scores of opportunities—and three themes stand out:

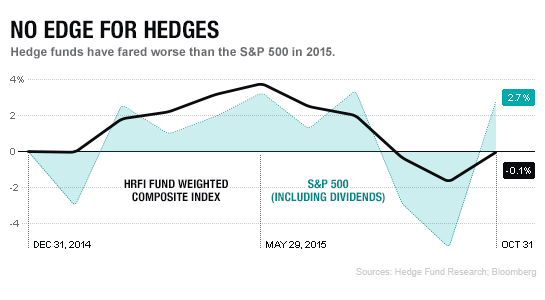

Overpaying doesn’t pay. In volatile times, “alternative” investment strategies are supposed to provide an edge that justifies their high fees. But hedge funds have underperformed stocks for 2015 so far. And private equity’s reputation for outperforming the markets has lost its luster. (Roger Lowenstein dissects private equity’s woes for Fortune here.) It’s telling that millennials, who started adulthood at a financial disadvantage to earlier generations, are demanding investment options whose fees don’t devour their savings. They’ve forced brokerages to adapt. To learn how one influential pension fund keeps costs down—and about how ordinary investors can imitate its methods—read Chris Taylor’s piece, “These Canadians Own Your Town.”

Crises create opportunities. Stock and bond valuations in the U.S. remain far above historical averages. This year’s real and perceived calamities, though, have made the stocks of some strong companies look unusually affordable. (For a roundup of some stocks and sectors that look promising, read Fortune’s “Good Stocks for Bad Times.”)

Tech is still exceptional. Many sectors of the market are cyclical, with stock prices that fluctuate with the economy’s ebbs and flows. But technology stocks may be cycle-proof: As venture capital investor Deven Parekh told us, business leaders can’t afford not to invest in technological improvements, even when times are lean. For a look at how one tech giant is positioning itself for the future and wooing skeptical investors, read Erin Griffith’s profile of SoftBank’s CEO-in-waiting, Nikesh Arora. And for a glimpse of yet another way in which technology is changing the way investors make decisions, see Jen Wieczner’s story on Dataminr and other services that gather lightning-quick intel on social media.

By the way, the last time the S&P 500 had an almost-flat year was 1994—and the index went on to register gains of at least 20% in each of the next five years. We don’t foresee that kind of bull run, but we hope that our guide will help you thrive, whatever 2016 brings.

For more coverage from the Fortune 2016 Investor’s Guide, click here.

A version of this article appears in the December 15, 2015 issue of Fortune with the headline “Choose Smart. Buy Cheap. Enjoy the Ride.”

For more about tech investing, watch this Fortune video: