Penumbra Inc., a maker of medical devices for those who have experienced strokes and other neurovascular diseases, tomorrow will begin trading on the New York Stock Exchange under ticket symbol PEN after raising $120 million in its initial public offering. The Alameda, Calif.-based company priced 4 million shares at $30 per share, giving it an initial market cap of around $1 billion.

J.P. Morgan (JPM) and BofA Merrill Lynch (BAC) served as co-lead underwriters.

The company last year generated $2.2 million of net income on $125 million in revenue, and already has reported $81 million in revenue for the first half of 2015.

Earlier today I spoke via phone with Penumbra CEO Adam Elsesser. What follows is an edited transcript of our conversation:

Fortune: You’ve just finished up your IPO road show. How did it go?

Elsesser: I loved the road show. It was an incredible opportunity to go out and have people listen to our story. My wife is sick of me talking about it all the time, so it was great to have people want to listen.

You are about to go public without having raised any traditional venture capital, even though the company did raise $111 million via private stock sales. What’s the backstory?

I used to practice law, and my best friend from college, Dr. Arani Bose, was a practicing neuro-interventionist. In 1998 we formed out first business, Smart Therapeutics, which we sold in 2002 to Boston Scientific (BSX).

In 2004, when we launched Penumbra, we had maybe a naive vision that we wanted to build not just a single product company again, but a real company with the capacity to do a lot more. In order for us to realize that vision and have the time to build a strong foundation, it made more sense for us to look to private investors — friends of mine who’d share the vision of a longer time-frame. So we were fortunate to raise a lot of money, just privately, which gave us a lot of flexibility. Ten years later, here we are with over 1,000 employees, more than $100 million in revenue and six distinct product families. We view the IPO as our next phase.

You did raise money from Fidelity, however, which has an 11.6% ownership stake in the company pre-IPO. Why?

Yes. Last year we brought in Fidelity in anticipation of entering this next phase. We had just expanded from our initial focus on neurovascular to peripheral vascular, and hired an entire dedicated salesforce pretty quickly to take advantage of that opportunity. We had gotten to know the folks over at Fidelity and clearly felt comfortable that we shared a similar vision for the next phase of Penumbra, so it was a nice fit for that moment in time.

Mutual funds like Fidelity often invest in private companies like yours, in part, so they can get their desired IPO allocation. Did Fidelity get what it wanted?

It’s too early to comment on allocations. All I’ll say is they’ve been really good to work with and have had great insight into this process.

Most healthcare technology companies go public long before they have nine-digit revenue. Why not do this earlier?

We really wanted to wait to take this step until we felt the foundation of the company was quite strong. There was no need or urgency with our investors or the management team, so we just focused on building out a very competitive and impactful product portfolio.

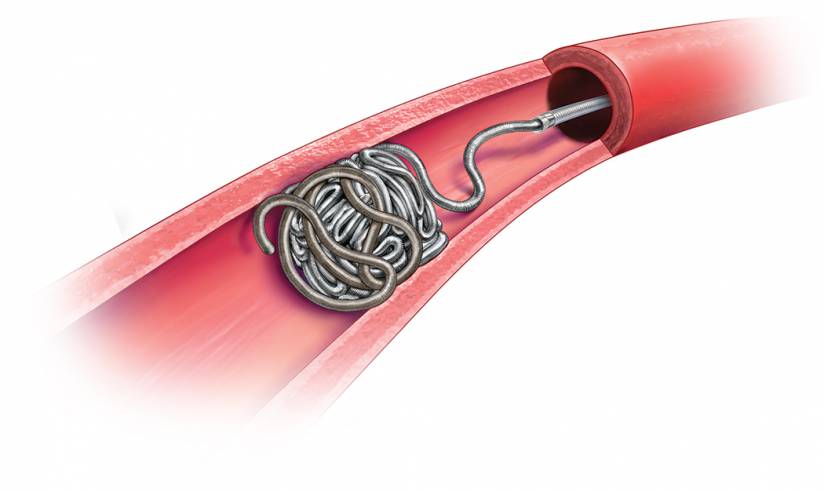

This particular moment makes sense not only because of all the areas we’ve grown into with our product lines, but also because it happens to be a very exciting moment around acute ischemic stroke, which happens to be the first disease we took on. With others, we’ve been a pioneer in treating this group of patients with a mechanical thrombectic solution, and this has been a watershed year with the MR CLEAN study that showed how interart thrombectomy was beneficial and some confirmatory studies that showed the same. It’s a real paradigm shift for those patients, which also means the market will grow.

You mentioned six product lines. Do you plan to add to it.

We’re not done. We plan on doing this for the next decade-plus. We have lots of new ideas and development projects in our pipeline. For obvious reason we don’t publicly discuss specifics, but our history shows that all of our work has been geared toward developing impactful products organically.

Penumbra was profitable from 2012-2014, but lost $169,000 during the first half of 2015. Is profitability an important metric for you?

I’ve always run this business with the thought that we should be profitable, and I think we’ve done a credible job over the years of being disciplined. But, as I said, we’re in a particular moment of time with so many different product families that have great opportunities to expand, so we’re obviously going to invest in those product lines. The IPO really gives us the freedom to do that in a very controlled way. But we have discussed with investors, at a very high level, our path back to profitability.

Tomorrow morning you’ll be ringing the New York Stock Exchange’s opening bell. Who will be with you?

We have invited a patient who was treated with our flagship stroke product to ring the bell, in order to remind us and investors that what we’re really doing is for patients like her.

Get Term Sheet, our daily newsletter on deals and deal-makers.

For more about IPOs, watch this Fortune video: