In this year’s letter to Berkshire Hathaway shareholders, Warren Buffett described investment bankers as “nearsighted and self-serving and pressing for deals that aren’t always in the best long-term interest of their clients.”

While Jimmy Lee was the quintessential master of that investment banker universe, he differed from the lot of players in ways that mattered.

“You were a nuclear power,” said JP Morgan Chase CEO Jamie Dimon, Lee’s boss, in his eulogy at a near-full St. Patrick’s Cathedral Monday morning. “You had unbridled enthusiasm and optimism that you poured onto us… I loved your honesty and your openness. I loved that you unconditionally cherished people from titans of industry to underprivileged kids. Most of all I loved how you loved your family.”

Other eulogies were given by Lee’s son, Jamie Lee, and former boarding school roommate Mike McBride, while Cardinal Timothy Dolan performed the Final Commendation.

The gathering of friends and colleagues and competitors of Jimmy Lee turned out to be Wall Street’s version of a state funeral, with a list of 46 honorary ushers that included former NYC mayor Mike Bloomberg, investor David Bonderman, IAC chief Barry Diller , NFL Commissioner Roger Goodell, General Electric CEO Jeff Immelt, DreamWorks Animation chief Jeffrey Katzenberg, Henry Kravis, hedge fund owner Dan Loeb, Yahoo CEO Marissa Mayer, CBS chief Les Moonves, Rupert Murdoch, Charlie Rose, David Rubenstein, Facebook COO Sheryl Sandberg, former NBA commissioner David Stern, Jack Welch, Discovery Communications CEO David Zaslav.

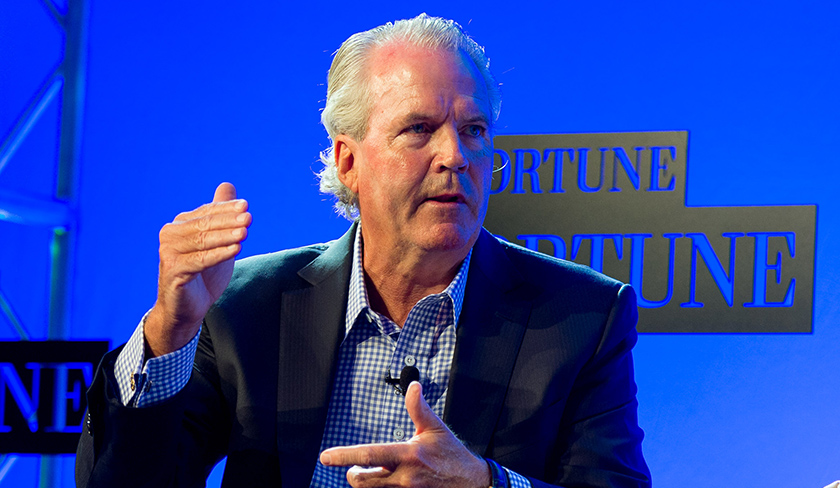

The passing of James B. Lee, Jr., a larger than life figure in finance for four decades, was a shock to everyone. Lee, who was 62, fell ill last Wednesday during his morning workout on his treadmill in his Darien, Connecticut home. He suffered a massive heart attack and died soon after in the hospital. He left his wife, Elizabeth, and one son, James, and two daughters, Elizabeth and Alexandra.

During his 40 years at JP Morgan Chase (JPM) and its predecessor, Chemical Bank, Lee was as productive and prolific as any deal-doer ever was. He guided General Electric (GE) through massive restructurings, he led some of the biggest ever IPOs—Visa (V), General Motors (GM), Facebook (FB) and Alibaba (BABA) —and he helped Michael Dell take his company private. As a vice chairman of JP Morgan Chase, Lee was Dimon’s consigliere, while also counseling such deal titans as Rupert Murdoch and Blackstone Group’s (BX) Steve Schwarzman, and grooming younger investors such as Dan Loeb and Silicon Valley venture capitalist Marc Andreessen.

For Lee, business was personal, always. “You used to say you were short pessimism and long America,” said Dimon. “When I was sick [with throat cancer] last summer, you came into my office everyday to give me a hug… I loved you like a brother.”

Lee was born October 30, 1952, in Danbury, Connecticut. His father, who owned the Frank H. Lee Hat Co., died of a heart attack at age 47, when Jimmy was 11. After graduating from Williams College in 1975, Lee joined Chemical Bank. Seven years later, he founded the bank’s loan syndications unit, which was the beginning of Chemical’s, and then Chase Manhattan’s, investment banking business. Lee rose swiftly, building and expanding the bank’s mergers and acquisition business which, in turn, helped the bank itself grow vastly larger.

Perhaps his son Jamie said it best: “He was a superstar and he went out on top.”