Another Hong Kong-listed company has seen its market value go into freefall Thursday, raising further questions about the integrity of the local stockmarket.

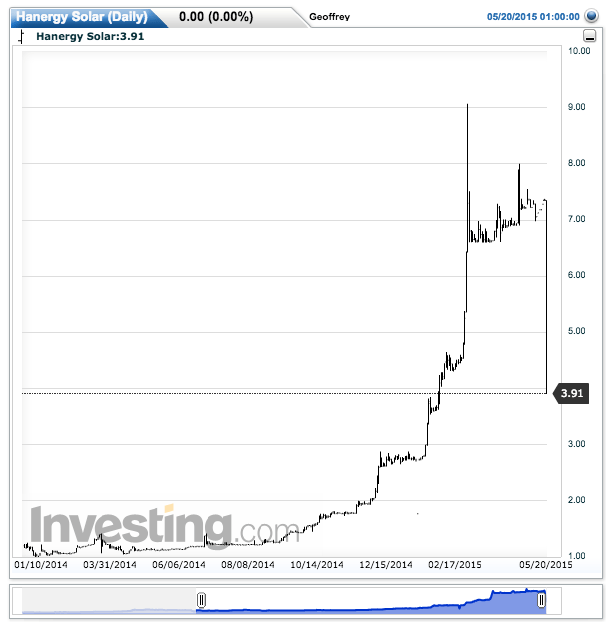

Shares in the two listed units of the Goldin Group conglomerate, which oversees assets ranging from real estate to wineries and polo pony studs, fell by over 40%, wiping a combined $25 billion off their value. That comes only a day after Hanergy Thin Film Power shares lost over 47%.

The similarities between the crashes–all three of which followed spectacular rallies in very thin trading volumes in stocks with a very high concentration of ownership–inevitably raises questions for the market regulator about whether stock prices have been manipulated, and how many more such cases there might be out there.

The Securities and Futures Commission, the local market regulator, had warned in March that over 98.5% of Goldin Financial’s shares were concentrated in the hands of only 20 investors, including a 70.3% stake held by chairman and chief executive Pan Sutong.

“Investors…should exercise extreme caution when dealing in the Shares,” it said at the time, but that was a pretty routine warning. The SFC has put out 10 such warnings about concentrated holdings so far this year, after 20 last year. Of the three stocks to crash and burn this week, only Goldin Financial featured on the SFC’s list.

The SFC was tight-lipped about the situation Thursday and couldn’t be reached for comment outside office hours. But market participants are already starting to be unnerved. One spectacular unexplained crash might be regarded as misfortune, but two looks like carelessness. As for three, well…

“The HK regulator has an urgent problem to solve,” tweeted analysis firm Iceberg Research after Hanergy’s collapse Wednesday.

Hanergy’s chairman Li Hejun owns well over 50% of his company’s shares.

Before this week, Goldin Financial’s shares had risen 320% in the last three months on an average daily trading volume of just 2.1 million shares, less than 0.03% of its total shares outstanding. On Thursday, volumes surged to 15 times that–some 32.1 million, but even so, less than 0.5% of Goldin’s shares changed hands.