Fitbit, a maker of fitness tracking devices that is being challenged by Apple’s (AAPL) new watch product, has filed for a $100 million IPO.

The San Francisco-based wearables company plans to trade on the NYSE under ticker symbol FIT, with Morgan Stanley, Deutsche Bank and BofA Merrill Lynch serving as lead bankers. Expect that the $100 million figure is a placeholder, rather than the amount Fitbit ultimately plans to raise.

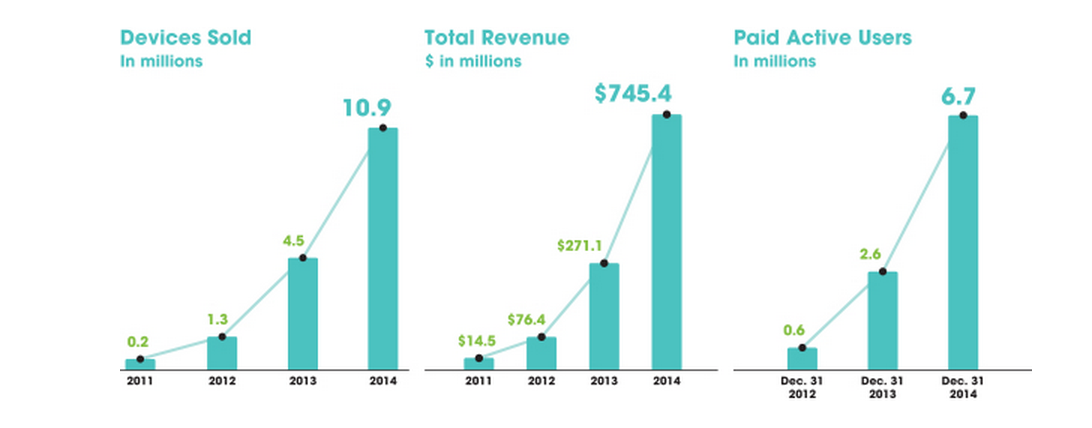

Fitbit reports nearly $132 million in net income on $745 million in revenue for 2014. This is a massive flip from 2013, when the company had a $52 million net loss on $271 million in revenue. For 2012, it was a $4 million net loss on $76 million in revenue.

Quarterly revenue has climbed around 3x between Q1 2014 and Q1 2015, while earnings are up more than 5x over that period (note: around half of Fitbit’s sales come in Q4, due to the holidays). One big explanation for the jump is an increase international sales, while 2013 (and Q1 2014) were harmed by a product recall.

The company also reported selling 10.9 million devices last year, which means that it accounted for more than half of last year’s fitness band market.

From the IPO filing:

Fitbit has raised over $80 million in VC funding since its 2007 founding, from firms like Foundry Group (28.9% pre-IPO stake), True Ventures (22.4%) and SoftBank Capital (5.6%), Sapphire Ventures, Qualcomm Ventures (QCOM) and Felicis Ventures.

Co-founders James Park (CEO) and Eric Friedman (CTO) each received around $222,000 in base salary last year, and the equivalent of $7.8 million in total compensation.

Fitbit reports having around $238 million of cash on the books, and $160 million in debt.

Get Term Sheet, our daily newsletter on deals and dealmakers.