From one vantage point, today’s labor market is like gangbusters. The Labor Department announced Friday morning that the economy added 295,000 new jobs in February and that the unemployment rate fell to 5.5%, the lowest reading since 2008.

Average hourly earnings also rose in February by 3 cents per hour, with average earnings up by 2% over the past year. While this sort of wage growth isn’t the kind that signals imminent inflation, it still shows that, on average, worker pay is rising faster than other prices. As I pointed out in a recent post, while average wage growth has been tame, it is actually fairly strong compared to previous U.S. economic recoveries, going back to the 1970s.

Friday’s report was great news for the economy, but it’s going to make the Federal Reserve’s decision regarding the timing of an interest rate hike all that more difficult.

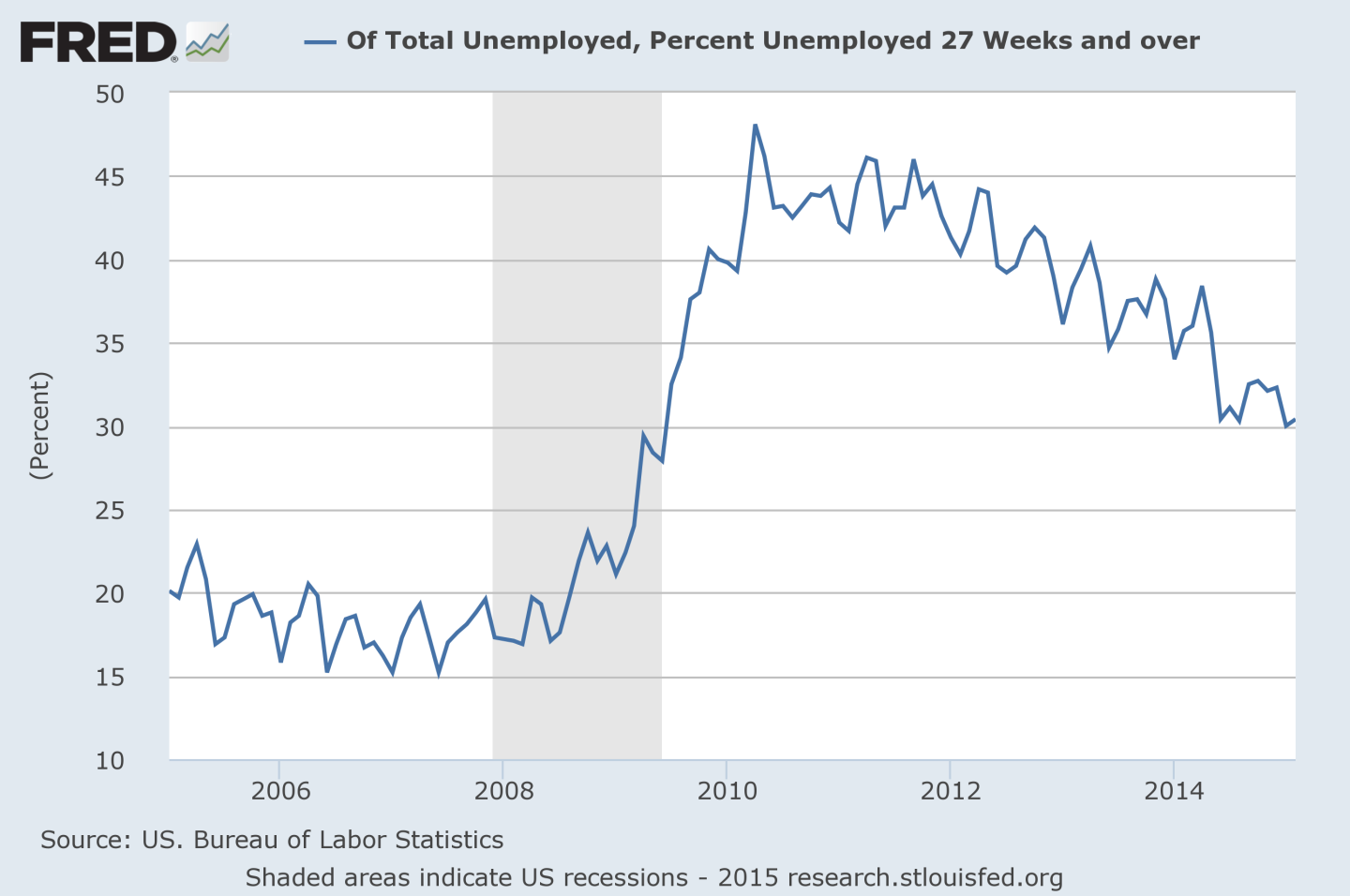

First, if you dig deeper into the numbers in Friday’s report, you’ll find evidence of an increasingly bifurcated recovery and what appears to be a large class of folks whose employment prospects have been deeply damaged by the Great Recession. Take, for instance, the fact that the number long-term unemployed workers (without jobs for 27 weeks or more) still sits at 2.7 million, or 31.1% of the unemployed population. The long-term unemployment problem is still much worse than what it was before the recession:

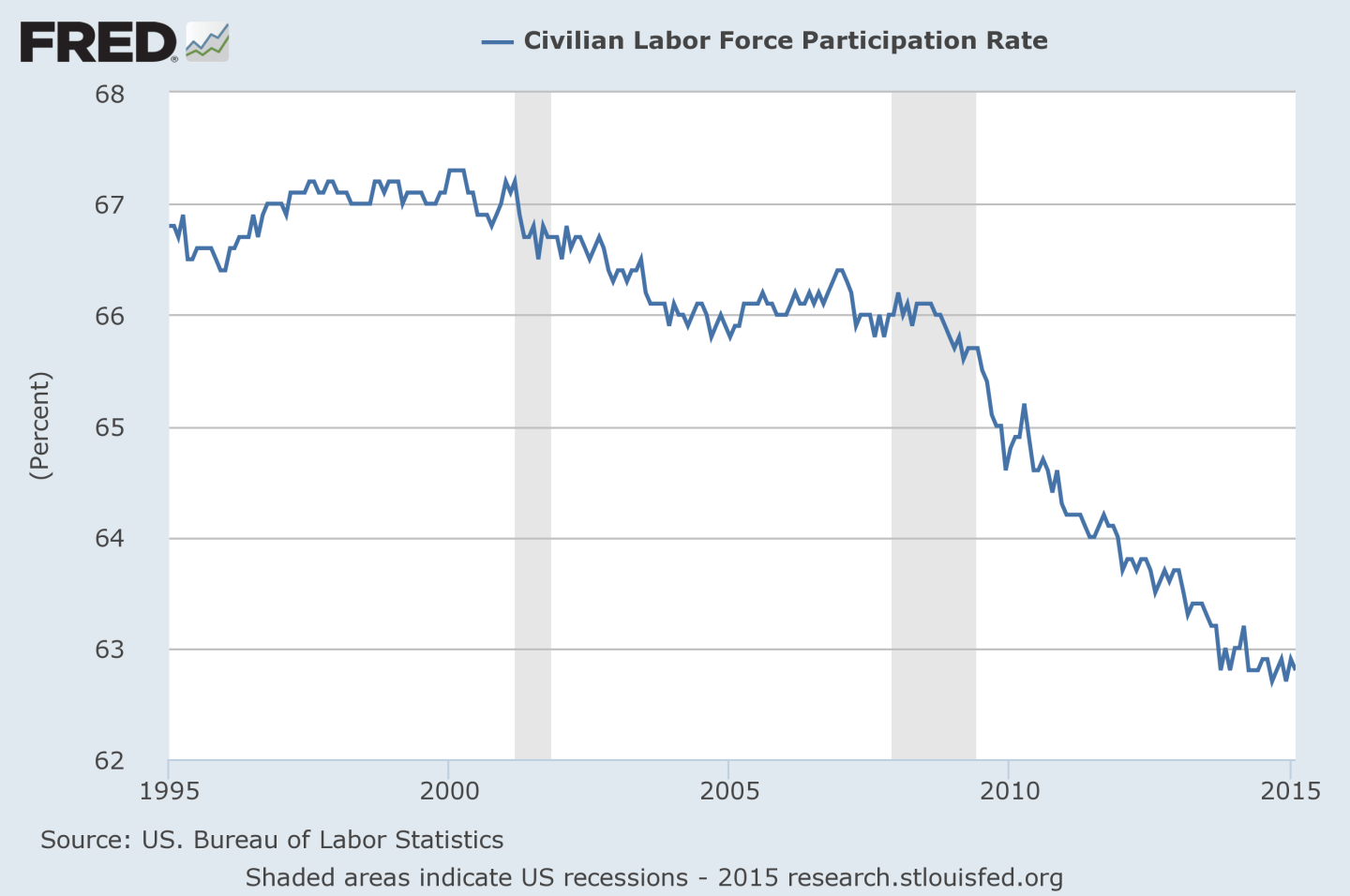

The job market is also not seeing improvement in the labor participation rate. It’s likely that somewhere between one-half and two-thirds of the decline in the participation rate since the recession is due to the aging of the U.S. population. But that still means that millions have left the labor force simply because the job market isn’t strong enough:

These job trends are very much at odds with the rapidly falling unemployment rate. The Fed has previously estimated that the natural rate of unemployment is somewhere between 5.2% and 5.5%. By that estimate, we are right now at full employment and are risking the onset of significant wage inflation.

The Fed has to answer the following questions: Have the employment prospects of folks who have dropped out of the labor force or are long-term unemployed been irreparably damaged by the recession? Have they been out of work so long that their skills are too diminished to be useful to employers? Or does the economy simply need several more months of crisis-level monetary stimulus before employers are forced to bring these workers back on board?

If these workers are not returning to the labor force, we’re then close to or at full employment and the Fed should think about raising interest rates soon. But if we simply need more time, the Fed would be doing a great disservice to the unemployed and the American economy by stamping out a recovery that is just now reaching escape velocity.

The central bank will need to make this decision with very little historical data to rely on. Before the Great Recession, the U.S. hadn’t experienced such an economic calamity as far-reaching since the 1930s, when economic data was sparse and the economy was much different than it is today.