Peer-to-peer lender LendingClub (LC) is now an $8.9 billion company, after pricing its IPO last night at $15 per share and opening its trades this morning at $24.75 per share. But LendingClub was hardly a sure bet when it was founded in 2006, as a nascent financial-tech startup that was seeking to disintermediate a banking sector that was flying high.

So what happened? A whole bunch of secular trends, including increased broadband coverage, greater public comfort with online finance and superb execution. But, perhaps most of all, LendingClub got to grow up while the financial markets fell down.

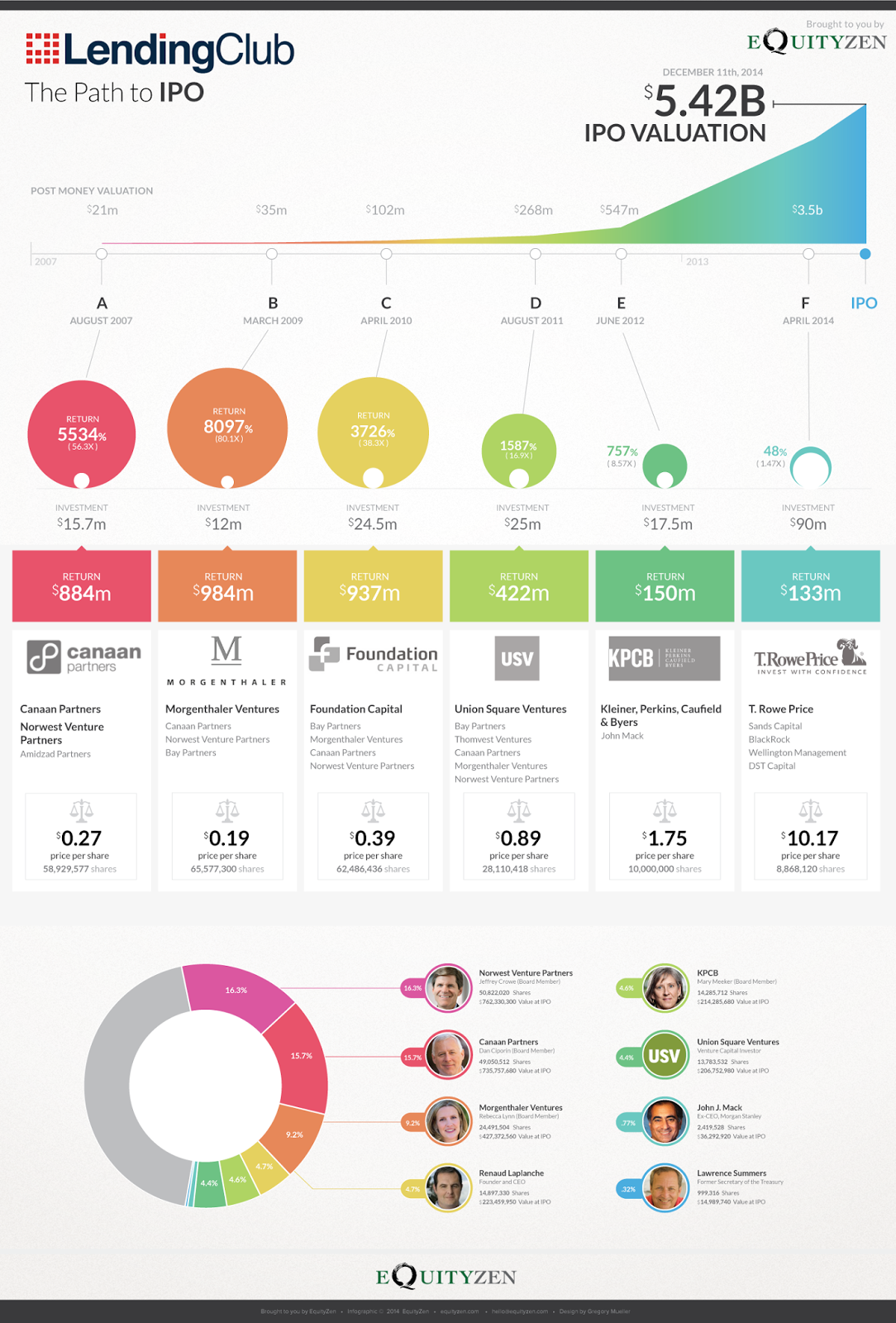

Venture capitalist Rebecca Lynn is an early LendingClub investor, and a member of its board of directors. Her firm stands to gain more than 80x return on its investment at the IPO price, and more than 130x return at the $25 per share open. Part of that is because the company’s valuation actually fell between Series A and Series B rounds, which is highly unusual.

“It was Q1 2009 and banks were completely frozen,” Lynn explains. “Even credit-worthy prime buyers couldn’t get loans. We felt that the banks would still be asleep for a few years, so LendingClub would have a great window to get off the ground… And that proved to be right.”

Below is an infographic showing VC investment and expected returns from LendingClub, courtesy of EquityZen.

Morgan Stanley and Goldman Sachs served as lead underwriters on the LendingClub IPO. The San Francisco-based company reports a $24 million net loss on $144 million in revenue for the first nine months of 2014, compared to $4.45 million in net income on $64.5 million in revenue for the year-earlier period.