The way CEO pay has grown over the past 30 years, you might think it’s bound to keep growing indefinitely. But if a suddenly stagnant market falls, we could see a stumble in top-level compensation, at least in the short-term.

For the past five years, the stock market has gone wild. The S&P 500 gained 30% in 2013 and 168% since the market low in February 2007. The Dow, S&P 500, and Nasdaq have all surpassed previous highs and reached new milestones. While CEOs aren’t the only ones making mint, executive compensation grew 46% while the U.S. CEO-to-worker-pay ratio jumped from 193-to-1 in 2009 to 296-to-1 by the end of 2013.

Part of this rapid increase has to do with the fact that the highest paid workers link their pay to the stock market. Equilar, a firm that provides executive payment data, says that from 2009 to 2013, median “performance-based” stock compensation increased by 50% for CEOs of S&P 1500 companies, while median bonuses only increased 7%, and median salary (base pay) was up by just slightly over 3%.

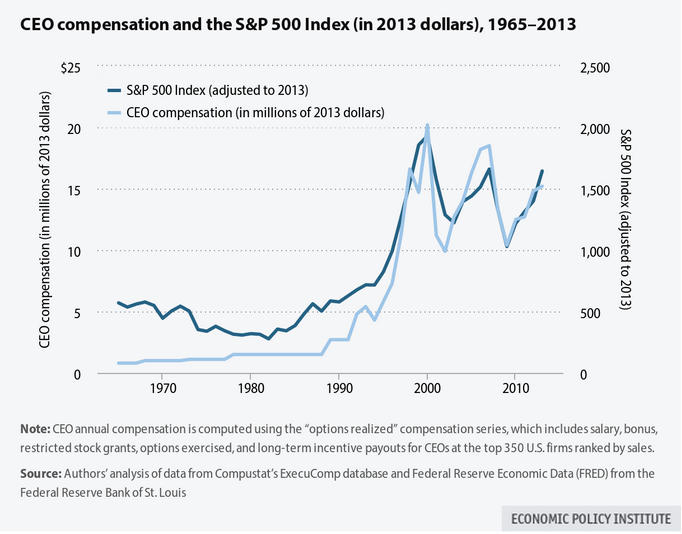

This isn’t a new trend, though. The chart below, developed by Lawrence Mishel and Alyssa Davis at the Economic Policy Institute, a left-leaning think tank located in Washington, D.C., highlights the connection. They argue that since 1990—when President Bill Clinton signed a law reducing taxes on performance-related compensation—executive pay and the market have danced a Texas two-step.

Some argue that linking CEO pay to performance encourages better decision-making at companies, which should ultimately benefit business. Whether it has done this or not, one thing is certain, stock and stock option awards have dramatically increased the wealth of America’s CEOs. A stagnant market could have a similarly dramatic effect on executive take-home pay.

What evidence do we have of a stagnant market? Over the past three months, the S&P 500 has hinted at weakness, moving downwards by almost 5%. Some experts have argued that the equities market is overvalued and with unemployment—often a lagging economic indicator—finally falling below 6%, there’s some evidence a market correction could be on the horizon.

Then there’s the Federal Reserve. With the employment numbers improving, analysts have targeted mid-2015 as a reasonable time to expect The Fed to finally inch up interest rates. That will serve as a drag on stocks, according to S&P Capital IQ analyst Sam Stovall.

“Many people think that stocks usually swoon in anticipation of a new rate tightening cycle,” says Stovall in a recent report, outlining historic market reactions when the Fed increases interest rates. “Surprisingly, however … the S&P 500 held up relatively well in the three and six months before the first rate increase, but stumbled a bit in the first three months after the initial rate hike and only started to catch its breath six months after.”

Expect CEO compensation to react the same way if the market dips. From 2000 to 2009, top-level pay fell by 94% in the wake of two downturns. In between those years, executives saw their pay increase, but overall pay decreases from a high point in 2000.

But as any financial adviser will explain to you, the longer you wait out the market, the more likely it will rebound. Over the long term, you will find yourself making far more than you put in. Remember, many CEOs receive stock options, which lets them pick and choose when to cash out. When the market drops, fewer CEOs collect on options, dragging their pay. “If the market goes down, executives get paid in ways that don’t depend on the stock market,” says Mishel. “They will get options and wait until the market recovers.”

The ability to cash in on the upside also helps explain why CEO pay has grown so quickly in the years since the 2008 downturn, all while worker wages have stagnated.

A market drop may be a short-term threat to a CEO’s pocketbook, which many might welcome. But expect CEO pay to fly back up when the bull market returns and as they cash in when the timing is just right.