The abdication of Bill Gross, the erstwhile king of bonds, has done something you rarely see: It’s brought intrigue to the world of fixed income and made it fun to write about. Gross, as you know, bailed out of Pimco, which he had built into the leader in actively managed bond mutual funds, to join Janus, whose bond fund assets are a pimple compared with Pimco’s.

But what you probably don’t know is that the kind of fund that Gross will run for his new employer—the Janus Global Unconstrained Bond Fund—is the hottest retail bond product on Wall Street. And you almost certainly don’t know that even though assets of “alternative bond funds” like Janus Unconstrained have more than doubled in size since the end of 2012, Gross’s Pimco Unconstrained Bond Fund suffered heavy investment outflows for much of that period.

Let me explain. Bond mutual funds are supposed to be simple, straightforward, relatively safe investments for retail investors—a bedrock of their investment portfolio. You put up your money, and in return you’re supposed to get a stream of interest payments and little or nothing in the way of excitement.

But thanks to the current ultralow interest rate environment created by the Federal Reserve Board, short-term bonds yield almost nothing, and long-term bonds have gotten dangerous. That’s because when interest rates finally rise, the price of existing long-term bonds will decline sharply.

As a result, Wall Street, always alert for sexy-sounding, high-fee-generating products, has been pushing alternative bond funds, whose managers are free to do whatever they please, rather than having to hew to various guidelines.

According to Morningstar, whose statistics I’m using throughout this article, these funds attracted a total of $80 billion of new investor money from the start of last year through the end of August, the most recent date for which data are available. Those inflows, combined with the funds’ returns, boosted unconventional bond assets to $154 billion, from $71.5 billion.

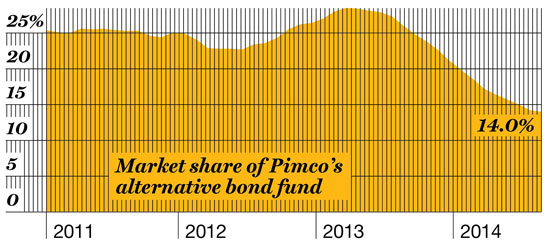

But in the past 12 months, according to an analysis that Morningstar did at my request, Gross’s Pimco Unconstrained suffered $8 billion of outflows, and its market share fell to 14% of the alternative bond category, from 24.8%. That outflow and market share loss offer one likely example of why Pimco was reportedly getting ready to depose Gross before he abdicated.

In the world of stocks there has been a stampede out of actively managed funds into low-cost index funds and some relatively low-cost active funds. But bond indexes give lots of weight to U.S. Treasury securities that are sure to be clobbered when rates rise. Hence the cash gushing into these nontraditional bond funds, whose sales pitch is that they will protect you when rates rise. “These funds are the last stand for active managers,” quips Don Phillips, Morningstar’s longtime research director, who stepped down last year but remains a managing director. If you buy into them, he says, “What is supposed to be the simplest building block of your portfolio is now the most complicated and untested part.”

“People believe these funds can protect them from rising interest rate environments, but we haven’t had such an environment since these funds became popular,” adds Josh Charney, an alternative-investments analyst at Morningstar. “You’re buying on faith that the manager can protect you.”

Can Gross do that for investors at Janus Unconstrained now that he is running a fund that had a mere $12.9 million—that’s an “m,” not a typical Pimco fund, with a “b” as in “billion”—in assets? He’ll have less market clout than at Pimco, but will have much more flexibility because the fund is small. Will the guy Fortune dubbed the Bond King in early 2002 (and who wrote for the magazine from late 2002 through 2007) succeed in attracting billions of dollars to his Janus fund? Can he make money for you, as opposed to Janus and himself, if you buy into it? There’s no way to tell, but it will sure be fun to watch.

This story is from the October 27, 2014 issue of Fortune.