Last week, the Government Accountability Office released a long-anticipated report on whether the nation’s largest banks get a subsidy for their bigness. A large subsidy would imply that the government would bail out the mega-banks if they get in trouble again.

So, will Washington come to the rescue once again? No, says the GAO. Although the study did find that big banks do receive a borrowing advantage based on the fact that they may be “too big to fail.” But that advantage is not very large, and it’s a lot smaller than it was a few years ago. That suggests that Dodd-Frank, along with other bank reforms passed in the wake of the financial crisis meant to end too big to fail, are working, mostly.

Plenty of journalists and commentators had strong feelings about the report. Matt Levine of Bloomberg argued that while the advantage is small now, that’s because few banks are about to fail. It’s like insurance. It’s only worth something when you need it.

Edward Kane of Boston College, in testimony to the U.S. Senate, said that the GAO, and pretty much everyone else, is looking at the wrong figures. Instead of looking at how much less big banks pay to borrow, Kane said we should really be looking at how much more investors pay for shares in these banks. Shareholders, after all, are the ones who really get saved in a bailout. And because they are the first ones to be wiped out in a failure (bank debts might live on), they are likely the most sensitive to whether a bank will get bailed out. Call it the too-big-to-fail stock premium.

How big is the too-big-to-fail premium? Zero. Actually, it’s less than zero. It’s a negative $213.7 billion.

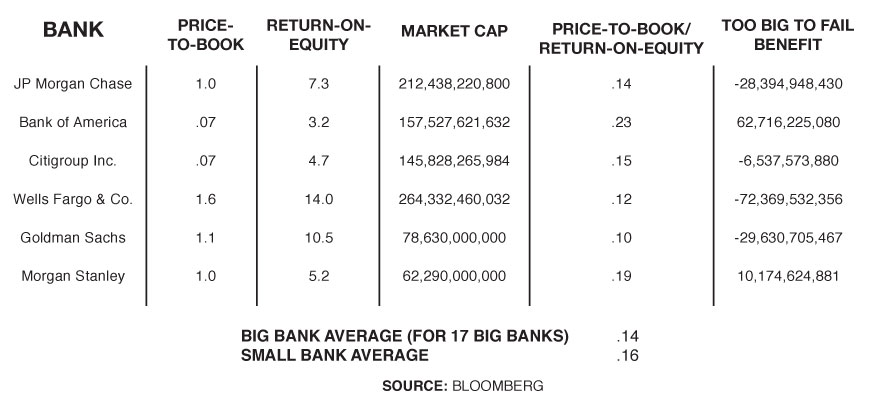

Here’s how I figured that out. I downloaded data on the nation’s 312 largest publicly traded banks. At the top of my list was JPMorgan Chase (JPM), with $2.5 trillion in loans, investments, and other assets. The smallest on the list was Baylake Corp (BYLK). It has has 22 locations and is based in Sturgeon Bay, Wisc. Its motto: “Helping build the good life.”

I then separated the list into the big banks, like JPMorgan, that are subject to the Fed’s annual stress tests, from the rest, which include some fairly big banks, but also plenty of Baylake-sized lenders. I calculated the average return on equity for the two groups and the average price-to-book-value. A number of studies have shown that investors will pay higher price-to-book values for companies with higher ROEs.

If investors were willing to pay more for big banks that yielded the same returns they would receive from small banks, then you could conclude that investors were paying for their bigness and the prospect of government protection.

But that’s not what I found. Investors don’t appear to be paying for bigness. In fact, they appear to be penalizing big banks for being big. In all, the nation’s largest banks get a nearly $214 billion penalty for their size. For context, JPMorgan has a market cap of $212 billion.

To be sure, there are a few reasons you might not want to take my findings, well, to the bank. First of all, the GAO spent nearly a year on its study, and it ran 42 different models factoring data from seven different years. I did my study in a few hours on a Monday morning. I used one, poorly organized, excel (!) spreadsheet.

Second, I used the same methodology to come up with my figures that I used to compute that Wal-Mart (WMT) could afford to give its workers a 50% raise and not significantly hurt its stock price. Some people, particularly Wal-Mart, have raised questions about my math. But I stand by it.

What’s more, most investors don’t trust bank balance sheets, particularly big bank balance sheets. There are still plenty of bad loans, which probably understates what investors are willing to pay for shares in these banks. Take out those bad loans and the price-to-book of the big banks would rise. So would the return on equity figures. The combination of those factors could erase, or at least shrink, the amount investors are underpaying for big banks.

Lastly, looking at the stock market might be a really bad way to measure too big to fail. Boston College’s Kane is really the only one advocating it should be measured this way. And when I called him to tell him that I found basically the opposite of what he suggested I would find, he said I had looked at the wrong thing. Then again, what he suggested I look at didn’t really prove his point either.

Instead, what I found backs up the GAO’s report. Investors don’t believe there is an implicit government guarantee for the big banks. If anything, they believe there is is an implicit penalty.

The one point where my numbers disagree with the GAO study: the big bank penalty has been shrinking. It has averaged just over $700 billion over the past half decade. So it appears that the response to the financial crisis and Dodd-Frank and other banking reforms have made investors more likely to expect bailouts, even if they are still not sure they will come. Too big to fail is dead, but, I guess, not as dead as it was a few years ago.