The largest private shareholder of AIG is enthusiastic about the insurance firm’s latest deal with the government and is certain that his patience will pay off.

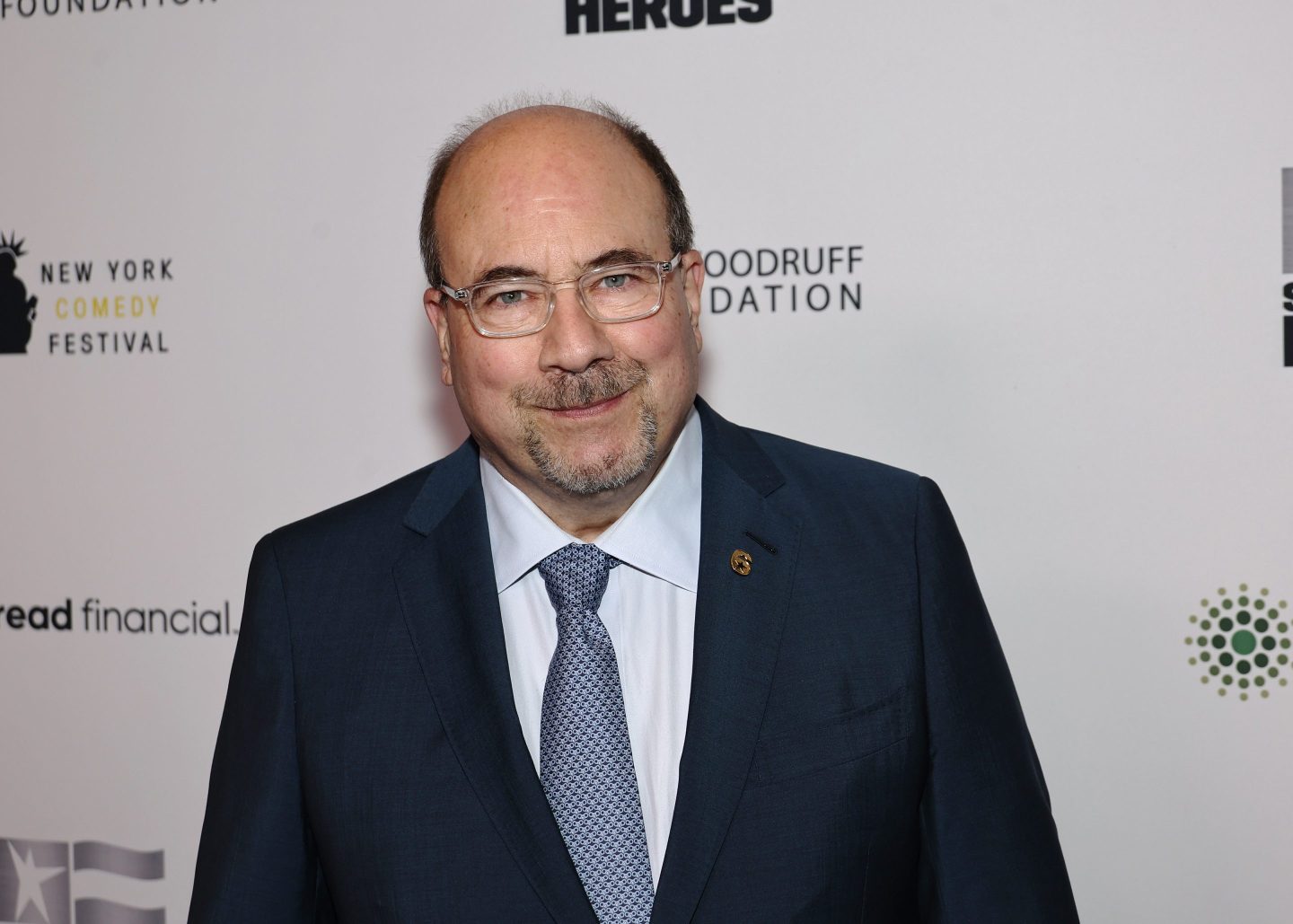

AIG shares rocketed up 13% Thursday on news that the beleaguered insurance giant plans to pay back $20 billion to the New York Fed. Fortune caught up with Bruce Berkowitz, founder of Fairholme Capital Management and AIG’s largest private shareholder, to discuss the latest development as well as AIG’s future.

At 42 million shares, Fairholme’s stake in AIG (AIG) gained about $224 million on Thursday. According to Berkowitz, it’s not over yet.

What does AIG’s plan to repay the New York Fed mean for its much larger tab to the US Treasury?

When AIG owes money to the New York Fed, they come first. The Treasury is on the on-deck circle. Now that the Fed is done, it’s focused on the Treasury. It’s a major achievement — it’s a milestone. One down, one to go. That’s pretty much it.

Investors seemed to like the news. The stock is up more than 10%. What do you think the market is looking at?

They’re probably reading the agreement that was filed with the SEC, which spells out the deal. This is a definitive agreement — the preliminary agreement was filed a couple weeks ago and it hasn’t changed. This is the second time now the plan has come out. With time, more people will read it and understand it. And I think it’s becoming clear now that the government is going to be paid with interest over time, and that some patience will also pay, both for taxpayers and for stockholders.

Fairholme added about two million new AIG shares in the past few weeks. Other investors are worried that the Treasury will hurt existing shareholders when they start selling their large stake, possibly starting in the spring. Are you not?

There’s a difference between permanent risk and volatility. Will people try to game the system by pushing the stock price down right before the Treasury tries to sell? Maybe. But if it happens, it would be a short-term effect. You could see what’s happened with Citigroup (C).

The government had a pretty good record selling its shares in Citi without hurting the stock price. Do you think that will happen with AIG?

Yes, I do. If the marketplace understands that the Treasury is not going to be forced to sell its position at a poor price, then the value of the company will start to be judged based upon its intrinsic value rather than a constant focus on the stock overhang. I mean, if you take a look now at the amount of the government shares, the government is going to do great. 1.66 billion shares at $46 is a lot more than they’re owed.

For more on Berkowitz, read Bruce Berkowitz: The mega mind of Miami