Over more than a century, three generations of Bucherers built one of the most exclusive watch and jewelry retailers in the world, selling expensive time pieces and glittering gems to the global rich and famous.

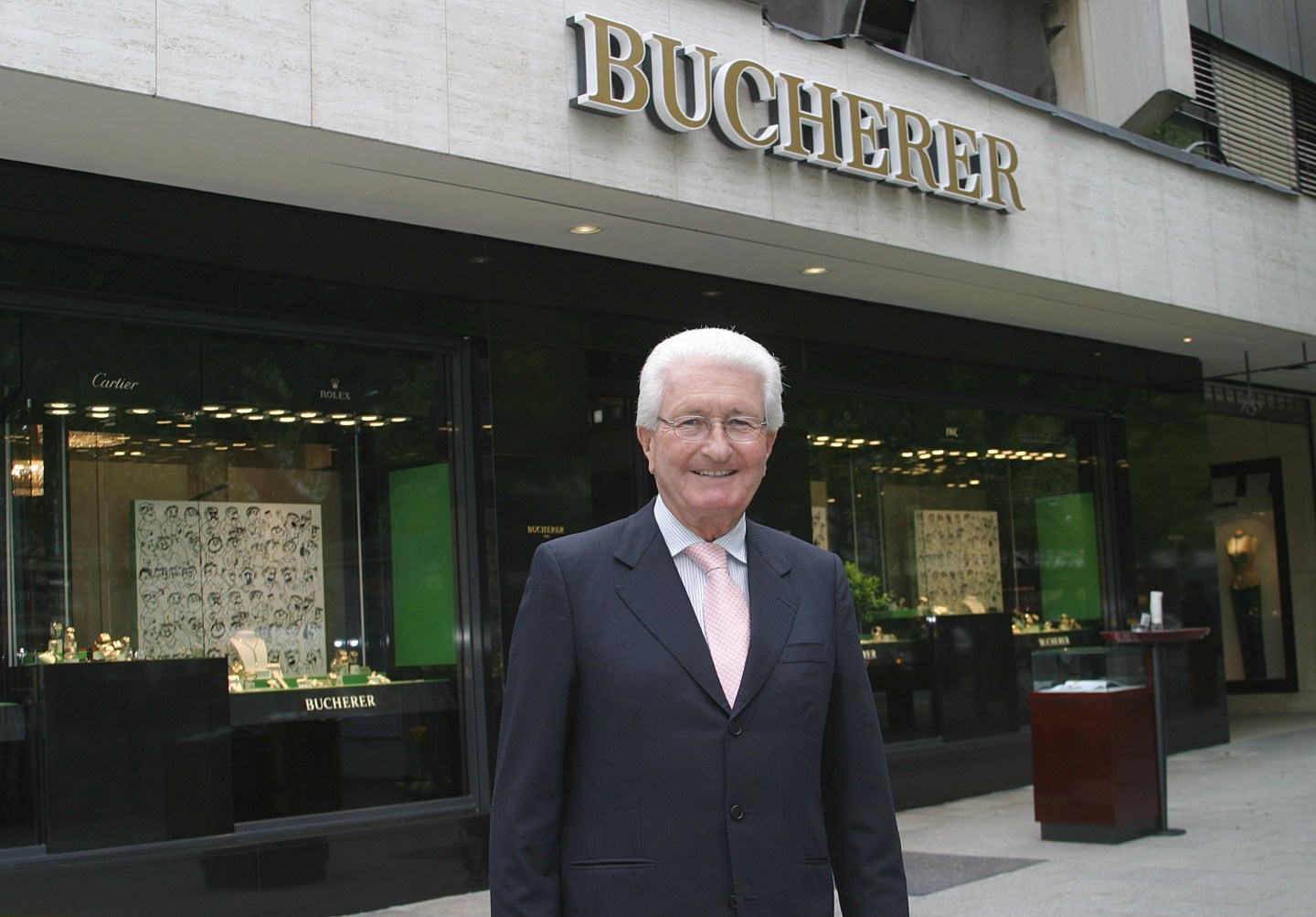

Now, the secretive 87-year-old Swiss billionaire behind the eponymous luxury boutiques — Chairman Jörg G. Bucherer — has agreed to sell Bucherer AG to Rolex in a move that has stunned the world of high-end watch retailing.

The companies didn’t disclose the terms of their deal and arriving at an estimate isn’t easy since neither Switzerland-based firm publishes financial results.

Jean-Philippe Bertschy, an analyst with Vontobel Holding AG, put annual sales at Bucherer’s more than 100 stores at about 2 billion Swiss francs ($2.3 billion), giving the firm an enterprise value of as much as 4 billion Swiss francs. He estimated Bucherer accounts for about 5% of Rolex’s sales.

The octogenarian Bucherer’s decision to dispose of the closely held family business took the industry by surprise partly because of the intense secrecy surrounding himself and the two watchmakers, whose histories have been closely entwined for decades. In a statement about the agreement, Rolex said his choice was made “in the absence of direct descendants.”

By buying Bucherer, Rolex is giving itself a major presence in consumer sales for the first time, a strategic shift from reliance on external distributors. The only store in the world currently owned and operated by Rolex is in its home city of Geneva.

Read More: Rolex Upends Luxury Watch Retail With Purchase of Bucherer

The deal, which still requires approval from authorities, comes amid what UBS Group AG has dubbed the greatest transfer of wealth in history over the next two decades as business founders and investors grow older. Yet it’s unclear where Bucherer plans to direct the proceeds from the sale. A spokesperson for the firm declined to provide any details beyond the Rolex statement, adding that Bucherer “has always been a very discreet company.”

What’s clear is that the move will put an end to dynastic control over the purveyor of pricey jewelry and watch brands including Rolex, its own Carl F. Bucherer, Chopard and Blancpain. The business traces its roots to 1888 when entrepreneur Carl-Friedrich Bucherer and his wife Luise opened a shop in Lucerne, according to the company’s website.

Their sons Ernst and Carl Eduard joined the business in the early 1920s, with Ernst reaching an agreement with Rolex founder Hans Wilsdorf in 1924 to add the brand to its product line. Third-generation Jörg took over management in 1977, expanding into Austria in the 1980s and then Germany a decade later. Bucherer opened a flagship store in Paris in 2013 and has also moved into London, Copenhagen and the US.

Jörg Bucherer has never been known to give a media interview and is mentioned only briefly on the company’s website. A French corporate filing lists him as a Swiss national.

German-born Rolex founder Wilsdorf created a Geneva-based foundation in his name in 1945 that took over the firm’s ownership, according to the company’s website. He died in 1960 and also didn’t have any direct descendants.

“Jörg Bucherer is the last person still in activity to have known and worked with Hans Wilsdorf,” Rolex said Thursday in its statement announcing the deal, adding that Bucherer will remain the retailer’s honorary president.