China has banned exports of key materials used to make a wide range of products, including smartphones, electric vehicles, radar systems and CT scanners, swiping back at Washington after it expanded export controls to include dozens of Chinese companies that make equipment used to produce advanced computer chips.

Both sides say their controls are justified by national security concerns and both accuse the other of “weaponizing” trade. Analysts say the latest restrictions could have a wide impact on manufacturing in many industries and supply chains.

“Critical mineral security is now intrinsically linked to the escalating tech trade war,” Gracelin Baskaran and Meredith Schwartz of the Center for Strategic International Studies, wrote in a report on Beijing’s decision.

The full impact will depend partly on whether U.S. industries can compensate for any loss of access to the strategically important materials, equipment and components.

Here’s why this could be a tipping point in trade conflict between the two biggest economies, coming at a time when antagonisms already were expected to heat up once President-elect Donald Trump takes office, given his vows to hike tariffs on imports of Chinese-made products.

What did China do and why?

China has banned, in principle, exports to the United States of gallium, germanium and antimony—critical minerals needed to make advanced semiconductors, among many other types of equipment. Beijing also tightened controls on exports of graphite, which is used in EV and grid-storage batteries. China is the largest source for most of these materials and also dominates refining of those materials, which are used both for consumer goods and for military purposes.

The limits announced Tuesday also include exports of super-hard materials, such as diamonds and other synthetic materials that are not compressible and extremely dense. They are used in many industrial areas such as cutting tools, disc brakes and protective coatings.

Next on the list of potential bans, experts say: tungsten, magnesium and aluminum alloys.

What did the U.S. do and why?

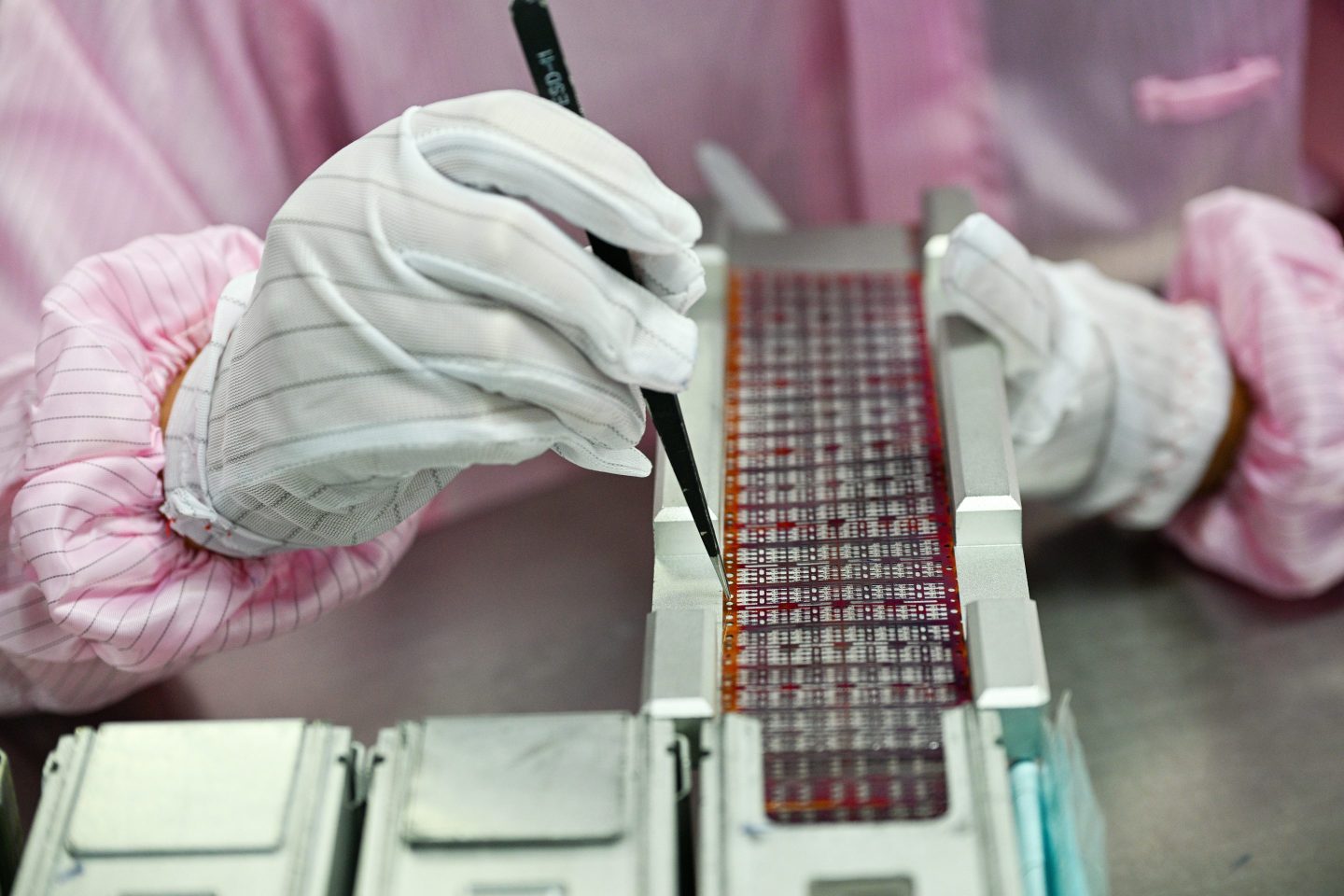

The Chinese Commerce Ministry announced its measures after the U.S. government ordered a slew of new measures meant to prevent sales to China of certain types of advanced semiconductors and the tools and software needed to make them. Washington also expanded its “entity list” of companies facing strict export controls to include 140 more companies, nearly all of them based in China or Chinese-owned.

Commerce Secretary Gina Raimondo said the revised rules were intended to impair China’s ability to use advanced technologies that “pose a risk to our national security.” The updated regulations also limit exports to China of high-bandwidth memory chips that are needed to process massive amounts of data in advanced applications such as artificial intelligence.

Export licenses will likely be denied for any U.S. company trying to do business with the 140 companies newly added to the “entity list,” as well as the dozens of others already on the list. The aim, officials said, is to stop Chinese companies from leveraging U.S. technology to make their own semiconductors.

The Biden administration has been expanding the number of companies affected by such export controls while encouraging an expansion of investments in and manufacturing of semiconductors in the U.S. and other Western countries.

Washington also extended the restrictions on exports of advanced semiconductor technology to companies in other countries, though it excluded companies in key allies like Japan, South Korea and the Netherlands that are thought to have adequate export controls of their own.

How important are those materials?

In a word: very. For the U.S., Japan, South Korea, Taiwan and other producers of advanced technology and components, access to materials with such properties as high conductivity is crucial: gallium and germanium increasingly are used in advanced semiconductors in place of silicon.

The materials subject to Chinese export controls are among 50 the United States Geologic Survey has designated as “critical minerals”—non-fuel minerals essential to U.S. economic or national security that have supply chains vulnerable to disruption.

Gallium topped that list. It is needed to make the same high-bandwidth memory chips the U.S. wants to avoid allowing China to access for use in artificial intelligence and defense applications. It’s used to make LEDs, lasers and magnets used in many products. Germanium is used for optical fiber and solar panels, among other uses.

A USGS study recently estimated the likely total cost to the U.S. economy from disruptions to supplies of gallium and germanium alone at more than $3 billion. But the situation is complicated. China imposed licensing requirements on exports of both metals in July 2023. It has not exported either to the U.S. this year, according to Chinese customs data. Antimony exports also have plunged.

China produces the lion’s share of most critical minerals, but there are alternatives. Japan also imports nearly all of its gallium, for example, but it also extracts it by recycling scrap metal.

Washington has been moving to tap sources other than China, forming a “Minerals Security Partnership” with the EU and 15 other countries. President Joe Biden’s visit to Africa this week highlighted that effort. Potential supply disruptions also have spurred efforts to tap U.S. deposits of rare earths and other critical materials in southeastern Wyoming, Montana, Nevada, Minnesota and parts of the American Southwest.

Germanium has been extracted from zinc mined in Alaska and Tennessee and the U.S. government has a stockpile. The Department of Defense has a recycling program that can extract scrap germanium from night vision lenses and tank turret windows.

But China’s dominance as a supplier gives it an overwhelming cost advantage, and U.S. resource companies face strong pressures over the potential environmental impact of mines and refineries.

What might happen next?

Since then-President Trump launched a trade war against Beijing that has ramped up over time, China has adopted a relatively constrained and cautious approach in responding to the U.S. limits on access to advanced technology.

Much depends on the future course of overall relations. It is unclear if Trump will follow through on his vows to push tariffs sharply higher once he takes office or if such declarations are the opening gambits in future trade negotiations.

China hit back with its own tariff hikes, but excluded many items crucial for its own economy. It sanctioned certain companies, especially defense contractors doing business with Taiwan, but refrained from outright bans on exports of vital materials to the U.S.

This time may be different.

Just after China’s Commerce Ministry announced its export ban, various Chinese industry associations including automakers and the China Semiconductor Association issued statements denouncing Washington’s moves to curb access to strategically sensitive technologies and declaring that U.S. computer chips are unreliable.

Beijing’s announcement also extends its ban on exporting Chinese-produced gallium and other critical minerals to the U.S. to apply to all countries, entities and individuals, saying violators will “be held accountable according to law.”