Paramount is again sweetening its hostile takeover bid for Warner Bros. Discovery, while again extending the deadline for its tender offer as it scrambles for more shareholder support.

On Tuesday, the Skydance-owned company said it would pay Warner shareholders an added “ticking fee” if its deal doesn’t go through by the end of the year — amounting to 25 cents per share, or a total of $650 million, for every quarter after Dec. 31. Paramount also pledged to fund Warner’s proposed $2.8 billion breakup payout to Netflix under its studio and streaming merger agreement.

The value of Paramount’s offer otherwise remains unchanged. The company is offering to pay $30 per share in cash to Warner’s stakeholders, who now have until March 2 to tender their shares.

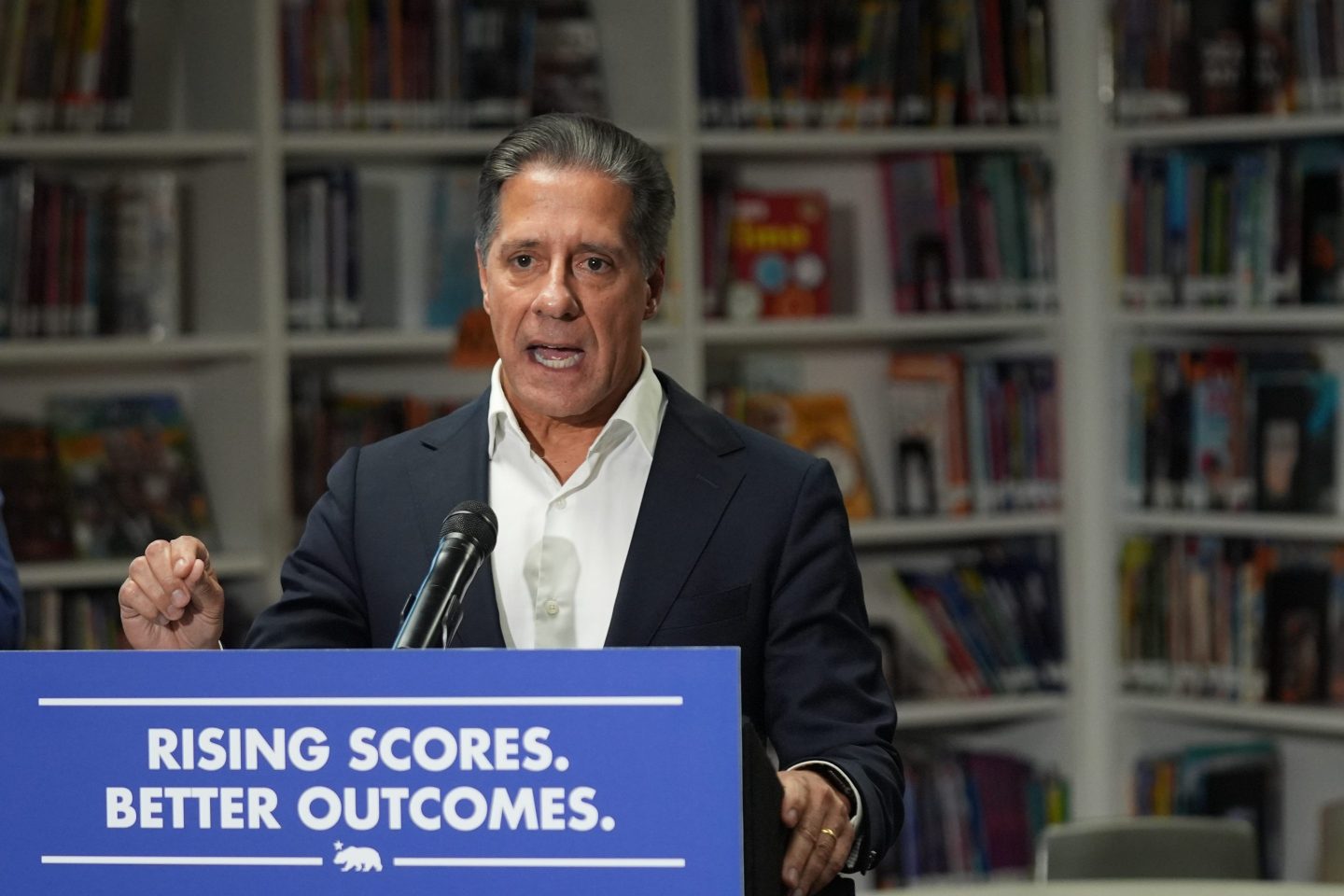

In a statement, Paramount CEO David Ellison said that the “additional benefits” announced Tuesday “clearly underscore our strong and unwavering commitment to delivering the full value WBD shareholders deserve for their investment.”

Paramount wants to buy Warner’s entire company for $77.9 billion, with a total enterprise value of $108 billion including debt. Beyond studio and streaming operations, that includes Warner’s networks like CNN and Discovery.

But it has a long way to go in terms of getting shareholder support — which, according to recent company disclosures, has appeared to decline over the last month. As of Monday, Paramount said that more than 42.3 million Warner shares had been “validly tendered and not withdrawn” from its bid, down from over 168.5 million Warner shares on Jan. 21.

Warner has about 2.48 billion shares outstanding in series A common stock today. Paramount would need more than 50% to effectively gain control of the company.

Netflix and Warner did not immediately respond to requests for comment Tuesday.

The new March 2 deadline marks the third time Paramount has pushed back the expiration of its tender offer, which it may keep extending. Paramount has also promised a proxy fight. Last month, the company begun soliciting proxies to challenge Warner’s agreement with Netflix.

Warner’s leadership has consistently backed the deal it struck with Netflix. In December, Netflix agreed to buy Warner’s studio and streaming business for $72 billion — now in an all-cash transaction that the companies have said will speed up the path to a shareholder vote by April. Including debt, the enterprise value of the deal is about $83 billion, or $27.75 per share.

Netflix and Warner have maintained that their agreement is better Paramount’s bid. But Paramount argues that its offer is superior — and on Tuesday pointed to a “sliding scale” value of the Netflix merger, which could range from $21.23 to $27.75 per share, depending on debt spanning from Warner’s previously announced spinoff of its networks business.

Unlike Paramount, Netflix doesn’t want to acquire Warner networks like CNN and Discovery. Under Netflix-Warner’ agreement, “Discovery Global” would become its own separate public company before their merger is closed.

The prospect of a Warner sale to either company has raised tremendous antitrust concerns from lawmakers worldwide. The U.S. Department of Justice has initiated reviews of both Warner’s agreement with Netflix and Paramount’s hostile bid — with all three companies disclosing that they’ve been in contact with the DOJ over requests for more information.

The companies have argued their proposed deals will be good news for consumers and the wider entertainment industry, claiming that merging will give streaming customers more content through bigger libraries. But unions and other trade groups have warned that further consolidation in the industry could result in job losses and less diversity in content — with particularly negative consequences for filmmaking.

Slide 2 of 3PreviousNext

FILE – A Netflix sign is displayed atop a building in Los Angeles, on Dec. 18, 2025, with the Hollywood sign in the distance. (AP Photo/Jae C. Hong, File)

| Photo Metadata (2 of 3) | |

|---|---|

| Date | Jan 20, 2026 08:14 |

| Headline | US Warner Bros |

| Source | AP |

| Notes | FILE |

Use information

Use of this content is for editorial purposes only. For inquiries regarding non-editorial uses, contact your licensing representative.