A comprehensive new report released by the Congressional Budget Office (CBO) portrays a stark transformation of the American economy over the last four decades, revealing a deepening divide where the wealthiest households have dramatically expanded their economic footprint while the middle class has steadily lost ground.

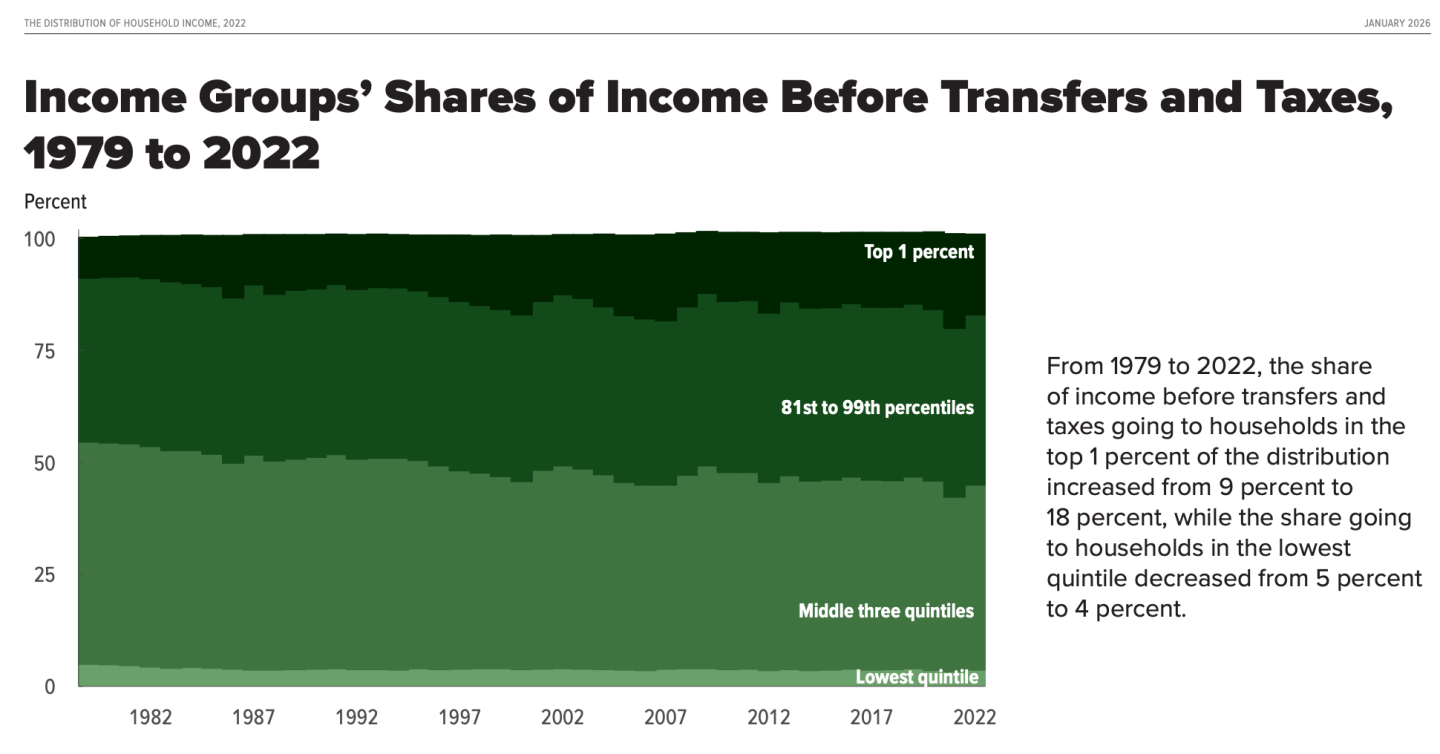

According to the data, which spans from 1979 through 2022, the distribution of national income has skewed heavily toward the very top. The report reveals the top 1% of households grew their share of income before transfers and taxes from 9% in 1979 to 18% in 2022, effectively doubling their slice of the economic pie.

A hollowing out of the middle

While the top tier prospered, the rest of the economic ladder struggled to maintain its standing. The CBO found as the top 1% seized a larger portion of market income, the share going to the lowest quintile dropped from 5% to 4%. This means most of the compression occurred in the middle.

Even after accounting for the stabilizing effects of the safety net and the tax code, the middle class has seen its relative status diminish. The share of income after transfers and taxes held by the “middle three” income quintiles decreased by 6 percentage points over the 43-year period. Conversely, the share of after-tax income going to the top 1% doubled from 7% to 14%.

The disparity in growth rates is even more pronounced when looking at the ultrawealthy. While average income grew for all groups since 1979, the acceleration at the summit was unmatched. Income for the highest quintile more than doubled, and for the top 0.01% of earners, average income after taxes and transfers grew more than sevenfold.

To be sure, the amount of wealth is greater overall, with the U.S. surging in the creation of more millionaires than ever before—a development so stark that UBS nicknamed it the “everyday millionaire.” While the wealthy own a greater share of household wealth, this is coming on the back of overall growth in the economy, with a rising tide arguably lifting all boats. The wealthy may have a greater share, in other words, but it’s a greater share of a larger pie.

Kent Smetters, the Wharton School professor and faculty director of the Penn Wharton Budget Model (PWBM), recently told Fortune that he thinks the behavioral economics phenomenon that is known as the “money illusion” is at play. This is where people don’t actually believe that they have gotten richer because of, well, sticker shock. “The reality is that, in fact, we have a much higher standard of living than we had even 20 or 30 years ago,” he said. “I’m not saying there’s no problems,” but just consider the family car, for example. He recalled his family having to budget for the car breaking down multiple times a year and that just doesn’t happen due to technological improvements.

Drivers of inequality

The report identifies market income—specifically capital gains—as a primary engine of this divergence. Realized capital gains constitute a much larger portion of income for households at the top of the distribution, leading to massive financial surges during boom years. Consequently, increases in market income at the top drove much of the overall rise in income inequality observed since the late 1970s.

The federal government has attempted to mitigate this widening gap through the tax and transfer system. The CBO notes the degree to which taxes and transfers reduce inequality has actually increased over the past four decades. However, the structure of federal revenue has shifted along with the income. Because the wealthy now command such a massive share of total earnings, they also pay a larger portion of the national tax bill; the top quintile paid 70% of all federal taxes in 2022, up from 55% in 1979.

Smetters also recently spoke to Fortune about misconceptions on the U.S. tax system. “What people don’t realize is just how progressive the United States income tax system is,” by far the most progressive in the OECD. With such a progressive tax system, he added, “it’s really hard to raise a lot of revenue,” because the wealthy are paying such a disproportionate share.

The CBO found over this 43-year period, the reliance on government assistance has grown for the poorest Americans. For the lowest income quintile, Medicaid and CHIP benefits ballooned from representing just 9% of their income in 1979 to 48% in 2022.

Post-pandemic volatility

The CBO also provided a snapshot of the volatile economy immediately following the COVID-19 pandemic. In 2022, average income after transfers and taxes actually fell for all income groups compared to the prior year.

For lower-income households, this decline was driven by the expiration of temporary pandemic-era policies, such as the expanded child tax credit and recovery rebate credits. For the wealthy, the 2022 dip was the result of a sharp decline in realized capital gains from a record high in 2021.

Despite the temporary fluctuation in 2022, the long-term trend remains clear. The Gini coefficient, a standard measure of income inequality, shows the gap between the rich and the rest of the country is significantly wider today than it was in 1979.

For this story, Fortune journalists used generative AI as a research tool. An editor verified the accuracy of the information before publishing.

[This report has been updated to add additional context on the growth of the economy since the 1970s and comments from UBS and Wharton professor Kent Smetters.]