The weakest job market since 2011 is increasingly being framed not as a glitch, but as the new normal—one where growth roars and jobs barely move, leaving a generation asking, “Dude, where’s my job?”

Bank of America Global Research’s “Situation Room” note warned in mid-December that markets are priced for a robust 2026 even as hiring stalls and unemployment rises and recalled a now 25-year-old cult classic stoner comedy starring Ashton Kutcher and Seann William Scott to make its point.

The entry-level worker would be forgiven, in other words, for feeling about their job search the way Kutcher and Scott felt about their stolen wheels. (In fact, the screenwriter of Dude, Where’s My Car? had a similar take on the show-business labor market, telling The Hollywood Reporter several weeks ago that he’d quit to become a therapist.)

“The job market has been weak this year,” wrote BofA’s Yuri Seliger and Sohyun Marie Lee, commenting on the double payroll report showing weak job growth in October and November. “A lack of recovery in the jobs market and a slower U.S. economy are key risks to watch for in 2026.”

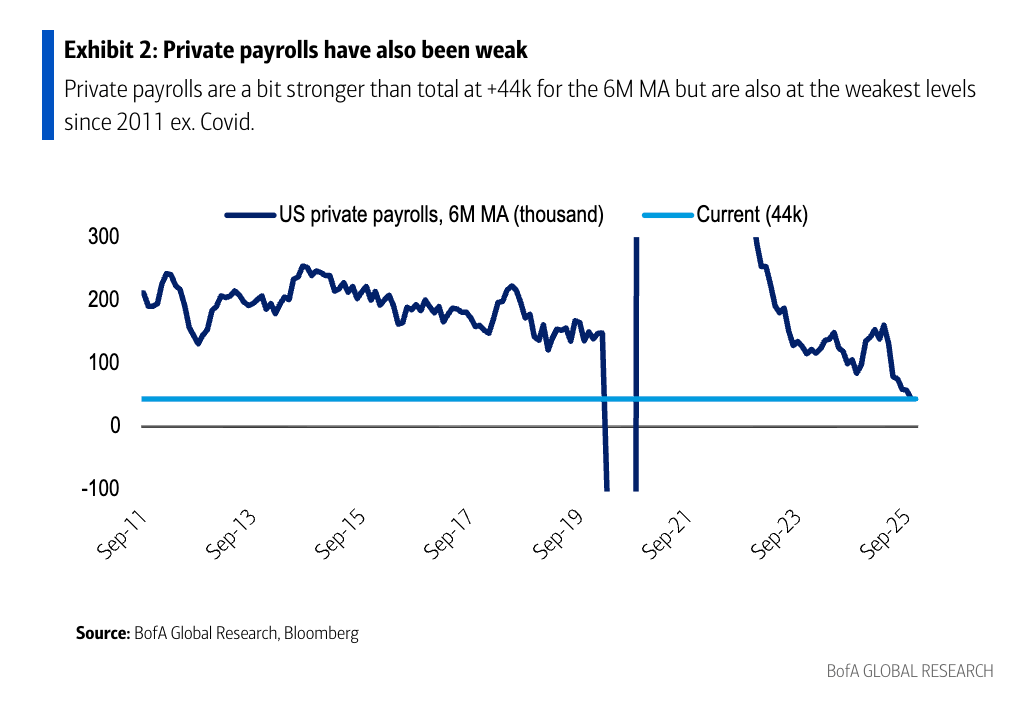

Seliger and Lee flagged what they called the weakest U.S. job market since at least 2011 (with the notable exception of the mass layoff wave from COVID), with growth in monthly payrolls averaging just 17,000 over the past six months—by far the slowest pace of job creation since the Global Financial Crisis. Private payrolls are only modestly stronger at 44,000 on a six‑month average basis, still at their weakest level in well over a decade, while broader U‑6 underemployment has climbed to 8.7% and job openings per unemployed worker have slumped to 1.0, both the softest since 2017.

Yet the Situation Room team also noted that credit spreads remain near cyclical heights and stocks near record highs, signaling that investors are still betting on a strong expansion in 2026. “A strong U.S. economy is likely not compatible with the absence of job growth,” they caution, warning that the lack of a labor market recovery is now one of the central risks to that bullish market narrative. The surprisingly strong GDP number for the third quarter, revealed after the BofA note was written, added new fuel to the fires of this argument.

K‑shaped growth with missing jobs

The headline growth number was eye‑catching: in the third quarter, U.S. GDP grew at a 4.3% annual rate, powered by a consumer spending surge and a $166 billion jump in corporate profits. But real disposable income was flat—literally 0% growth—meaning households did not gain purchasing power and instead relied on savings, credit, and cost‑cutting to keep spending, especially on unavoidable items like health care and childcare.

KPMG chief economist Diane Swonk previously described this to Fortune as a fully mature K‑shaped economy, where affluent households ride surging equity markets, elevated home values, and AI‑boosted corporate earnings, while lower‑ and middle‑income families are squeezed by affordability pressures and stagnant real income.

Businesses, she argued, have learned how to grow without hiring, squeezing more output from lean teams rather than expanding payrolls to meet demand—a pattern that aligns with BofA’s evidence of historically weak payroll gains in an otherwise solid macro backdrop. “We are seeing most of the productivity gains we’re seeing right now as really just the residual of companies being hesitant to hire and doing more with less,” Swonk told Fortune. “Not necessarily AI yet.”

Her analysis aligned with what BofA’s Savita Subramanian told Fortune in August about a “sea change” in worker productivity, as companies replaced people with process. Companies had learned how to “do more with fewer people” after the inflation that followed the pandemic, and she predicted this will be a positive for stocks: “A process is almost free, and it’s replicable for eternity.”

Goldman’s ‘jobless growth’ and Gen Z

More darkly, Goldman Sachs economists warned about the prospect of “jobless growth,” echoing Fed Chair Jerome Powell’s description of a “low-hire, low-fire” labor market. In an October note, Goldman economists David Mericle and Pierfrancesco Mei found that outside of health care, net job creation turned weak, zero, or negative in many sectors even as output keeps rising, with executives increasingly focused on using AI to reduce labor costs—a “potentially long‑lasting headwind to labor demand.”

They argued that the modest job gains alongside robust GDP seen recently are “likely to be normal to some degree in the years ahead,” with most growth coming from productivity—especially via AI—while aging demographics and lower immigration limit labor‑supply contributions.

Apollo Global Management’s Torsten Slok pointed out in a December note that demographic change is now becoming visible: The number of families with children under 18 peaked at around 37 million in 2007 and has declined to approximately 33 million as of 2024, reflecting lower birth rates and an aging population, despite overall population growth continuing.

A fragile equilibrium

Both BofA and Goldman stop short of predicting mass unemployment, but neither sees an easy path back to the old playbook where strong GDP reliably meant plentiful new jobs. Still, Goldman sees a larger shakeout for the economy: “History also suggests that the full consequences of AI for the labor market might not become apparent until a recession hits,” Mericle and Mei wrote in October.

In the meantime, the mid‑2020s labor market may remain defined less by layoffs than by scarcity of opportunity—especially for Gen Z—an era of job hugging at the top and job hunting in vain at the bottom. Seen in light of the GDP figures and the prospect of jobless growth over the horizon, BofA’s glib, throwback question may only become more pressing in the new year: Where are the jobs?