The mere hope of maybe becoming a homeowner someday is such a potent motivator that it affects how people work, consume, and invest, but many Americans are writing off that dream, researchers said.

According to a paper published earlier this month by Northwestern University’s Seung Hyeong Lee and the University of Chicago’s Younggeun Yoo, younger generations are not just delaying homeownership—they are increasingly giving up on it.

That’s as the housing affordability crisis has put ownership out of reach for millions. The median house price was 5.81 times the median household income in 2022, up from a ratio of 4.52 in 2010 and 3.57 in 1984. And that doesn’t include related costs that have grown like insurance.

Once homeownership looks impossible, behavior shifts away from working toward saving enough for a down payment, Lee and Yoo warn. On the flip side, renters who hold on to dreams of owning a home tend to be more careful with their money and keep hustling at work, putting them on the path to ownership.

“These dynamics underscore the powerful role of hope: belief in the attainability of homeownership shapes savings, work effort, and investment decisions in compounding ways over the life cycle, with profound implications for long-run wealth inequality,” they wrote.

That helps explain elevated consumption among millennials and Gen Zers who are “doom spending” on lavish purchases or vacations. In fact, the share of millennial renters with zero savings for a down payment jumped to 67% in 2023 from 48% in 2018, according to Apartment List data.

Meanwhile, demands for more work-life balance and declarations of “quiet quitting” track with a diminished perception that working harder will pay off. Lee and Yoo found that among renters with net worths under $300,000, the share who admit to low work effort is 4% to 6%, which is twice the rate among homeowners.

And as homeownership hopes fade, new investment platforms and the proliferation of risky crypto assets have created an alternate avenue for growing wealth.

“If steady saving and traditional asset accumulation no longer suffice to secure a home, some households may instead pursue high-risk, high-return strategies—such as investing in cryptocurrencies—as a last resort,” Lee and Yoo said. “For those priced out of the housing market, gambling on improbable but potentially transformative gains may appear rational, particularly among younger cohorts.”

‘Effectively living hand-to-mouth’

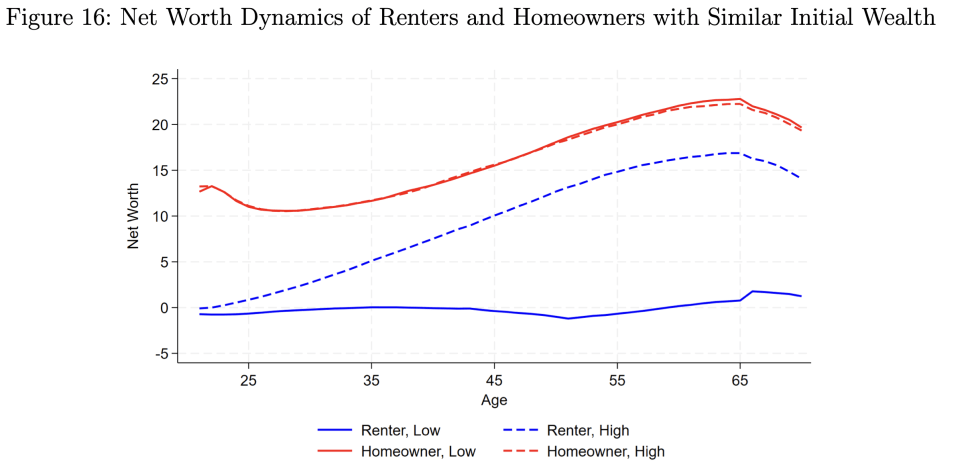

Even when there isn’t much difference in wealth between young renters with a low probability of owning and those with a high probability, the change in behavior over their lifetimes produces vastly different results, according to the researchers.

Giving up makes it even harder to escape low-wealth trajectories. They found that renters with low ownership odds continue to have nearly zero net worth through much of life, “effectively living hand-to-mouth with negligible asset accumulation.”

That behavior tends to carry over, Lee and Yoo added. Children of parents who lost hope start with fewer resources and are more likely to give up, too. Conversely, children of homeowners are more likely to be homeowners as well.

“In this way, giving up homeownership can act as a transmission mechanism that entrenches and amplifies wealth inequality over generations, potentially leading to a society in which homeownership becomes increasingly out of reach for households without intergenerational transfers,” they explained.

By age 40, most renters have determined whether they still have a good shot at homeownership or not. Lee and Yoo propose aid for renters on the margins who have lost hope but could still transition to the hopeful category with enough money to get them over the threshold.

Their research adds to the growing signs of economic anxiety amid the overall affordability crisis, even among higher-income Americans.

A recent survey from the Harris Poll showed many who earn six figures are privately struggling. Among the findings was that 64% of six-figure earners said their income isn’t a milestone for success but merely the bare minimum for staying afloat.

“Our data shows that even high earners are financially anxious—they’re living the illusion of affluence while privately juggling credit cards, debt, and survival strategies,” Libby Rodney, the Harris Poll’s chief strategy officer and futurist, said in a statement.

And in a viral Substack post last week, Michael Green, chief strategist and portfolio manager for Simplify Asset Management, said the real poverty line should be about $140,000 a year in household income to account for the increased cost of housing, health care, childcare, transportation, and college.

At the same time, Americans who are below Green’s version of the poverty threshold are still falling behind, even as they climb the income ladder.

“Our entire safety net is designed to catch people at the very bottom, but it sets a trap for anyone trying to climb out,” he explained. “As income rises from $40,000 to $100,000, benefits disappear faster than wages increase. I call this the Valley of Death.”