Amazon, Google, Meta, Microsoft, and Oracle are increasingly funding their operations through debt, according to Bank of America analyst Yuri Seliger. This year, these five “hyperscalers” have issued $121 billion in debt, including $27 billion alone to fund Meta’s new data center in Richland Parish, La., Seliger said in a research note dated Nov. 17. Amazon also issued $15 billion in new debt on Nov. 17.

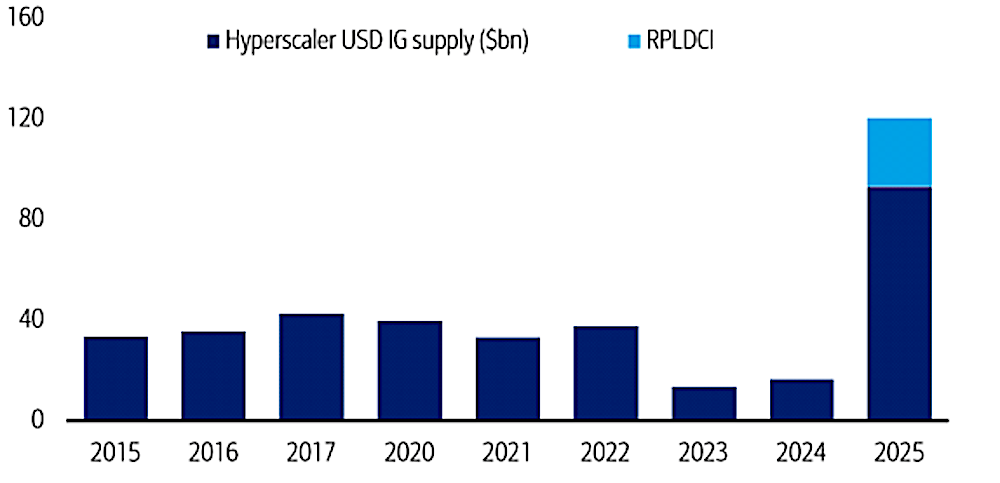

To put that $121 billion in perspective, it’s more than four times the average level of debt ($28 billion) issued by these companies annually over the previous five years, per this Bank of America chart:

The sudden influx of these investment-grade (IG) corporate bonds into the market has increased their “spread,” Seliger said in the note: the gap between the interest yield on bonds from these companies, compared with a risk-free rate or the market as a whole. The yield on Oracle’s debt has increased by 48 basis points (0.48%) since September, the note said.

“Not surprisingly, this deluge of supply has widened hyperscaler spreads materially. From Sep 1st to Nov 14th, spreads are +48bps wider for ORCL, +15bps wider for META, and +10bps wider for GOOGL. That’s 27%-49% wider, significantly underperforming the overall IG index,” he wrote.

Seliger told clients he expects to see a further $100 billion in debt offered to the market next year.

All five companies generate more than enough cash flow to cover their operations. However, the arrival of debt vehicles to fund AI development has complicated the investment case for tech stocks, Morgan Stanley Wealth Management chief investment officer Lisa Shalett told Fortune recently. “What was a very simple story is suddenly getting a lot more complex,” she said.