Between Wall Street, retail investors, Ivy League economists, and Washington policymakers, you’d be hard-pressed to find someone who isn’t nervous about America’s national debt burden. Their concern is for the day when confidence in the bond market wanes, when buyers of America’s borrowing question whether Uncle Sam can really pay his debts.

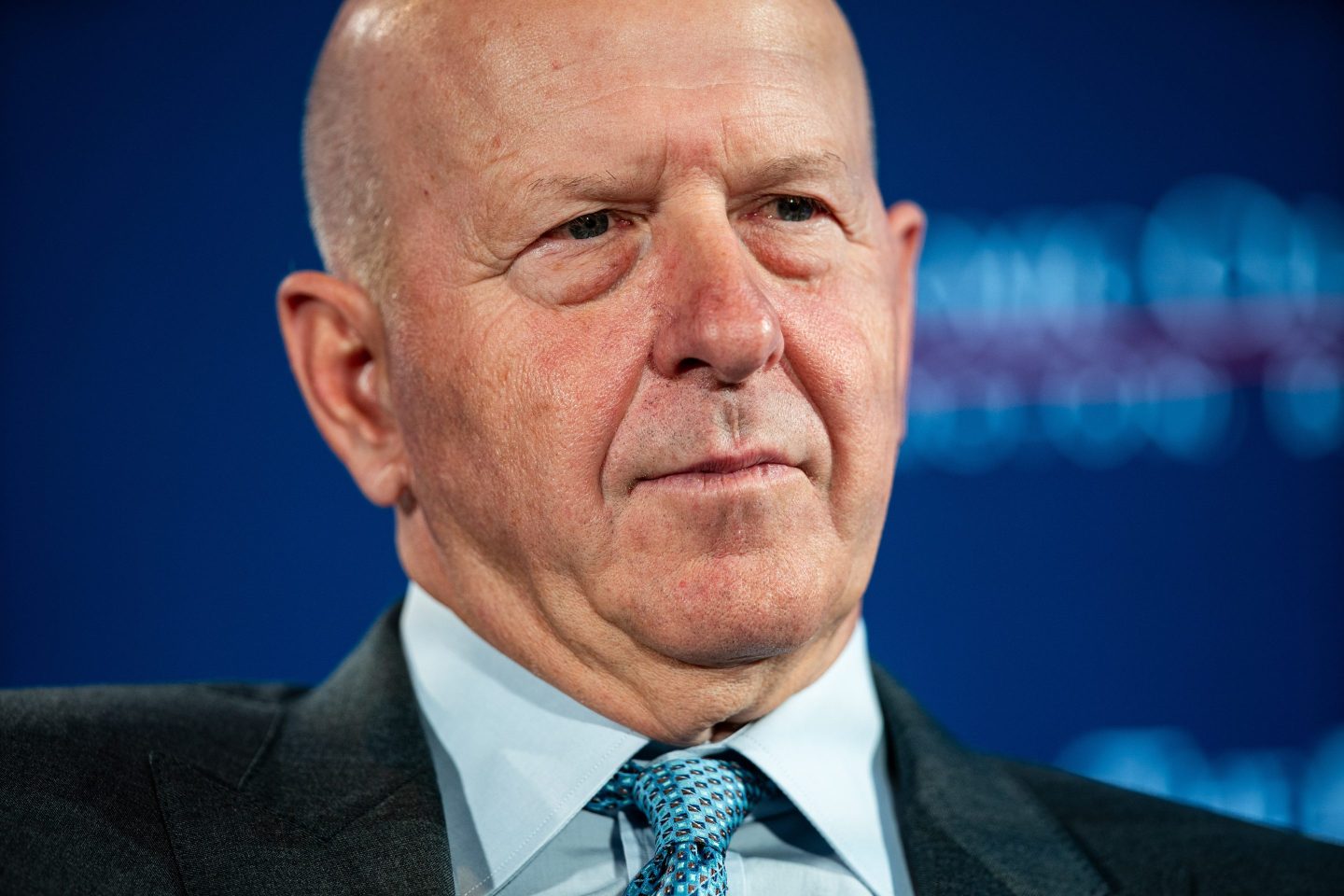

Goldman Sachs CEO David Solomon is among those concerned about the $38 trillion national debt problem, joining the ranks of JPMorgan CEO Jamie Dimon, Fed chair Jerome Powell, Bridgewater Associates founder Ray Dalio, and increasingly, politicians on Capitol Hill.

Indeed, like his counterparts, Solomon isn’t necessarily worried about the value of the debt America has accumulated, but rather its debt-to-GDP ratio. This barometer indicates to the market how much the U.S. is adding to its debt obligations in relation to how quickly its economy is growing—and thus its ability to pay back the loans. At present, that balance sits at around 125% according to Treasury data, but is expected to hit 156% by 2055, according to the Congressional Budget Office (CBO).

The balance of debt to GDP presents two options to reduce the benchmark: either cutting spending or growing the economy. The latter is seen as preferable by many, but potentially an optimistic choice that doesn’t address the problem of fiscal overstretch.

Solomon said, in the current environment, with the promise of AI boosting Wall Street to new highs, the growth option is looking more and more realistic. Speaking at the Economic Club of Washington, D.C. last week, the banking titan noted: “The path out is a growth path. The difference between compounding growth of 3% and 2% is monstrous in terms of dealing with this issue, so there’s a lot of discussion about running … real growth play.

“I think we have some things that are going to give us a better opportunity to have a higher growth trajectory, particularly … technology, AI getting embedded into the enterprise, and the productivity opportunity from that,” he added. “But if we continue on the current course, and we don’t take the growth level up, there will be a reckoning.”

According to the latest data, there’s reason for Solomon to hope. Per the Bureau of Economic Analysis’s most recent estimates (last shared on Sept. 25 as no new releases are being shared during the government shutdown), GDP in the second quarter was up 3.8%.

An embedded behavior

Solomon, who has led Goldman Sachs since 2018, added that national debt doesn’t have to become a “crisis.” That being said, he did say many of his contacts in the business community are worried about the level of debt and the behavior that now seems to be the norm.

“I think people are worried about … the fact that we’ve reached a point—and by the way, this is true in the United States, but it’s true in every other developed economy—where … fiscal stimulus and aggressive fiscal play is really just kind of embedded in the way these democratic economies are operating, and it’s accelerated meaningfully in the last five years,” he added.

Since President Donald Trump returned to the Oval Office, economists have highlighted the unusual ways the administration is rebalancing the books. While chief among them is raising revenues through tariffs, Trump has also suggested raising funds to pay off national debt through a “gold card” visa program, which would charge wealthy immigrants $5 million for green card privileges “plus a route to citizenship.”

The president said in February he believed he could avert the potential debt crisis entirely with gold cards, saying: “A million cards would be worth $5 trillion, and if you sell 10 million of the cards that’s a total of $50 trillion. Well, we have $35 trillion in debt, so that would be nice.”

He noted he would have $15 trillion “left over” if he managed to sell 10 million cards, adding: “It may be earmarked for deficit reduction, but it actually could be more money than that.”