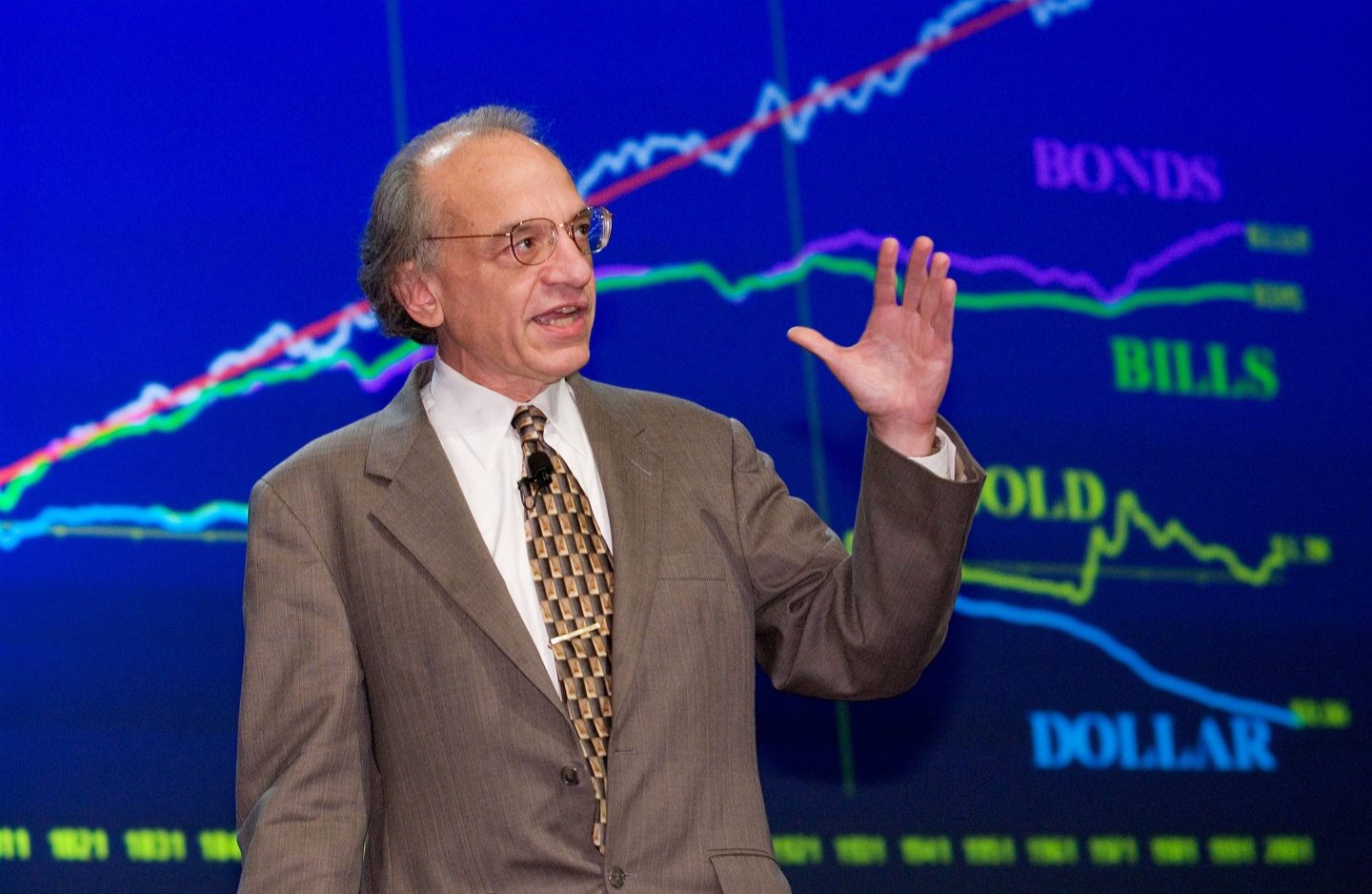

China’s tightening grip over the minerals that power advanced technologies has moved from long-term strategic concern to immediate economic threat—and the U.S. is woefully unprepared, Wharton’s Jeremy Siegel warned.

“It’s scandalous that we don’t have a rare earth strategic reserve,” Siegel told CNBC’s Squawk Box Monday, calling it a major security failure. “We let China monopolize 90% of refining rare earth materials. Where were we, realizing the importance of these?”

Siegel urged the U.S. to build a rare earth stockpile similar to the Strategic Petroleum Reserve, which was created in 1975 after the Arab oil embargo left the country exposed to geopolitical blackmail.

His warning comes just days after Beijing unveiled sweeping new export controls that would require companies worldwide to seek Chinese approval before shipping thousands of products containing even trace amounts of rare earths. The move sent shockwaves through U.S. manufacturing and defense supply chains, which rely heavily on Chinese mineral processing.

But Treasury Secretary Scott Bessent said Monday that President Donald Trump will still meet China’s Xi Jinping later this month and is ready to respond “with whatever it takes” to counter China’s export restrictions.

Bessent, speaking in a Fox Business interview, said there had been “substantial communication” between U.S. and Chinese officials over the weekend and confirmed the much-watched Trump–Xi bilateral remains scheduled during the Asia-Pacific Economic Cooperation (APEC) summit in South Korea, sometime in late October.

The meeting had been thrown into doubt after China abruptly moved to tighten exports of rare earth elements: critical minerals used in advanced weapons systems, electric vehicles, wind turbines, smartphones, and semiconductor manufacturing.

“This is China versus the world,” Bessent said, warning Beijing had “pointed a bazooka at the supply chains and industrial base of the entire free world.”

Rare earths as leverage

Getting repetitive

While the U.S. once led the industry, refining shifted to China in the 1980s and 1990s due to lower costs and looser environmental regulation.

But the U.S. is also scrambling to reduce its long-term reliance on Beijing. The Pentagon has funded new rare-earth processing facilities in Texas and California, while the Department of Energy has backed partnerships with alternative suppliers such as Lynas Rare Earths in Australia.

Beijing has repeatedly signaled willingness to weaponize its mineral dominance during geopolitical disputes. In 2010, it briefly halted rare-earth exports to Japan over a territorial disagreement in the East China Sea. More recently, during the U.S.–China trade war in 2019, Chinese state media hinted rare earths could be used as “China’s counterweapon.”

The announcement last week enraged U.S. officials. Trump initially threatened to cancel his meeting with Xi and unveiled plans for an additional 100% tariff on Chinese goods beginning Nov. 1. The White House has framed the move as retaliation for what it calls Chinese “economic coercion.”

“Whatever it takes”

Bessent said Monday the U.S. would respond forcefully if China maintains its restrictions.

“We have plenty of straight brute-force countermeasures we can pull,” he warned.

He cited leverage over semiconductor software exports, access to U.S. financial markets, aircraft components from companies like GE and Honeywell, and even the presence of more than 300,000 Chinese students studying at American universities.

He also hinted the U.S. may use export controls similar to those deployed against Huawei and China’s AI chip sector in 2022 and 2023, when Washington moved to choke Beijing off from advanced technology and chipmaking tools.

“But we’re willing to do whatever it takes and to adopt whatever posture it takes,” Bessent said. “As President Trump says, we do have more cards.”

The Treasury secretary said the administration aims to rally support from Japan, South Korea, India, Australia, and European allies, many of whom also depend on Chinese refined minerals. The issue is expected to dominate discussions this week in Washington during the annual International Monetary Fund and World Bank meetings, where Bessent said Chinese and American officials will hold lower-level talks.

Siegel, for one, expects the economic fallout to be temporary.

“Once it’s resolved, given all the other good things that are happening, I see no reason why we can’t continue on to new highs,” he said, noting the S&P 500 was already rebounding after Friday’s sell-off.