The bull market just celebrated its third anniversary, and top analysts on Wall Street are beginning to voice the previously unthinkable: Is artificial intelligence, the dynamo powering the great rally, actually kind of bad for economic growth? The consensus holds that AI will inevitably deliver large productivity gains, and that’s powered deals worth hundreds of billions of dollars into a throwback, 19th-century-style (or late-1990s-style) infrastructure boom. This has led to fears of bubble formation, with even Jeff Bezos saying recently, “[It’s] kind of an infrastructure bubble,” not one purely driven by financial speculation, and it will pay off for years, even generations.

“It seems you can’t go anywhere without talking about AI,” according to Aditya Bhave, senior U.S. economist at Bank of America Global Research, whose team tackled the subject on Friday. “AI: It’s what everyone is talking about,” they said.

In BofA’s client discussions, according to Bhave’s team, “one of the most frequently discussed topics is AI and what it means for growth, productivity, and the labor market.” They concluded that they have not found evidence of AI usage leading to job losses, especially across white-collar occupations. “The productivity story seems to be winning, at least so far.” Morgan Stanley Wealth Management’s Lisa Shalett and UBS’s Paul Donovan aren’t so sure.

Shalett, chief investment officer for Morgan Stanley Wealth Management, previously told Fortune she was “very concerned” about bubbly conditions around AI, and reiterated in an Oct. 1 research note that the rally is in its “seventh inning.” Morgan Stanley’s Global Investment Committee flagged three concerns on their mind as the ball game nears its end: challenges in free cash flow growth among the so-called hyperscalers, speculative deal-making, and, finally, “slowing growth in key revenue segments.”

Paul Donovan, global chief economist for UBS Wealth Management, wrote on Friday that a simple question is haunting markets: “Is AI hurting growth?” He noted “the exuberance” around it, which “should be based on an expectation that investing today will generate higher economic output in the future,” and in that sense, AI is surely good for long-term growth. The problem, in other words, is closer to home, in those last two innings Shalett has been worrying about.

Growing debate among experts

Donovan’s analysis includes boosts to growth from the now-archetypal data centers leading to economic activity from construction workers, programmers, and so forth, which have helped lift U.S. growth. “But AI potentially lowers current growth by diverting resources,” he said. For example, he cited research by Bloomberg showing that as regional electricity prices are pushed higher by the power needs of data centers, the spiking bill for consumers results in less money to spend elsewhere in the economy. Likewise, energy-intensive businesses will face higher costs, too. This risks “creating a gap in the economic growth story,” Donovan said, because this dynamic could force some currently economically productive businesses to close. In other words, does the local small business have to die so the data center can live?

Morgan Stanley’s Shalett flags a different concern, that even the supposedly dynamic new AI-based businesses just aren’t growing so fast right now. She blames “market saturation or monopolies—as seen in search and digital advertising—and increasing competition,” citing cloud services, where new entrants are competing on price in a battle for market share. She’s also worried about huge amounts of venture capital flocking to fledgling business models, and advised investors to rethink their exposure to small-cap and unprofitable tech firms.

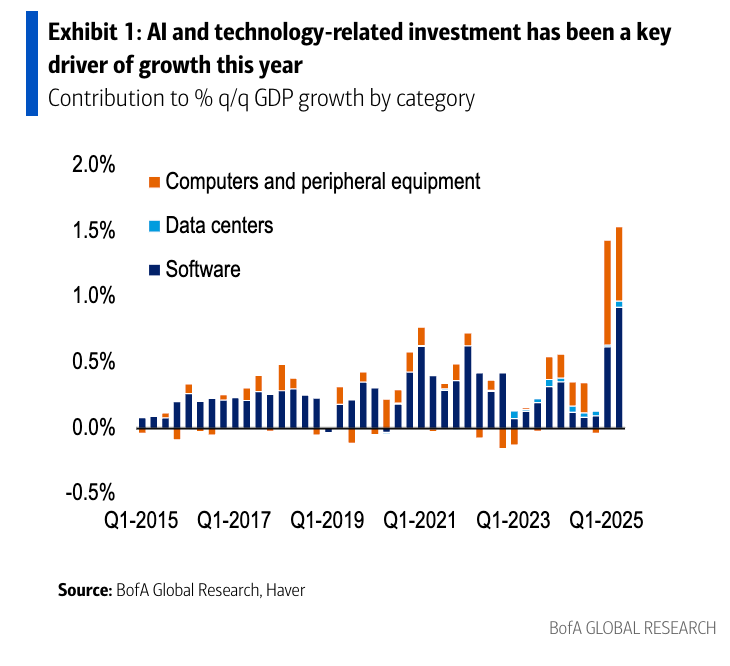

Bhave’s team is generally more bullish. While allowing that risks aren’t off the table in the medium term, they argue that, for now at least, AI appears to be a “net positive” for growth. Just look at the GDP figures from the first half, which surprised even BofA’s relatively optimistic expectations. The rebound to an annualized rate of 1.6% is “particularly resilient considering the missing imports problem” in the first quarter owing to the Trump tariff shock, which “blurs the picture” a bit. Investment in AI is just a huge force driving the economy forward, they say.

Bhave’s team cited senior analyst Vivek Arya, who covers the semiconductors sector, and his bullish call that despite concerns about the medium term, capital expenditures will still power GDP growth. Arya previously told Fortune in an interview that he thinks jitters have to do with this particular time of year, the fourth-quarter crunch, as most businesses start thinking about what’s around the bend. Economist Owen Lamont calls it “panic season” in markets, and Shalett herself noted the S&P 500 has recently managed to defy the “September curse” of historically poor performance, delivering a nearly 3% gain.

Arya told Fortune that BofA has seen “in prior years right around this time … people get justifiably very nervous about what is going to be the amount of spending next year.” In the start of 2025, he added, clients expected cloud capital expenditures to only grow about 20% or so, but that’s been blown out of the water with 50% to 60% growth instead. “But now it’s the worry again for next year and the year beyond that.”

Another voice is former Obama administration economist Jason Furman, on the faculty at Harvard, who calculated in late September that without data centers, those GDP figures would look a bit different. Subtracting all that capex results in a growth of just 0.1% on an annualized basis for the first half of 2025. To Donovan’s point, some other productive activities would have taken its place, Furman added: “Absent the AI boom we would probably have lower interest rates [and] electricity prices, thus some additional growth in other sectors. In very rough terms that could maybe make up about half of what we got from the AI boom.” Still, the question of AI and growth isn’t a straightforward one.