President Trump’s tariff regime is about to start suppressing wage growth in the U.S., according to data compiled by Pantheon Macroeconomics analysts Samuel Tombs and Oliver Allen.

The pair admit annual wage growth in the U.S. has been “fairly robust” so far this year—it was 3.7% in August, down from 4.0% the previous December. But, they argue, a key job market indicator recently hit zero, signaling that employers are reducing pay growth when offering new jobs.

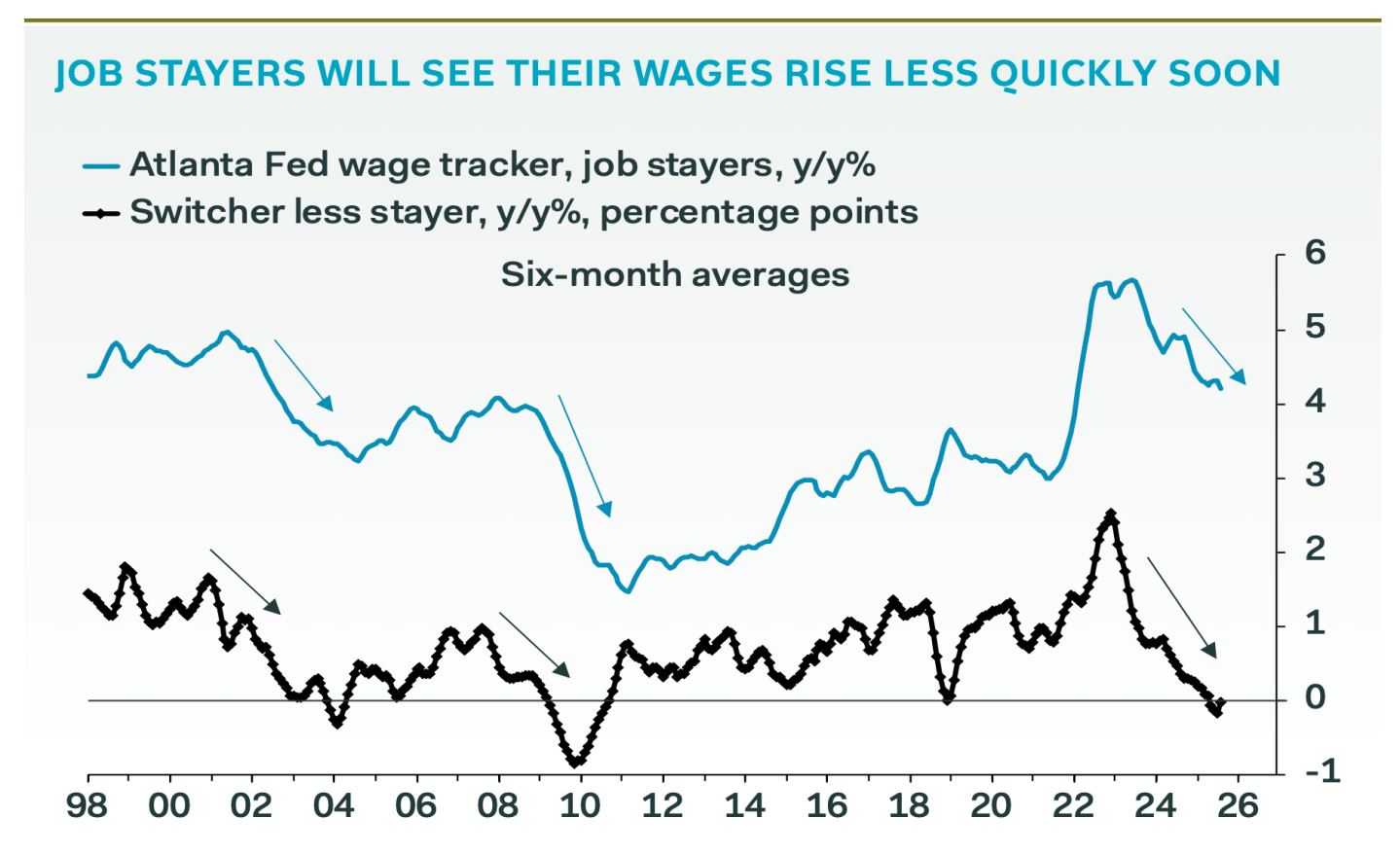

The Atlanta Fed’s Wage Growth Tracker measures “switchers and stayers”: wage growth gained by people who switch jobs minus the growth gained by those who stay. The gauge is usually positive because switchers generally switch for higher pay, while pay growth for people who stay with a company usually goes up less dramatically. But in recent months, the two measures have cancelled each other out—meaning job switchers are not finding higher pay growth elsewhere in the market.

That happened as a range of other gauges of wage growth have softened recently, including the ratio of job openings to unemployed people, which is now below one.

Four of five regional Fed surveys show the number of companies saying they will increase wages has “slumped” recently, Tombs and Allen say. Wage growth will slow to 3% by early 2026, data from the Atlanta Fed suggests.

Pantheon argues wage growth is an important measure even though it is often eclipsed in the news by the jobs number and the unemployment rate because “a half-percentage point slowing in year-over-year growth in wages has just as much impact on labor income as a 70K decline in monthly payroll growth.”

The pair blame Trump’s tariffs, as companies that are forced to pay the new import taxes look to cut wages to make their margins back. That conclusion is unexpected because the Trump administration’s crackdown on immigration had led many to assume that a tighter labor market would lead to higher pay.

“Data show wage growth has slowed more in the trade and transportation sector, and to a lower level, than any other major sector since the end of last year. Fears workers would be able to secure larger wage increases in response to the tariffs look highly unlikely to be realized,” they wrote.