- The current AI boom is not sustainable, a Deutsche Bank research note warned this morning, because tech spending won’t “remain parabolic.” AI capex is now so massive it is keeping the U.S. out of recession, the bank said. Separately, Bain & Co. estimate there will be an $800 billion shortfall in the revenues needed to fund the demand for AI computing power. About half the S&P 500’s gains this year have been driven by tech stocks.

On the heels of Nvidia’s $100 billion investment in OpenAI, two research notes out today suggest the current boom in AI may be unsustainable.

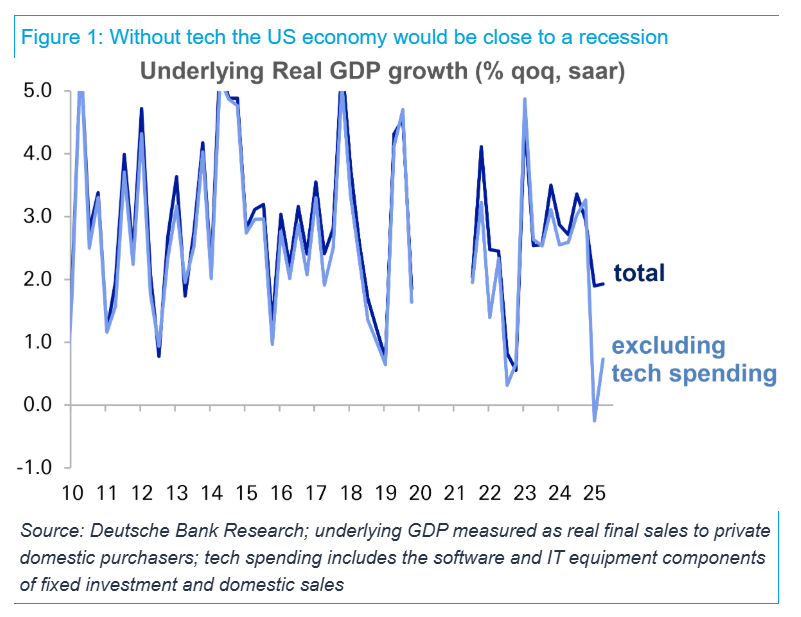

“AI machines—in quite a literal sense—appear to be saving the U.S. economy right now,” George Saravelos of Deutsche Bank wrote to clients. “In the absence of tech-related spending, the U.S. would be close to, or in, recession this year.”

Separately, Bain & Co.’s annual global technology report says that AI won’t be able to generate enough revenue to sustain the computing power it needs to build. “Two trillion dollars in annual revenue is what’s needed to fund computing power needed to meet anticipated AI demand by 2030. However, even with AI-related savings, the world is still $800 billion short to keep pace with demand,” the report says.

The market has been highly driven this year by the Magnificent 7 tech stocks, based on their spending on AI and the revenues they generate from AI capital expenditure from other companies.

However, there isn’t a consensus on Wall Street regarding AI’s longevity. Goldman Sachs took a more bullish view this morning. “We expect productivity gains from artificial intelligence (AI) to boost GDP significantly, by about 0.4% through the next few years and 1.5% cumulatively as adoption rises over the long run. Once it is widely adopted, AI is likely to allow workers and firms to produce more output for a given set of inputs, which will raise [total factor productivity] growth,” Manuel Abecasis and his colleagues told clients in a note seen by Fortune.

Estimates vary as to how much is being spent by AI hyperscalers on the data centers and the massive power infrastructure they need to support them. Goldman Sachs estimated that AI capex totaled $368 billion through August of this year.

Whatever the number is, it is so massive that it’s boosting GDP, Deutsche’s Saravelos said: “It may not be an exaggeration to write that NVIDIA—the key supplier of capital goods for the AI investment cycle—is currently carrying the weight of U.S. economic growth. The bad news is that in order for the tech cycle to continue contributing to GDP growth, capital investment needs to remain parabolic. This is highly unlikely.”

He also noted that “growth is not coming from AI itself but from building the factories to generate AI capacity.”

AI spending is also distorting the stock market, Deutsche Bank’s Jim Reid argued in a separate note published this morning. “The S&P 500 is now up +13.81% so far this year, whereas the equal-weighted version is only up +7.65%. Or in other words, it’s been the Magnificent 7 driving the gains,” his team said.

Apollo Management’s Torsten Sløk agrees: “The upward consensus revision to 2026 earnings for the S&P 500 since Liberation Day comes entirely from the Magnificent 7, see chart below. The outlook for the rest of the economy is much more bearish: Earnings expectations for the S&P 493 have remained suppressed and are not moving higher.”

“There is an extreme degree of concentration in the S&P 500, and equity investors are dramatically overexposed to AI,” he warned.

Here’s snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were flat this morning. The index closed up 0.44% in its last session, hitting a new all-time high at 6,693.75.

- STOXX Europe 600 was up 0.48% in early trading.

- The U.K.’s FTSE 100 up 0.35% in early trading.

- Japan’s Nikkei 225 was up 0.99%.

- China’s CSI 300 was flat.

- The South Korea KOSPI was up 0.51%.

- India’s Nifty 50 was flat before the end of the session.

- Bitcoin rose to $113.1K.