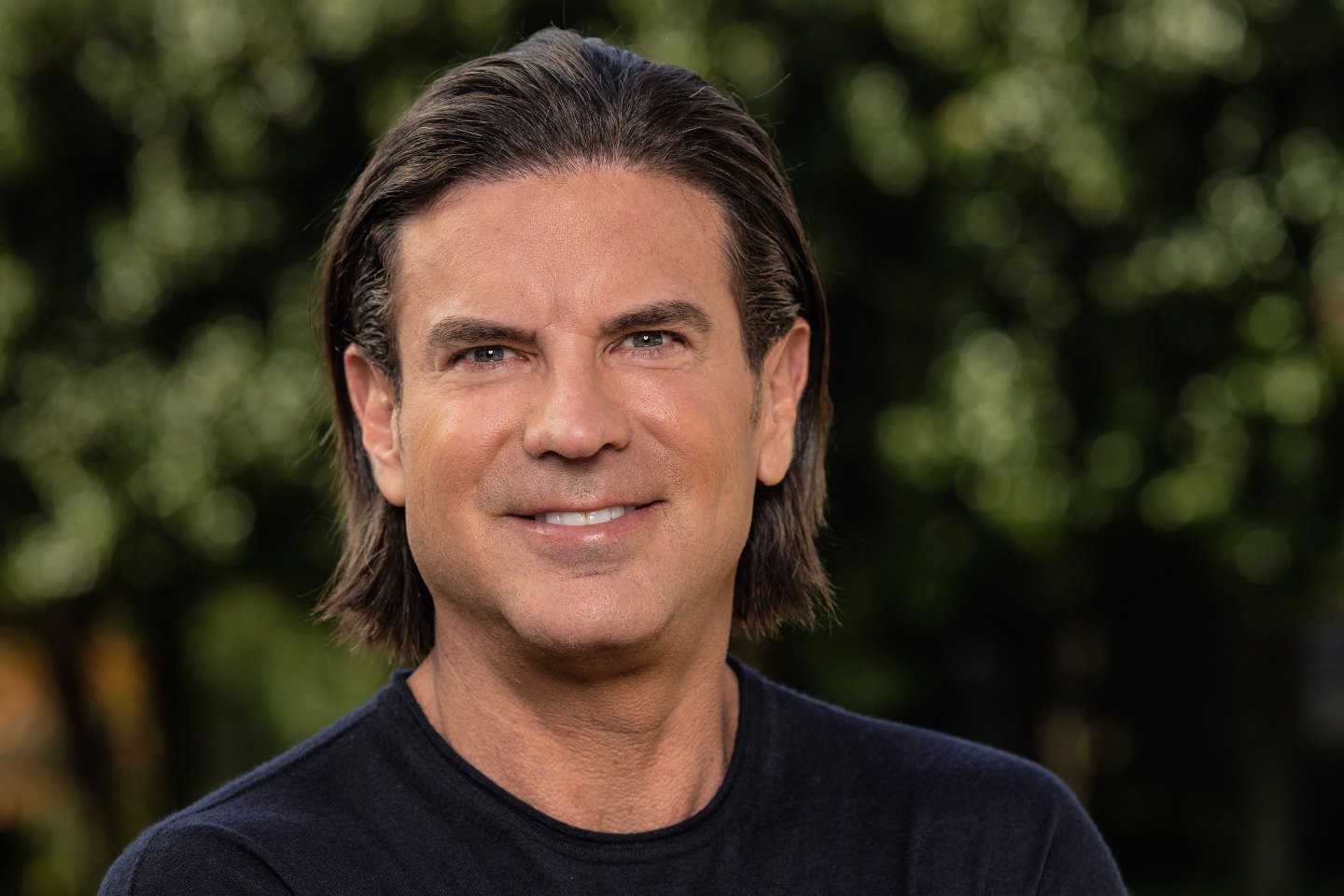

As CEO of a national student housing company, I’ve learned that the most valuable business lessons aren’t in sales or spreadsheets—they’re about people, patience, and perspective.

I first learned that at 13, after losing a basketball game bet to family friend Alan Horwitz, founder of Campus Apartments. My loss landed me in the glamorous role of cleaning his real-estate office every Saturday. What began as punishment turned into a curiosity about the business, and soon thereafter, I invested $2,000 of my bar mitzvah money into one of Campus Apartments’ Philadelphia properties.

Forty years later, Campus Apartments is one of the nation’s largest private student housing companies, with more than $2 billion in assets under management across 18 states. And while the company has grown significantly, the most valuable lessons I’ve learned while scaling a family business into a national leader extend far beyond real estate.

Take smarter risks

In the mid-2000s, several student housing companies rushed to go public, convinced that institutional capital required such a platform—investors expected it, competitors were doing it, and the market seemed to reward it.

But that’s exactly why I chose a different route.

Instead of filing for an IPO, I partnered with a sovereign wealth fund and a well-known real-estate investor to create the largest joint venture the student housing sector had ever seen. It was a risky move, but it gave us long-term capital without the pressure of meeting short-term financial goals. That choice allowed us to remain agile and invest strategically in graduate, faculty, and mixed-use housing while our competitors were constrained by public-market demands.

Some of the most pivotal decisions in business aren’t the obvious ones. They’re the nontraditional but calculated risks taken in moments of uncertainty. Long-term leaders are the ones who resist the urge to join the crowd for short-term momentum and instead position their companies for tomorrow.

Specialize in the whitespace

When I entered the real estate sector in 1994, student housing was undervalued, overlooked, and seen through the lens of John Belushi in Animal House; most of the industry saw the greatest potential in traditional categories like office, retail, industrial, and multifamily real estate.

But student housing represented a clear, underappreciated opportunity. Universities were quickly expanding, and most lacked both the operational expertise and financial flexibility needed to meet growing housing demands. Rather than compete in traditional, saturated markets, I focused on this clearly emerging segment. What was once considered a niche would become the foundation of our legacy.

Through this, I learned that sustainable business growth stems from identifying untapped opportunities, committing to them for the long haul, and building the expertise to lead within them. In my experience, focusing deeply on a core strength creates a competitive edge for your company to define the standard for your industry.

Build companies on people

Capital may drive growth, but the true foundation of Campus Apartments has always been our people. Many of our executives have been with us for more than a decade, and our leadership team averages 18 years of tenure—well above the 4.9-year average for Fortune 500 C-suites.

That kind of continuity comes from a culture built on trust, autonomy, and accessibility. At Campus Apartments, that starts with leadership. I’ve maintained an open-door policy throughout my tenure, ensuring my team knows they have direct access when it matters. In businesses, senior leadership can often feel distant; fostering an environment of approachability has become a defining aspect of our culture and a key factor in our long-term resilience.

This culture of openness has been a competitive advantage, allowing us to scale nationally without sacrificing our identity.

In my experience, leaders who invest as deliberately in their people as they do in their strategies are better equipped to navigate market shifts, downturns, and disruption. Capital drives growth, but culture is what sustains it.

Since that first investment as a teenager, the most defining outcomes in my career haven’t come from individual deals, but from a series of intentional decisions rooted in taking smart risks, building trust, creating opportunity, and leaving an impact that endures beyond any single cycle.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.