A leading Wall Street analyst says the wave of government layoffs driven by Elon Musk’s DOGE initiative—the so-called Department of Government Efficiency—marked the end of a three-year rolling recession in the U.S. Michael Wilson, Chief U.S. Equity Strategist at Morgan Stanley and one of the market’s most respected voices, shared this view in the firm’s latest US Equity Strategy note, published September 15.

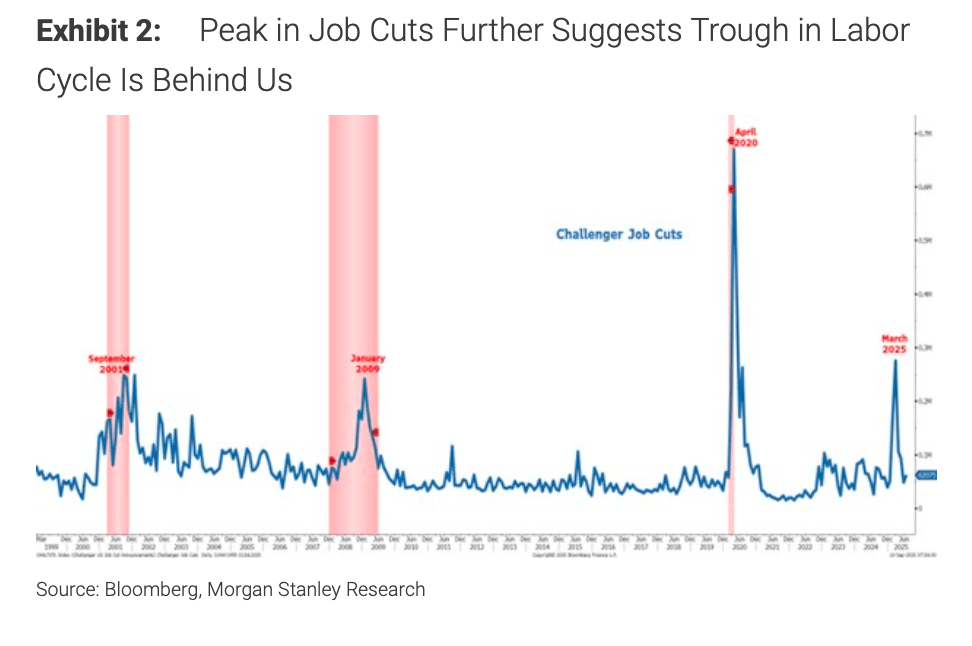

According to Wilson’s analysis, the so-called Liberation Day price lows in April 2025 capped a “rolling recession,” his phrase for a recession that didn’t register in GDP data but rather rolled sequentially through different sectors of the economy, which he believes likely started in 2022. This was characterized by persistent sector-by-sector earnings weakness, widespread negative job growth, and periodic surges in announced layoffs. You weren’t crazy to think that the last three years felt like a recession, Wilson has been consistently arguing. The “rolling” nature of this recession meant different sectors hit their troughs at different times, but Wilson argues that the government sector was the last domino to fall—with DOGE’s mass layoffs acting as a clear inflection point.

The good news is that for every recession there’s a recovery, and Wilson continues to call for a bullish “rolling recovery,” stating: “We’re buyers of dips into year-end.” He wrote that the bank is standing by its S&P 500 bull case of 7200 through the middle of next year.

Weak labor data reflects past pain

Wilson wrote on Monday that Morgan Stanley has forecast government hiring as due for a downturn “going back to our original thesis on the rolling recession,” and the bank has been predicting that from the start, dating back to 2022. In fact, Wilson told Barry Ritholtz in September 2024 that the phrase dates back even further: “We sort of invented [it] in 2018,” he said on the Masters in Business podcast, adding that he regretted it, “’cause now people kinda use it in a way, which I think is misused. But anyways, we can leave that where it is.”

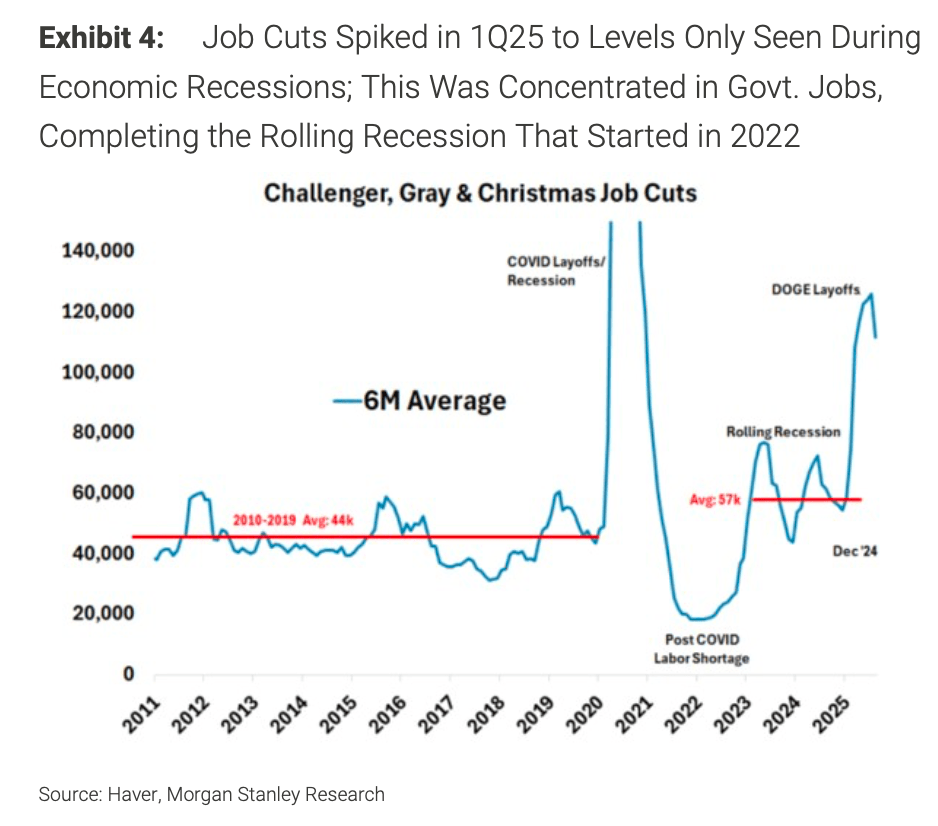

In Morgan Stanley’s outlook for 2025, Wilson notes, the bank highlighted that DOGE might lead to a “government labor cycle” and against that backdrop, “we believe the DOGE layoffs marked the end of the rolling recession that likely began 3 years prior.” He cited the bank’s projects that job cuts over the period lasting from 2022-2025 were roughly 30% higher on average than during the last economic expansion that lasted from 2010 to 2019.

The market reaction to these layoffs was swift: stocks, especially small caps, fell sharply into April as massive government-sector job cuts—some 280,000 positions announced in February and March alone—drove recessionary levels of household and corporate confidence.

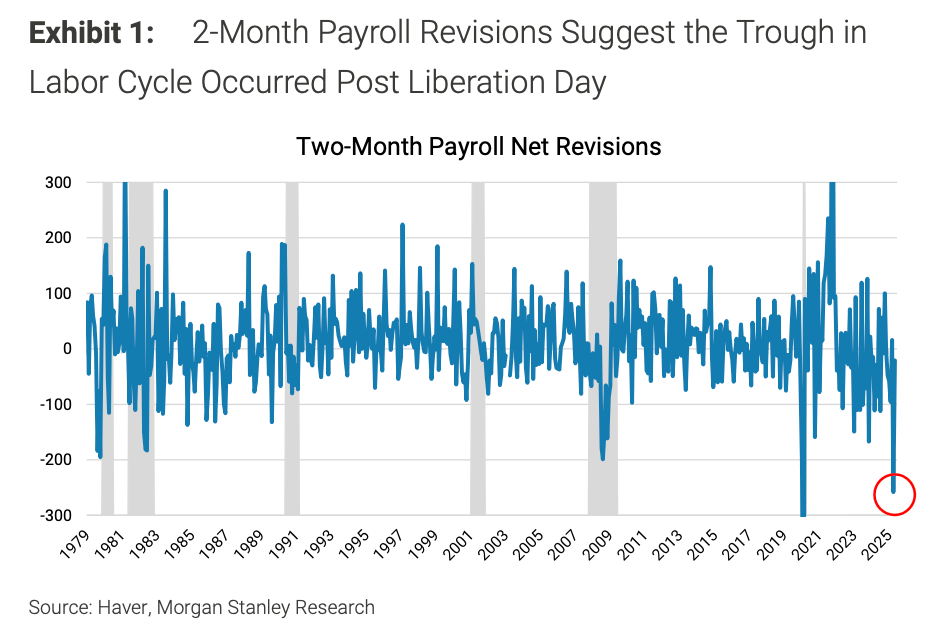

Wilson acknowledges ongoing risks from lagging labor indicators, but contends that the worst of the economic pain is now behind. Payroll revisions for the year ending March 2025 showed a total downward adjustment of 911,000 jobs—much larger than expected—with most of the damage concentrated in the private sector. (Wilson noted it was the second worst net payroll revision for any two-month period in U.S. history.)

Given that consumer confidence was also stuck in recessionary gloom, Wilson said it “makes sense” that lagging jobs data would come in weaker on the back of this, saying it’s “already troughed.” Still, he argues that the data suggests that “job cuts peaked in the aggregate in March of this year, and it’s unlikely we will revisit such an extreme again this fall.”

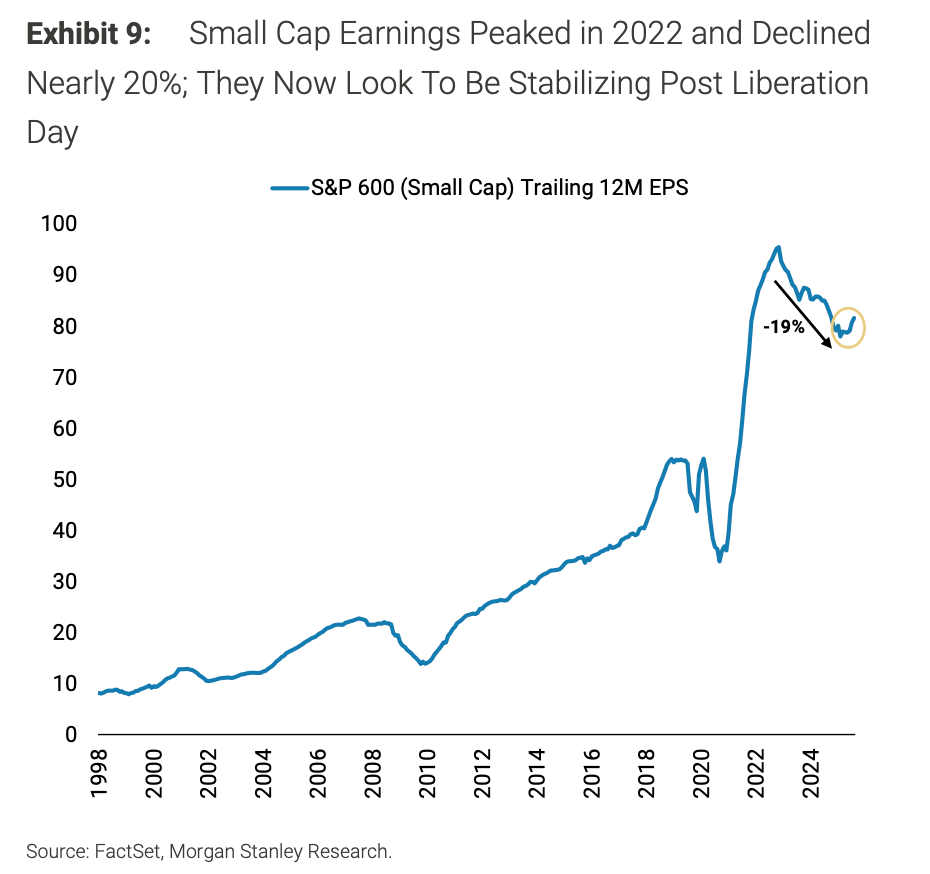

As more evidence of the rolling recession, Wilson cited negative median stock earnings growth and small-cap growth in earnings per share (EPS) from 2022 through 2024. Both spent years in negative territory, only to rebound sharply in early 2025. Exhibit data from the note show Russell 3000 median EPS growth transitioning into positive territory for the first time in years by mid-2025, a dynamic only seen during early-cycle recoveries.

Morgan Stanley’s forecast is buoyed by a historic rebound in “earnings revisions breadth,” a top-down measure that looks at the net flow of upward versus downward adjustments across the market. The three-month change hit +35%, another figure consistent with the start of new bull markets. Wilson argues that with corporate earnings guidance now inflecting higher, job cuts should slow, and further labor market weakness—if it emerges—will be met by aggressive Federal Reserve rate cuts, mitigating the risk of a renewed downturn.

Fiscal, Fed, and the path forward

The report also calls attention to policy risks. The Fed’s reaction function remains critical, as markets increasingly expect a rapid easing cycle. If government payroll softness intensifies in the fall, Morgan Stanley expects an even more dovish policy stance from the central bank, which should ultimately support equities.

Wilson also reiterates that the Trump administration “appears ready to let the economy ‘run hot,'” as it previously discussed. This sets the stage for rate cuts and higher asset valuations, especially for small caps and reflationary plays in 2026, but it could also mean the risky and unorthodox central banking strategy of cutting rates against rising inflation. Bank of America Research has noted ominously that such a combination is rare, happening only 16% of the time since 1973, and the last time it happened was in the back half of 2007. (The bank issued this analysis in a note called “ghosts of 2007,” recalling the period immediately before the Great Recession.)

While some market participants fear another bout of labor market weakness could trigger a fresh recession, Wilson disagrees. He doesn’t anticipate a sharp rise in unemployment “unless we were to see another exogenous shock to the economy.” Of course, history has a way of throwing up exogenous shocks when you least expect it.