- Goldman Sachs warns a major slowdown in AI investment by Big Tech could cut the S&P 500’s valuation multiple by up to 20%, but adds the current risk is below the level of previous bubbles. The fallout depends on hyperscaler capital expenditure trends. Analysts expect a deceleration in late 2025 or 2026, though guidance keeps rising.

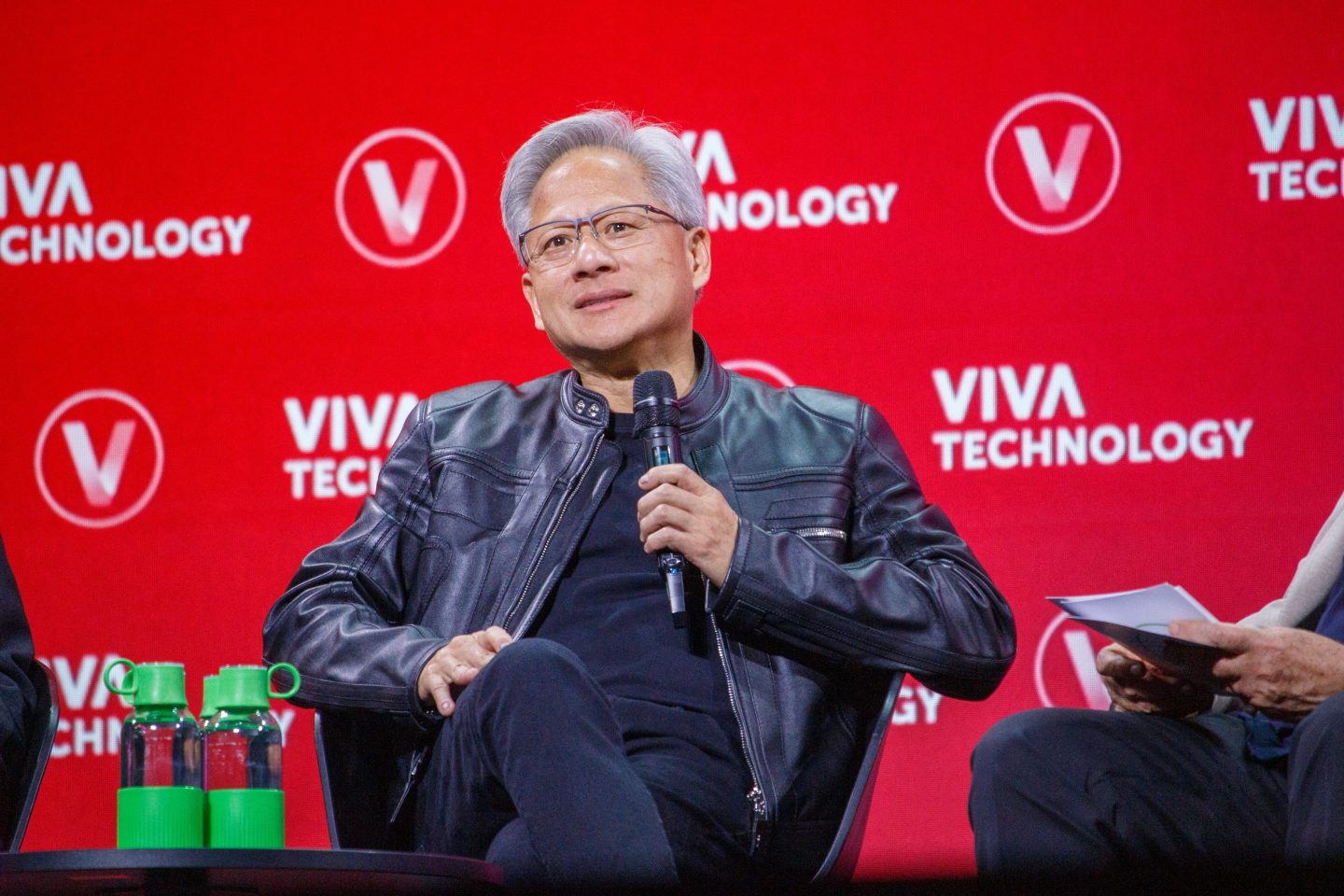

Another day, another record high for the S&P 500, and another investment bank has a research note asking whether AI stocks are in a bubble. Today it is the turn of Goldman Sachs, where Ryan Hammond and his team have made a lengthy and thoughtful attempt to assess whether Nvidia et al. are heading for a crash.

Their conclusion: We’re not there yet.

The S&P was up 0.83% to 6,502.08 yesterday, a new record.

Valuations are high, but they are actually lower than they were in the dotcom boom of 2000, Goldman says. There is one danger looming, the bank notes, and that is the “inevitable slowdown” in capital expenditures by the “hyperscaler” AI companies, (Amazon, Alphabet, Amazon, Meta, Microsoft, and Oracle).

Under what Goldman calls “an extreme scenario in which the hyperscalers cut capex back to 2022 levels,” the “lost” revenues to AI companies would represent a 30% cut to Goldman’s estimate of $1 trillion in total sales growth across the S&P 500 companies next year. In turn, “a reversion of long-term growth estimates back to early 2023 levels would imply 15%–20% downside to the current valuation multiple of the S&P 500.”

AI stocks rose 32% in 2024 and 17% year to date, Goldman says, and “investors increasingly ask us whether current U.S. equity prices are reflective of overly optimistic investor expectations.” But tech stocks are currently trading below historic bubble levels, Hammond’s team wrote. “The five largest stocks in the index (NVDA, MSFT, AAPL, GOOGL, AMZN) trade at P/E multiple of 28x, compared with 40x at the peak in 2021 and 50x at the peak in the Tech Bubble [of 2000].”

The factor keeping valuations reasonable is the huge amount of real money that companies serving the hyperscalers are taking in as revenues. Goldman estimates that hyperscaler capex has totaled $368 billion so far this year.

The question then becomes, when does the slowdown in AI spending happen? “Analysts currently assume a sharp deceleration in 4Q 2025 and 2026,” Goldman says. But expect that date to slip: Hyperscaler companies keep revising their capex guidance upward.

The note also suggests that as well as a deceleration (after all, spending will have to plateau at some point) investors are going to want to see more meaningful results as time goes on. With regard to so-called Phase 3 companies, for example, those which will benefit from the ripple effect of the technology, the analysts write: “We expect the AI trade will eventually broaden out to some Phase 3 companies, but investors will likely require evidence of a tangible near-term impact on earnings … Our equity analysts acknowledge that there has been limited value creation in enterprise software applications thus far.”

Here’s a snapshot of the markets globally this morning:

- S&P 500 futures were up 0.2% this morning. The index closed up 0.83% to 6,502.08, another record high, in its last trading session.

- STOXX Europe 600 was up 0.33% in early trading.

- The U.K.’s FTSE 100 was up 0.36% in early trading.

- Japan’s Nikkei 225 was up 1.03%.

- China’s CSI 300 was up 2.18%.

- The South Korea KOSPI was up 0.13%.

- India’s Nifty 50 was up 0.19% before the end of the session.

- Bitcoin rose to $112.7K.