- Nvidia surpassed analyst expectations when it reported earnings this week, but it also revealed the influence of its two biggest customers has grown. In a filing with the Securities and Exchange Commission, the chipmaker disclosed two anonymous customers together made up 39% of its revenue for the second quarter, an increase from the same period last year.

Nvidia’s second-quarter earnings narrowly beat analyst expectations, but the company also revealed the growing influence of two of its biggest customers who, together, accounted for 39% of its revenue.

Two anonymous customers, identified in a filing as “Customer A” and “Customer B,” made up 23% and 16% of the company’s Q2 revenue, respectively, according to Nvidia’s most recent quarterly filing with the SEC. In the same quarter last year, buyers identified as “Customer A” and “Customer B” made up just 14% and 11%, respectively.

Nvidia’s stock was the hottest of 2024 and is up about 30% year to date, but its customer concentration raises questions about vulnerabilities. If these two mystery customers change their buying habits, for instance, it could cost the chipmaker greatly.

Nvidia’s chief financial officer, Colette Kress, also said in a statement that half of the revenue brought in by its biggest moneymaking segment, its data-center business, relied on cloud providers.

Nvidia controls more than 90% of the AI GPU market, but some cloud providers, namely Google and Amazon, have begun offering alternatives to Nvidia chips—and have even started developing their own hardware.

Still, at least one analyst downplayed the influence of Nvidia’s mystery customers. Although its buyers’ spending could change, the demand for AI progress remains high, and Nvidia’s chips are the best in the industry, said Dave Novosel, senior investment analyst for telecommunications, media, and technology at Gimme Credit.

“The concentration of revenue among such a small group of customers does present a significant risk,” Novosel told Fortune. “But fortunately for Nvidia, these customers have bountiful cash on hand, generate massive amounts of free cash flow, and are expected to spend lavishly on data centers over the next couple of years.”

In its SEC filing, Nvidia noted that both of its biggest anonymous buyers are “direct customers.” These customers buy directly from Nvidia, but may not be the ultimate user of the chips. Some examples listed in the filing include, but aren’t limited to, add-in board manufacturers, distributors, original design manufacturers (ODMs), original equipment manufacturers (OEMs), and system integrators.

An Nvidia spokesperson declined to comment to Fortune on the identity of the customers.

“We have experienced periods where we receive a significant amount of our revenue from a limited number of customers, and this trend may continue,” Nvidia disclosed in the filing.

Nvidia on Wednesday reported revenue of $46.74 billion, 56% higher than during the same period last year. It reported net income of $26.4 billion, an increase of more than 59% year over year.

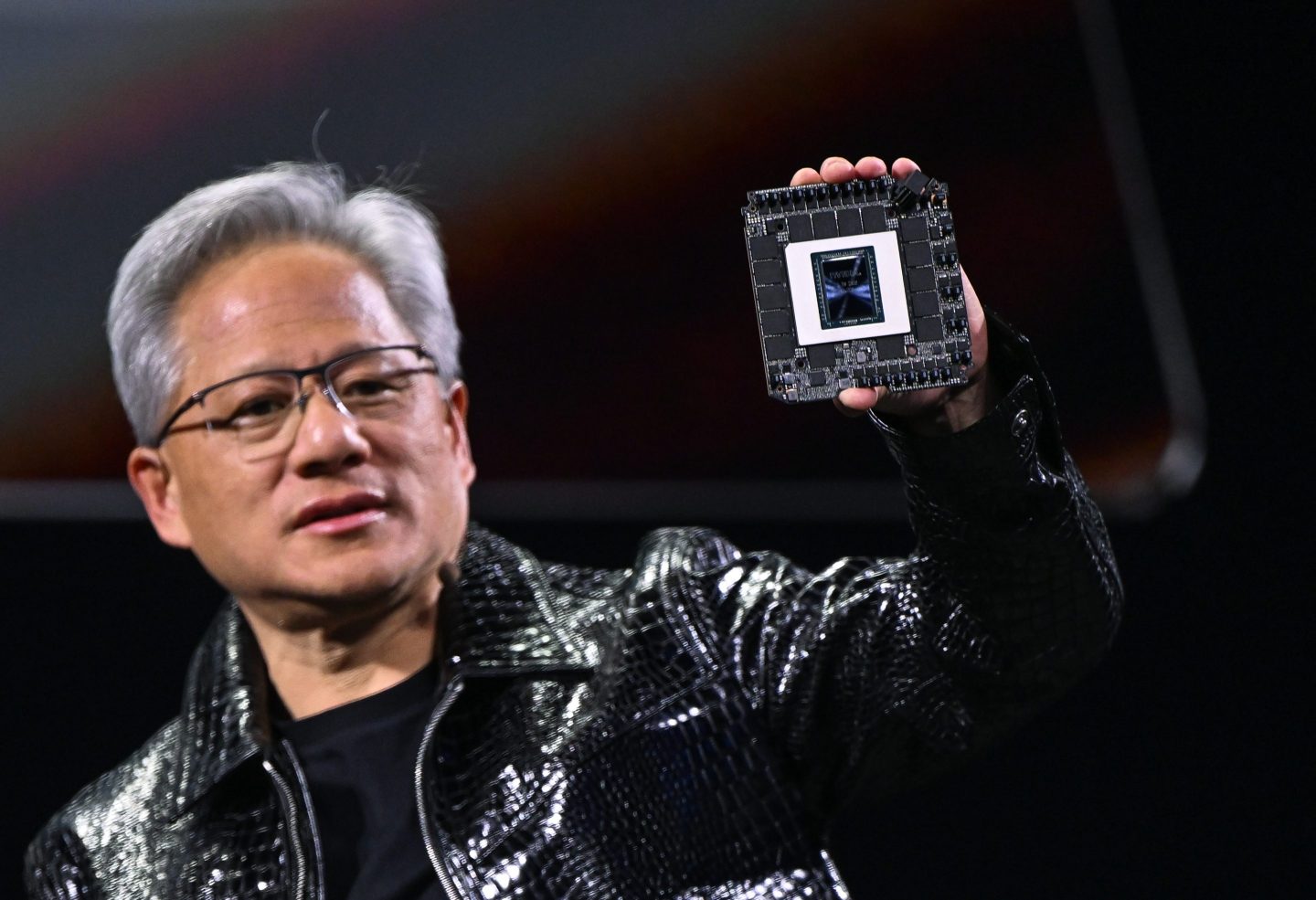

The company pointed to the constant building of AI data centers by tech companies and the demand for its newest Blackwell chip as contributing to its earnings beat. The company noted its “sovereign AI” efforts, or sales to foreign governments, are on track to bring in $20 billion this year, although ongoing negotiations with the Trump administration have, as of yet, prevented the company from selling any of its AI-accelerating H20 chips to China.