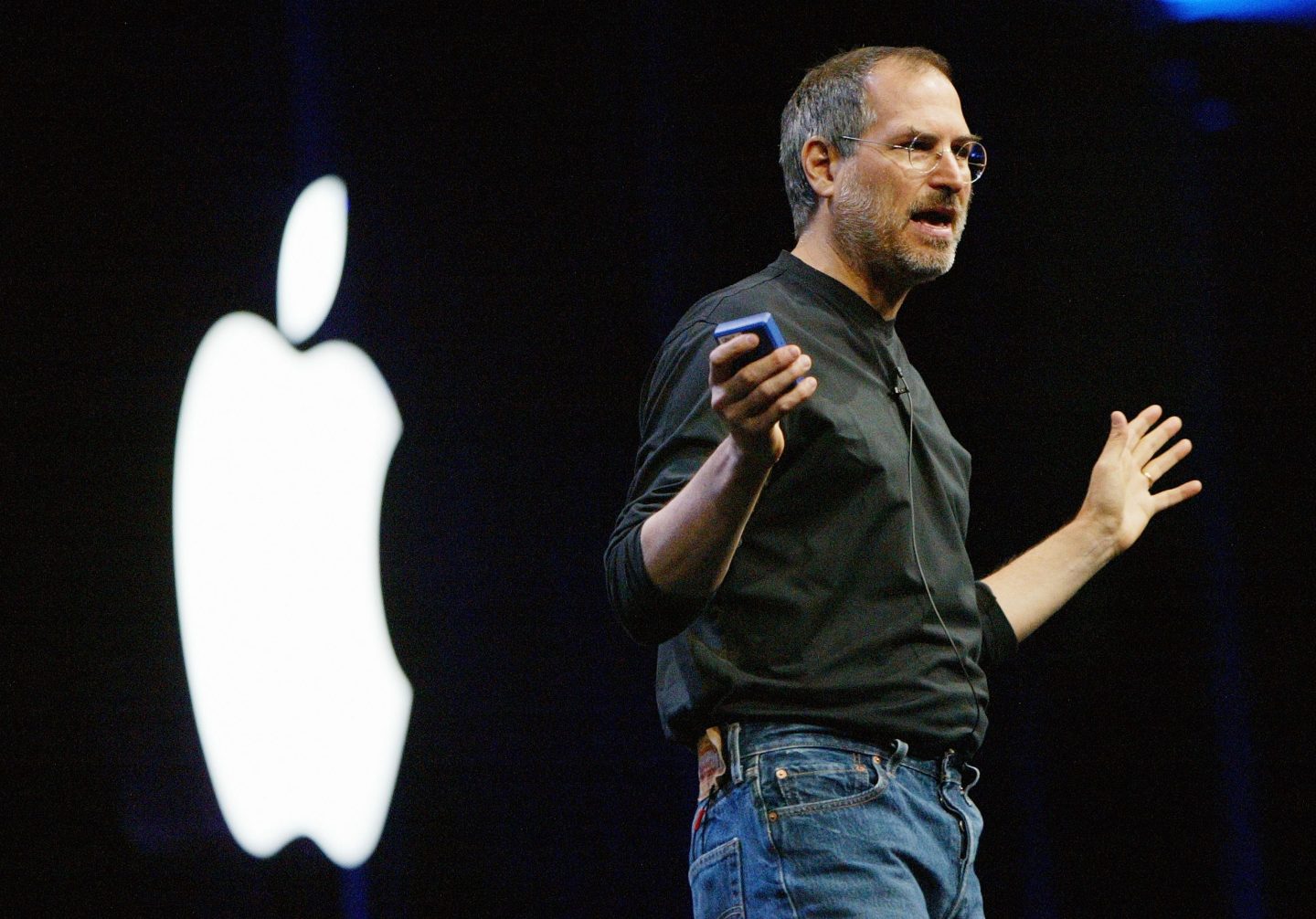

- Atari cofounder Nolan Bushnell turned down his former employee, the late Steve Jobs, when he was offered to buy a third of Apple for $50,000 in the 1970s. With the iPhone titan now standing at $3.1 trillion, the video gaming pioneer missed out on making $1 trillion from his relatively small investment. But he isn’t troubling himself with regret, reasoning he might not be as happy—and Apple may not have been as successful—if he accepted the deal.

Many people may be kicking themselves for not buying Bitcoin or investing in Nvidia stock sooner—but few will have missed out on a bigger deal than Atari cofounder Nolan Bushnell, the first Silicon Valley boss of the late Steve Jobs.

A young Jobs offered the gaming mogul an eye-popping deal: buy a third of Apple for just $50,000. What might come as a shock to many is that Bushnell turned it down.

Apple has since grown into a $3.1 trillion sensation with over a billion iPhones sitting in people’s back pockets, and over 100 million Mac users worldwide—and if Bushnell had taken the deal, his cut would have made him $1 trillion today.

But Bushnell isn’t crying over the missed opportunity

Bushnell first witnessed Jobs’ potential as a businessman in the 1970s, when the college dropout joined Atari as a technician and games designer before moving into entrepreneurship.

Jobs was an essential engineer “solving problems in the field” at Atari, Bushnell recalled, but his leadership mentality also meant some tension at the office. The Atari cofounder strategically employed Jobs during nightshifts, knowing that Wozniak would also join and help out on projects like the brick-breaking game “Breakout.” But Jobs would also barge into his office to tell Bushnell that the other employees weren’t good at soldering, offering to instruct them. Bushnell recognized that Jobs was a genius—albiet, a complicated one.

“He was a difficult person,” Bushnell told ABC News in 2015. “He was very smart. Often he was the smartest person in the room, and he would tell everybody that. It’s generally not a good social dynamic.”

But years later, the tech pioneer isn’t quietly simmering over his choice to reject the offer.

“I could have owned a third of Apple computer for $50,000, and I turned it down,” Bushnell said in the interview. “I’ve got a wonderful family, I’ve got a great wife, my life is wonderful. I’m not sure that if I had been uber, uber, uber rich that I’d have had all of that.”

In fact, Bushnell even thinks Apple may not have been so successful if he had taken the deal. And his potential payout may not have soared to that trillion-dollar height.

“I’m still an Apple fan and you know I think that hindsight is 20/20,” he told Tech Radar in 2013, when asked about his decision to say no. “I can go through a thread very easily which, by me turning Steve down led to me introducing him to Don Valentine, and he introduced him to Mike Markkula who is as responsible for Apple’s success as Steve Woz[niak] and Jobs.”

He’s not the first tech boss to have missed out on billions

Bushnell isn’t the only one who missed out on critical business opportunities that would launch them into billionaire status—there are even others who blew it on big deals with Apple.

Ronald Wayne, the lesser-known third Apple cofounder, was also working at the electronics company Atari when he stepped up as Jobs’ friend to help convince Wozniak of formalizing Apple’s launch. Wayne even typed up the contract, penning that he would receive a 10% share in the tech company, while Jobs and Wozniak would each be awarded a 45% stake.

However, less than two weeks after drafting up the document, Wayne sold his stake for just $800, also reaping $1,500 to forgo any claim to the company. Looking back, it’s a massive misstep as his 10% share could now be worth between $75 billion and $300 billion today. His wasted opportunity isn’t as stark as Bushnell’s—and the decision mainly came from a desire to have financial stability in his life.

“Jobs and Woz didn’t have two nickels to rub together,” Wayne told Business Insider in 2017. “I, on the other hand, had a house, and a car, and a bank account—which meant that I was on the hook if that thing blew up.”

YouTube’s cofounders, Chad Hurley, Steven Chen and Jawed Karim could also be sitting in a sizable nest egg today if they didn’t sell their company so early.

The YouTube creators sold their popular video platform to Google for $1.65 billion in fall 2006—each receiving millions of dollars worth of stock. Hurley got company shares worth around $345 million, according to The New York Times, while Chen accepted about $326 million worth. Karim, who left the business early to go back to school, got $64 million of shares. They were ecstatic about the deal in the beginning, but the buyer’s remorse would potentially creep up less than 20 years later.

Today, YouTube is valued at $550 billion—333 times higher than its market cap from nearly two decades prior, adjusted to inflation. If Hurley and Chen accepted the same stock deal today that they did in 2006, each could have more than $100 billion in their bank accounts.