Good morning. The Fortune 500—the authoritative ranking of America’s largest companies—highlights their resilience.

In this year’s 71st edition, only 22 companies from the previous year were displaced—the second-lowest total in the past 30 years. Fortune 500 profits climbed 10% to a record $1.87 trillion over the past year. Revenues increased by 6%, an improvement from 4% growth the previous year.

For the 13th straight year, Walmart earned the top spot on the Fortune 500 list, followed by Amazon, UnitedHealth Group, Apple, and CVS Health. Several industries saw even stronger revenue gains, with aerospace and defense up 20%, wholesalers up 18%, and the tech sector rising 13%. You can view the complete list here.

This year, 55 women are in the CEO role at Fortune 500 companies—the highest share in the list’s history at 11%. The increase in representation is important to acknowledge and celebrate; however, “the pace of change remains stubbornly slow,” Jennifer McCollum, president and CEO of Catalyst, a workplace gender equity organization, told Fortune in an interview.

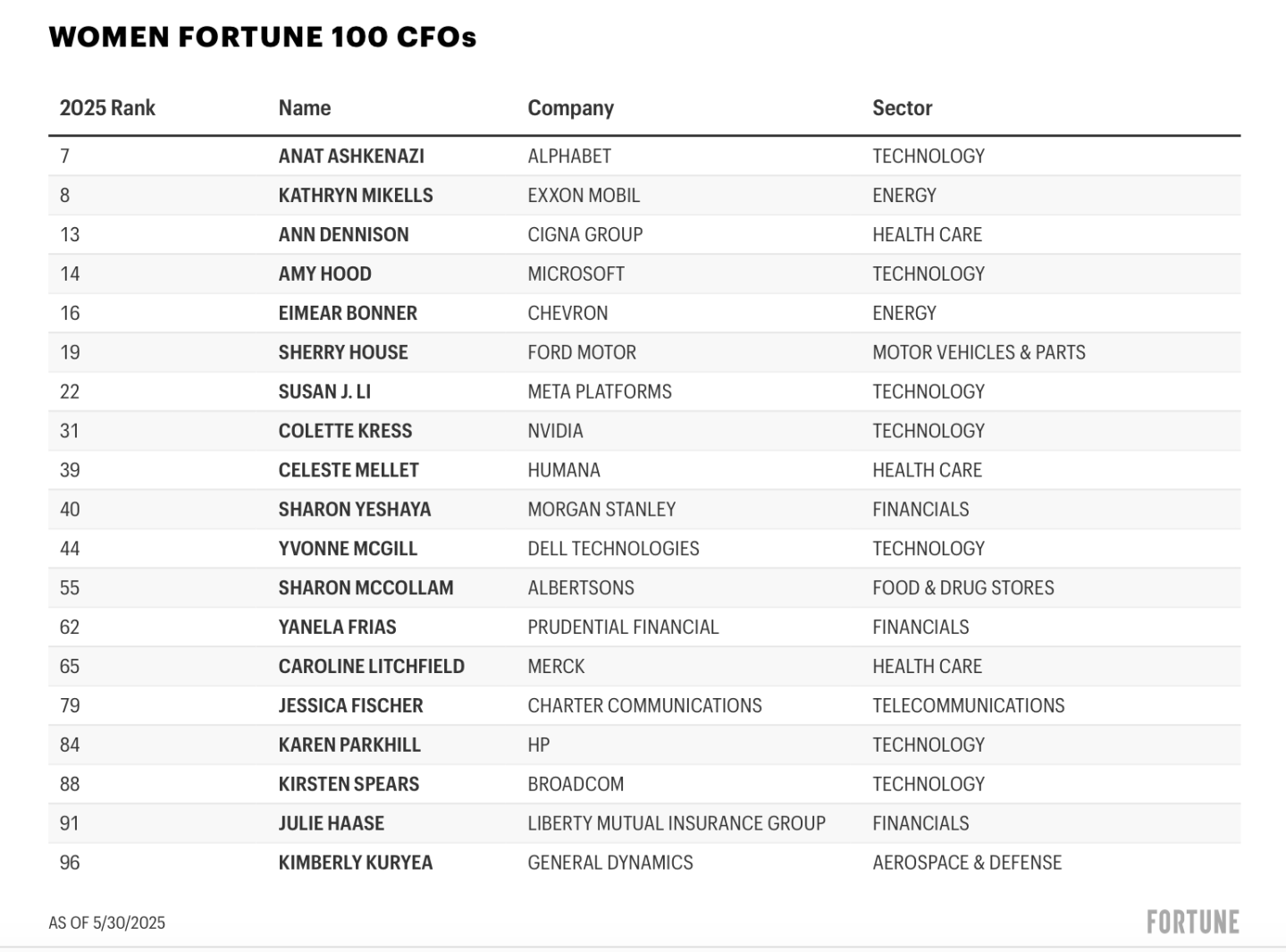

CEOs and CFOs are strategic partners leading these companies. The role of finance chiefs has evolved far beyond traditional financial stewardship and reporting. CFOs are now expected to be operational leaders, business partners, and key drivers of growth and innovation. This year, there are 87 women in CFO roles (17.4%) at Fortune 500 companies, slightly higher than 85 last year. By comparison, in 2015, about 12% of CFO roles at these large companies were held by women.

Zooming in on the top 100 companies this year, 19 of the CFOs are women. For example, Anat Ashkenazi has been the CFO of Alphabet (No. 7) since July 2024. One of her strategic priorities as finance chief of the $2 trillion company is to integrate AI within its processes to boost efficiency and productivity, with cost reductions helping to fund AI innovation. Kathryn Mikells, SVP and CFO of Exxon Mobil (No. 8), joined Exxon Mobil in 2021. She is Exxon’s first official CFO; before her appointment, finance duties were shared across a range of executive roles.

Yanela Frias began her tenure as EVP and CFO of Prudential Financial (No. 62) in March 2024. Frias has been with the company for more than 25 years. “From a role model perspective, for my two daughters, for all the women that I interact with, my goal is to show everyone that anything is possible,” Frias told me last year. “There are no limits other than what you apply to yourself.”

Meet the women CFOs at the top 100 companies in the Fortune 500:

Sheryl Estrada

sheryl.estrada@fortune.com

The new Fortune 500 ranking is here

In total, Fortune 500 companies represent two-thirds of U.S. GDP with $19.9 trillion in revenues, and they employ 31 million people worldwide. Last year, they combined to earn $1.87 trillion in profits, up 10% from last year—and a record in dollar terms. View the full list, read a longer overview of how it shook out this year, and learn more about the companies via the stories below.

- A passion for music brought Jennifer Witz to the top spot at satellite radio staple SiriusXM. Now she’s tasked with ushering it into a new era dominated by podcasts and subscription services. Read more

- IBM was once the face of technological innovation, but the company has struggled to keep up with the speed of Silicon Valley. Can a bold AI strategy and a fast-moving CEO change its trajectory? Read more

- This year, Alphabet became the first company on the Fortune 500 to surpass $100 billion in profits. Take an inside look at which industries, and companies, earned the most profits on this year’s list. Read more

- UnitedHealth Group abruptly brought back former CEO Stephen Hemsley in mid-May amid a wave of legal investigations and intense stock losses. How can the insurer get back on its feet? Read more

- Keurig Dr. Pepper CEO Tim Cofer has made Dr. Pepper cool again and brought a new generation of products to the company. Now, the little-known industry veteran has his eyes set on Coke-and-Pepsi levels of profitability. Read more

- NRG Energy is the top-performing stock in the S&P 500 this year, gaining 68% on the back of big acquisitions and a bet on data centers. In his own words, CEO Larry Coben explains the company’s success. Read more

Leaderboard

Josette Leslie was appointed CFO of Contentstack, a customer experience platform. Leslie brings over 25 years of financial leadership experience. She replaces David Overmyer, who is retiring. Leslie previously spent seven years at Squarespace, where she helped scale finance operations and support the company’s IPO in 2021. Most recently, she served as CFO at CAIS, an alternative investment platform for independent financial advisors.

Robert VanHimbergen was appointed EVP and CFO at Elanco Animal Health Incorporated (NYSE: ELAN), effective July 7, 2025. VanHimbergen succeeds Todd Young, who will remain with the company as an advisor through Aug. 31. VanHimbergen currently serves as the SVP and CFO of Hillenbrand, Inc. Before that, he spent 15 years at Johnson Controls where he led the global finance, and accounting and reporting functions, including CFO of the automotive interiors business in Shanghai, China, and led the battery division in Asia.

Big Deal

Tech company Kyndryl has released a new global study that finds a gap between AI investment and workforce preparedness. Ninety-five percent of businesses have invested in AI. Meanwhile, 71% of leaders say their workforces are not yet ready to successfully leverage the technology. About half believe their organizations lack the skilled talent needed to manage AI, and 45% of CEOs think most employees are resistant or even openly hostile to AI.

Workforce readiness varies by industry. Businesses in banking, financial services, and insurance report the highest levels of preparedness, while those in healthcare report trailing behind.

The findings are based on a survey of more than 1,000 senior business and technology executives across 25 industries and eight geographies.

However, the research also finds that a small subset of “AI pacesetters” has leveraged AI for business growth while addressing workforce readiness. These organizations are making strategic workforce decisions and seeing benefits across their employee populations, according to the report. Pacesetters are addressing three key barriers that are inhibiting AI adoption, Kyndryl finds.

Going deeper

“Inside IBM’s rebound: Can CEO Arvind Krishna bring the tech company back to its former glory?” is a new Fortune article by Sharon Goldman.

From the article: “IBM’s AI strategy today looks radically different from that of competitors like OpenAI, Meta, and Google. Rather than chasing flashy, consumer facing applications focused on massive, general-purpose language models, IBM has doubled down on the less-sexy side of generative AI.

“Its flagship offering, Watsonx, is optimized for relatively niche business functions like financial services, supply-chain optimization, and IT operations, and IBM aims to embed the technology into the critical infrastructure of its corporate clients.”

Overheard

“It taught me the customer. And that idea that you don’t point the customer to the ketchup aisle, you walk them over there, and you show them the five or six different kinds.”

—Brian Murphy, CEO of the $3.4 billion cybersecurity company ReliaQuest, told Fortune in an interview that he was first exposed to the world of business as a teenager, bagging groceries and pushing carts at his local Publix Supermarket. (His brother is now the CEO of Publix.) The lessons he learned as a teenager are just as relevant today, Murphy said.