Over the years, we have steered clients through turbulent times—including the Global Financial Crisis, COVID market shocks, and numerous choppy waters in between. Today, we face similarly volatile financial conditions from swift and unpredictable changes in U.S. trade policies. The uncertainty has rattled markets and client portfolios, reminding us that navigating volatility is inevitable and integral to long-term investing success.

Understandably, many investors are deeply concerned. Anxiety is spiking as we witness equity market selloffs, volatile Treasury yields and dramatic swings in currency markets. Questions like, “Is this the start of a recession?” or “Should I make changes to protect my investments?” are at the top of people’s minds. However, as history shows, reacting impulsively during market stress can undermine investment success. Instead, we advise our clients to “confirm the course” so they don’t make strategy changes at the exact wrong moment.

The tariff turmoil and market reaction

The recent tariff announcements and corresponding retaliations have triggered historically dramatic market responses. In just one example, the Nasdaq entered a bear market in the two days following the April 2 tariff announcements, bounced back for a record-breaking single-day point gain following the announcement of the 90-day pause, then reversed course again the next day as the long-term ramifications of elevated trade barriers settled in. The bond market, meanwhile, currently faces intense stress, with longer-dated Treasury yields spiking due to unwinding leveraged trades and waning foreign capital inflows. Even as global markets reel, these disruptions underscore a critical truth about investing during volatile periods: short-term market movements are unpredictable, but long-term discipline remains the key to success.

Get comfortable staying the course

We anchor our advice in a goals-driven framework, which emphasizes aligning portfolios to individual financial goals based on the unique character of each goal. Amid significant market turbulence, this framework becomes especially important because it helps investors focus on their goals and objectives—instead of reacting to news and volatility. Central to the goals-driven framework is the portfolio reserve. This strategic buffer, composed of high-quality shorter duration fixed income and cash, meets short-term spending needs during market downturns. The portfolio reserve allows clients to avoid selling risk assets such as equities at depressed prices, ensuring their long-term strategy remains intact as markets stabilize.

In the heightened uncertainty we are experiencing, we are “confirming the course” with clients in three key ways.

Confirming your goal-aligned asset allocation is still appropriate. There is a high likelihood that markets will remain volatile, so ensuring your overall asset allocation correctly reflects your goals and your risk preferences around funding those goals is important.

Discussing whether you have sufficient liquidity. A portfolio reserve comprised of cash and high-quality bonds is an ideal way to ride out equity volatility. It enables near-term goal funding and lifestyle spending even as risk asset markets remain stressed.

Ensuring risk asset portfolios are appropriately diversified. Year to date, U.S. equities are underperforming their non-U.S. peers. It is important to ensure that portfolios have adequate global diversification and exposure to cash-flow-generating risk assets like public infrastructure. Even real assets can play an important diversification role in portfolios today.

Keep perspective in the fog

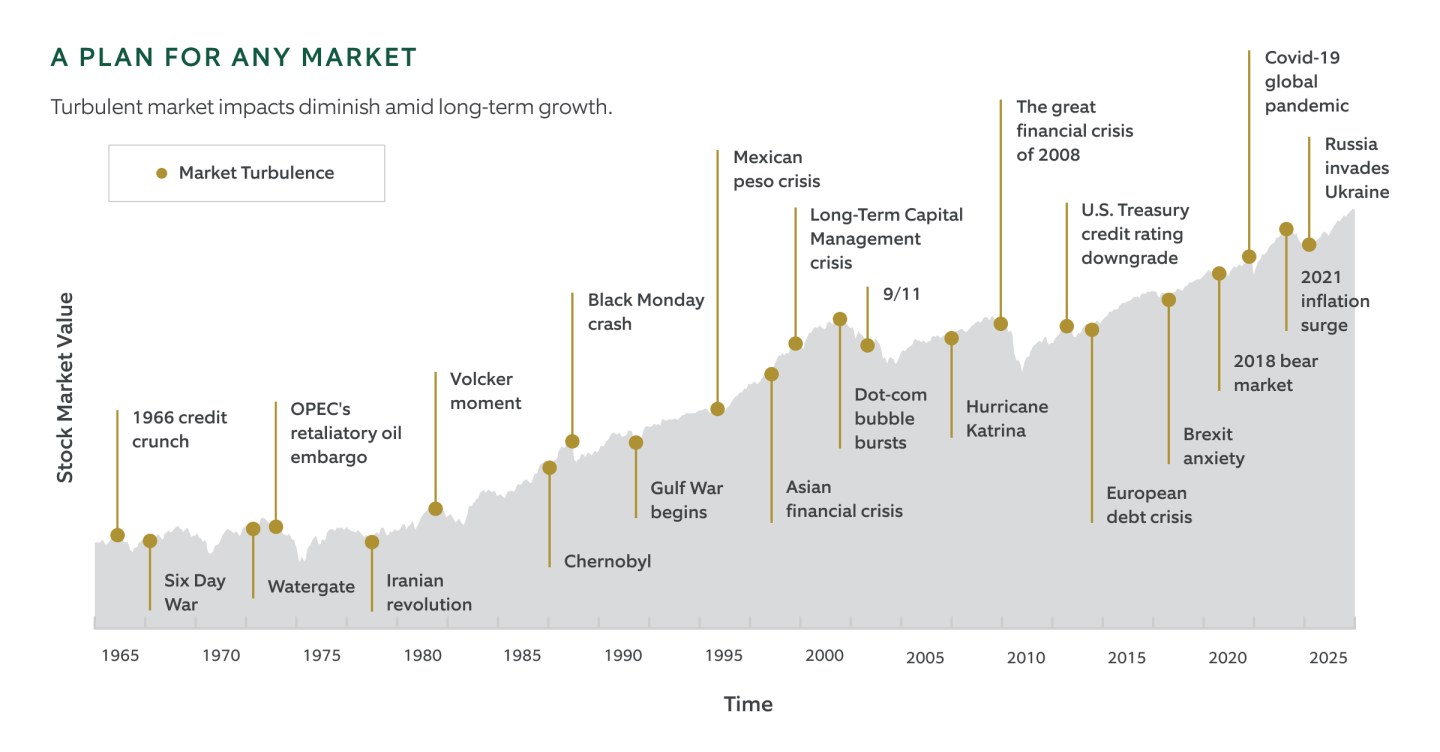

Confirming the course through episodes of turbulence can feel overwhelming or uncomfortable in the heat of the moment. Still, it is vital to remember the lessons learned from prior tumultuous periods. No matter how severe they seem, short-term disruptions rarely derail the long-term growth trajectory of well-constructed portfolios. The key is to maintain perspective, avoid rash decisions, and trust the process you have embraced.

Remember: For long-term investors, market volatility and even enduring bear markets is the toll we pay for capturing long-term market returns. Trade disputes, geopolitical events, and policy shifts will come and go—but markets have historically rewarded patience and discipline. By focusing on your financial goals and leveraging tools like a portfolio reserve, you can confidently weather the storm while positioning for recovery.

Final thoughts

More than anything, we strive to instill confidence in our clients during uncertain times. We have planned for moments like these together, and our approach helps them stay on track. Market volatility is not a call for panic; it is a reminder to lean into the strategies we have built to endure through market cycles. Remember, clarity will eventually emerge, and market resilience has been proven time and again.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.