Donald Trump promised on Day 1 to seize the Panama Canal.

“We’re taking it back,” the US president declared in his inaugural address.

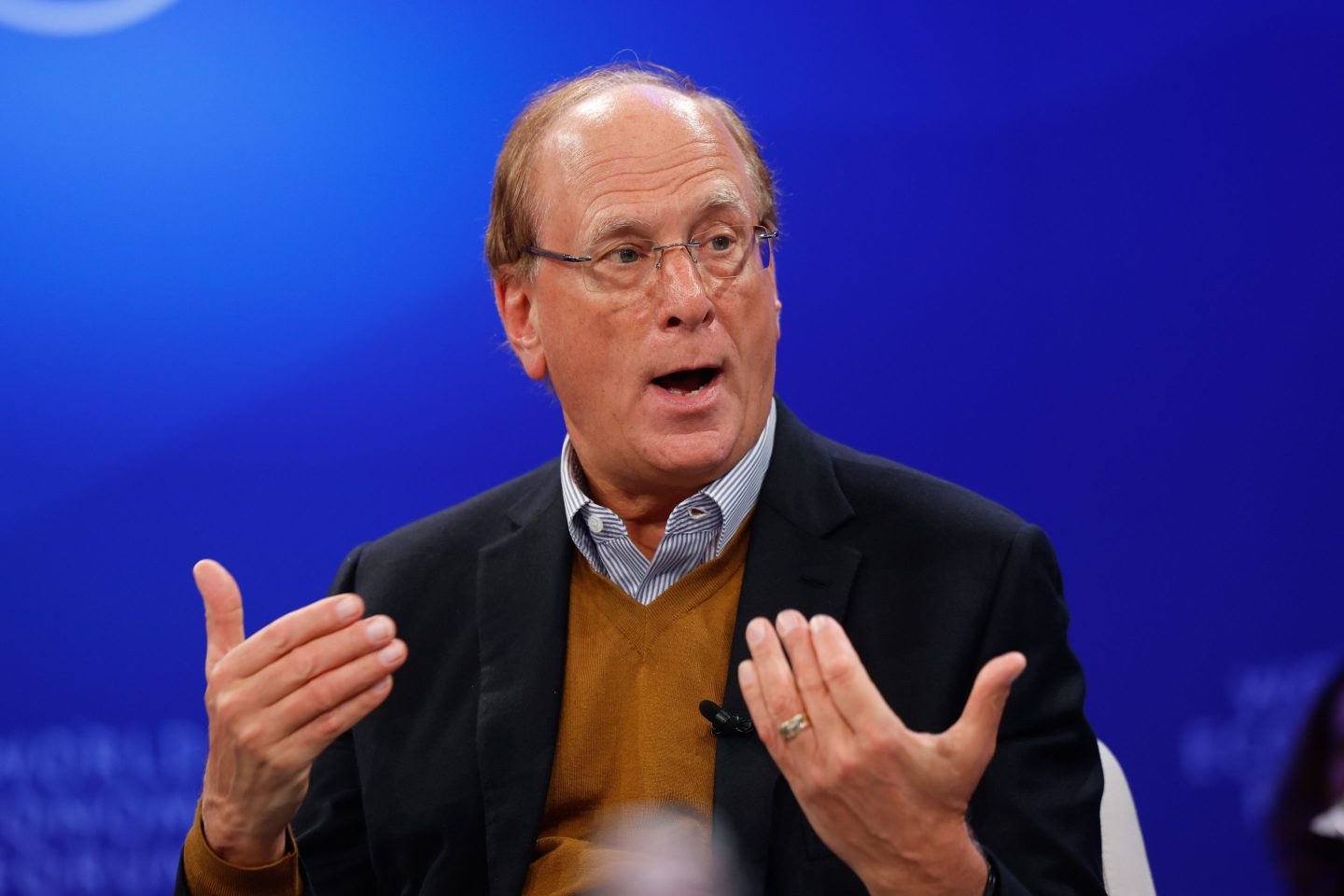

Within weeks, Wall Street billionaire Larry Fink was on the line with the White House.

His pitch: Fink’s investment company, BlackRock Inc., was interested in buying the ports on either side of waterway, shifting them into American hands, according to people familiar with the discussion. And with that, there would be no need to have the US take the century-old canal by force.

So went days of whirlwind negotiations that now are set to deliver control of those ports to a consortium led by BlackRock, the $11.6 trillion investment giant Fink has run for almost four decades.

The deal, which will hand the seller $19 billion, reflects an extraordinary confluence of Trump’s America First vision and Wall Street’s globe-spanning quest for profit.

Trump has repeatedly expressed his desire to regain US ownership of the Panama Canal, which he has claimed, without evidence, is run by China.

Fink capitalized on that desire to secure the biggest infrastructure deal in BlackRock’s history – handing Trump a win as the president flexes over international trade, the wars in Ukraine and Gaza, NATO and more.

The deal is also a sign of Fink’s and BlackRock’s ambitions to clinch major deals in far-flung private markets and compete with the biggest alternative asset managers. In a statement announcing the transaction Tuesday, he boasted of BlackRock’s ties to companies and governments around the world, noting: “We are increasingly the first call.”

When Trump took the lectern Tuesday night for a primetime address, he hailed the deal as a step toward “reclaiming” the canal for the US. He didn’t use BlackRock’s name.

“Just today, a large American company announced they are buying both ports around the Panama Canal and lots of other things having to do with the Panama Canal and a couple of other canals,” he said. “The Panama Canal was built by Americans for Americans, not for others.”

Dozens of Ports

BlackRock said it agreed to buy the two ports in Panama and more than 40 others around the world from CK Hutchison Holdings Ltd., the sprawling conglomerate controlled by the Li family, one of Asia’s richest clans. In recent months, the Hong Kong family found itself thrust into the center of a political firestorm over who controls the crucial waterway and key ports.

For Trump, having a US investment company take over the ports would reduce China’s influence in the region, according to people familiar with the talks, who like others spoke on the condition of anonymity given the delicate diplomacy. The deal wouldn’t have come together without Trump’s support, these people said.

BlackRock is acquiring the operations with Global Infrastructure Partners, an infrastructure firm it bought last year and is headed by Adebayo Ogunlesi. Other investors include Terminal Investment Ltd., which operates ports served by the world’s largest shipping company, Mediterranean Shipping.

Fink has moved in Trump’s circles for years, and people close to the deal say his personal involvement was crucial. In recent days, Fink briefed Trump as the talks quickly unfolded. Treasury Secretary Scott Bessent and Secretary of State Marco Rubio were also kept in the loop.

In a statement, Frank Sixt, co-managing director of CK Hutchison, said the deal resulted from a “rapid, discrete but competitive” process — and was unrelated to politics. Blackstone Inc. and KKR & Co. also considered bids, according to people with knowledge of the matter. Representatives for both firms declined to comment. The White House didn’t respond to a request for comment.

CK Hutchison’s American depositary receipts rose as much as 3.4% to $6.02 at the start of trading Wednesday. They gained 17% on Tuesday.

Panama will review the transaction and an audit of the Panama Ports contract will continue, according to a statement posted on Panama President Jose Raul Mulino’s account on X.

‘Purely Commercial’

Under terms disclosed Tuesday, BlackRock, GIP and Terminal Investment will acquire units that hold 80% of the Hutchison Ports group. The consortium will also acquire 90% of Panama Ports Co., which operates the two ports in Balboa and Cristobal, on either side of the Panama Canal.

“We’ll probably have ownership of the Panama Canal ones very shortly,” Fink told a financial industry conference Tuesday.

As Trump publicly complained about China’s influence over the canal, Panama’s government weighed whether to cancel its contract with CK Hutchison to operate the ports, Bloomberg reported last month.

That arose even though CK Hutchison is based in Hong Kong, a Chinese territory with its own borders, currency and legal system. Beijing has clamped down on the former British colony since 2020 when it imposed a broad national security law that paved the way for a crackdown on dissent.

Reached Wednesday morning in Asia, CK Hutchison referred to Sixt’s earlier statement. In it, he said, “I would like to stress that the transaction is purely commercial in nature and wholly unrelated to recent political news reports concerning the Panama Ports.”