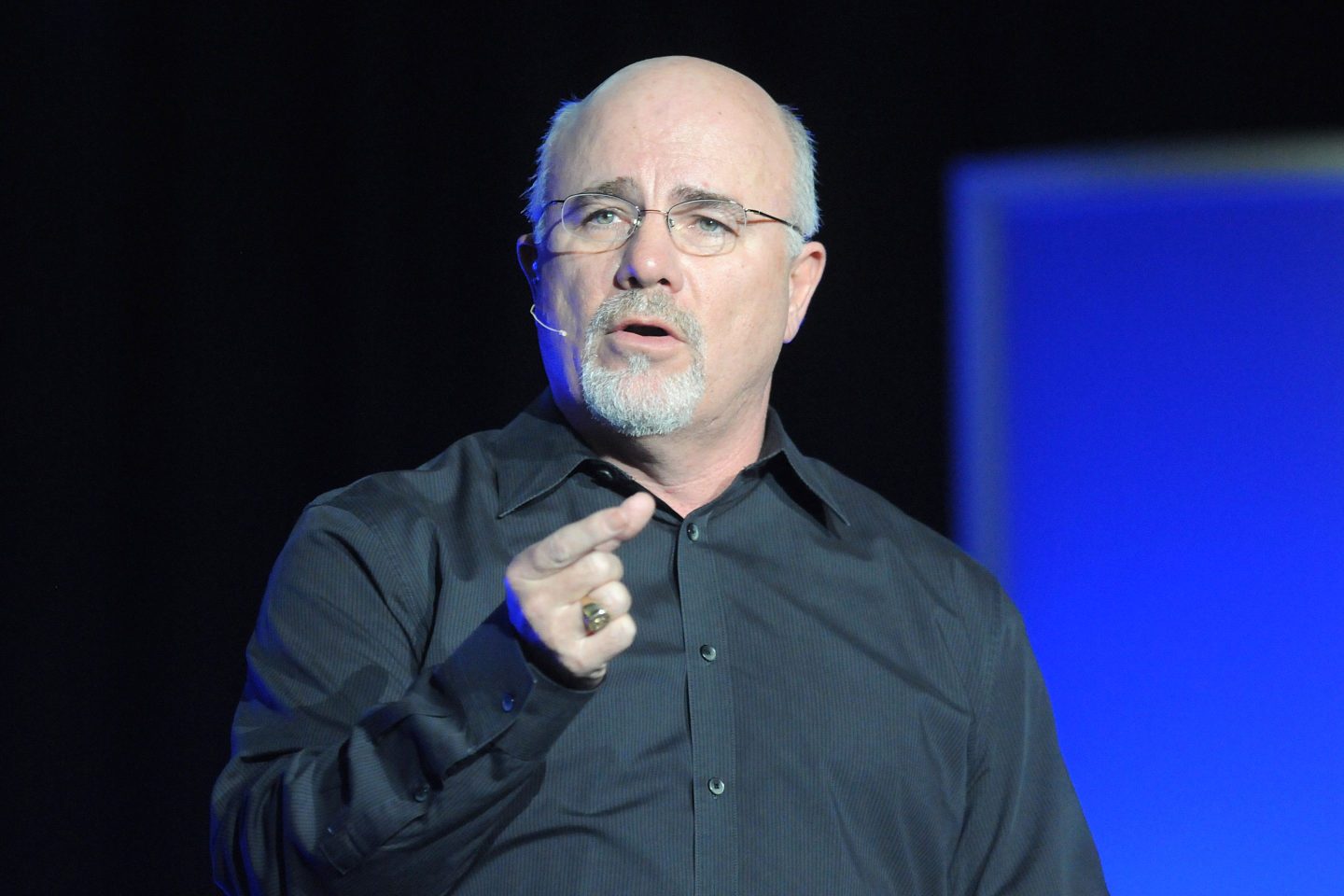

- Dave Ramsey, a personal finance guru and radio host, says he can tell who will stay paycheck-to-paycheck by the cars parked in front of their modest homes. His money advice could help Americans, who are $1.66 trillion deep in auto debt.

Driveways decked out with Audis and Porches may be a smokescreen for the actual financial situation of their owners, according to one financial expert.

“The way you know someone is going to stay middle-class is when they have two very nice cars that are obviously $500, $600, $700 payments, sitting in front of a middle-class house,” Dave Ramsey, personal financial expert and radio host, said on his show last year. “One hundred percent, those people are going to stay middle-class until they break that habit. It’s a huge indicator.”

Many Americans are struggling with money management, and Ramsey often takes calls with his 3.88 million YouTube listeners who are in a pinch. If there’s one thing he espouses above all else, it’s that people shouldn’t be living outside of their means. While he thinks it’s perfectly okay for a billionaire to drive off the lot with a brand-new Mercedes, the average worker shouldn’t.

Read more from Fortune

“One of the guidelines we’ve developed here is to not have more than half your annual income tied up in things that have motors and wheels,” Ramsey said. “We tell folks not to buy a brand-new car until you have a net worth of a million dollars. If you do have a car, you should sell it if it violates those things.”

Instead, he suggests that middle-class earners should buy used cars. Otherwise, they would have too many assets sinking in value while they’re already financially struggling. Ramsey refers to nice cars as “toys,” and says that they should be out of the question until they hit that seven-figure status.

And Ramsey has a point—missed car loans and other forms of consumer debt are dragging working Americans into sticky situations.

America’s auto-loan debt

Many people in the U.S. are deep in debt—so much so, that the nation’s household debt ballooned to $18.04 trillion in the third quarter of 2024. And auto debt has continued to worsen.

“While mortgage delinquency rates are similar to pre-pandemic levels, auto loan delinquency transition rates remain elevated,” Wilbert van der Klaauw, economic research advisor at the New York Federal Reserve, said in a press release. “High auto loan delinquency rates are broad-based across credit scores and income levels.”

American auto-loan balances increased by $11 billion in the fourth quarter of 2024, standing at $1.66 trillion in total. And when it comes to serious delinquency—when a borrower is 90 days behind or more in payments—the numbers are rising with auto loans and credit card debt. About 2.96% of loans flowed into serious delinquency in the third quarter of 2024, compared to 2.66% in the third quarter the year prior. Americans are falling deeper into debt—and it’s hurt their ability to climb out of a financial hole.