Outgoing Washington Gov. Jay Inslee is proposing a novel tax on personal wealth above $100 million in hopes of plugging a budget shortfall and averting cuts to education, mental health services and police.

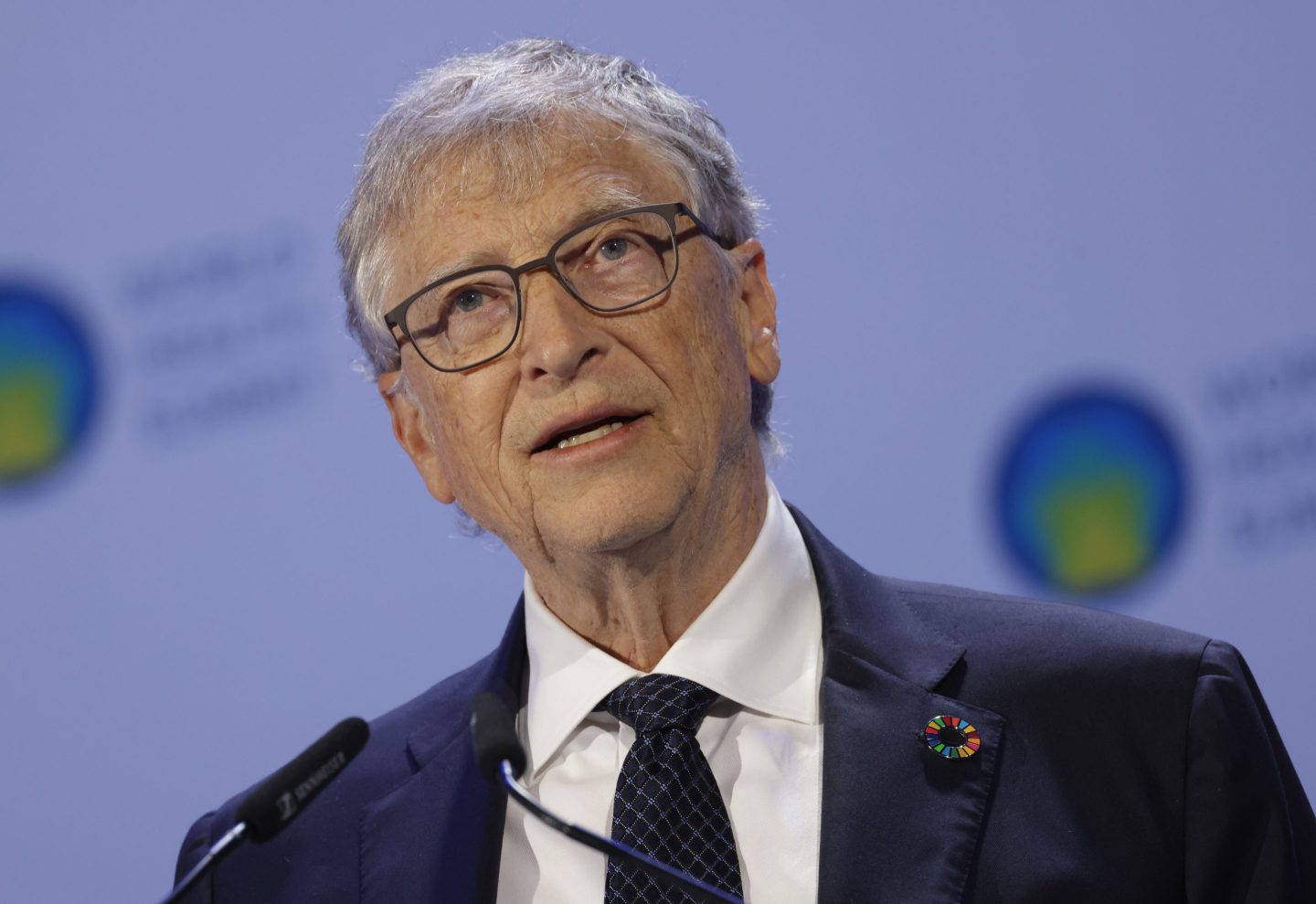

The tax would apply to about 3,400 residents — Microsoft founder Bill Gates among them — and bring in $10.3 billion over four years, Inslee, a Democrat, said Tuesday.

No other states — and only a few countries — have taxes structured the way Inslee is proposing, according to the Tax Foundation, a conservative-leaning policy organization.

Inslee’s successor as governor, Democrat Bob Ferguson, did not immediately respond to an email seeking comment. He recently told The Seattle Times he would not rule out tax increases to cover the budget shortfall, which Inslee said is estimated at $16 billion over four years.

Lawmakers in several Democratic-led states, including Washington, have in recent years proposed wealth or other taxes on their richest inhabitants, with Massachusetts voters in 2022 approving a “millionaire tax” — an income tax surcharge on those making more than $1 million a year.

Washington, which does not have an income tax, is considered to have one of the most regressive tax systems in the country, meaning lower-income residents pay a larger share than richer ones. Voters in November overwhelmingly upheld the state’s new capital gains tax against a repeal effort, demonstrating a desire to make the tax system fairer, Inslee said.

“The state and the nation has to respond to this inequity beyond human imagination,” Inslee said. “We cannot survive as a healthy, robust community … while we have this level of poverty and want amidst this enormous wealth.”

Republicans in the Legislature blasted the proposal, saying the state has a problem with spending, not revenue. In an emailed statement, Rep. Travis Couture, of Allyn, the ranking Republican on the House Appropriations committee, called it unserious.

“Governor Inslee’s $13 billion tax hike and reckless spending increase show just how out of touch his administration is with the financial realities facing Washington families,” Couture said.

The Tax Foundation calls wealth taxes “economically destructive,” saying they encourage perverse tax-avoidance strategies. Jared Walczak, the organization’s vice president of state projects, said Tuesday that only four countries have taxes on wealth — Norway, Spain, Switzerland and, recently, Colombia — while several others had repealed them, including Austria, Denmark, Germany and France.

Such taxes can be challenging to administer because some assets — a private business that’s never been sold, for example — can be difficult to value, Walczak said. And unlike taxes on profits, taxes on wealth can cut into the principal value of an asset. The tax could be imposed even if the asset is losing money, he said.

“This can significantly erode capital and discourage investment and economic growth,” Walczak said.

Washington is among a number of states facing budget shortfalls. Inslee blamed inflation, higher caseloads in social safety net programs, and lower-than-expected state revenues from home sales and the capital gains tax.

Inslee said that in addition to the wealth tax, his budget proposal includes increased taxes on about 20,000 businesses annual income of more than $1 million in the “service and other activities” category, such as some lawyers and accountants.

It also includes $2 billion in cuts or delayed spending, including by shuttering the Mission Creek Corrections Center for Women because of less need for lower-security beds.