Good morning.

At the start of this year, when chipmaker Nvidia was a slip of a thing that hovered around $48 a share, conversations about AI felt tinged with existential angst. Many leaders said they were all in, eager to learn more and vowing to disrupt themselves, lest they be disrupted. We all assumed the impact was going to be big—so big that a majority of AI experts polled predicted there was at least a 5% chance it would cause human extinction.

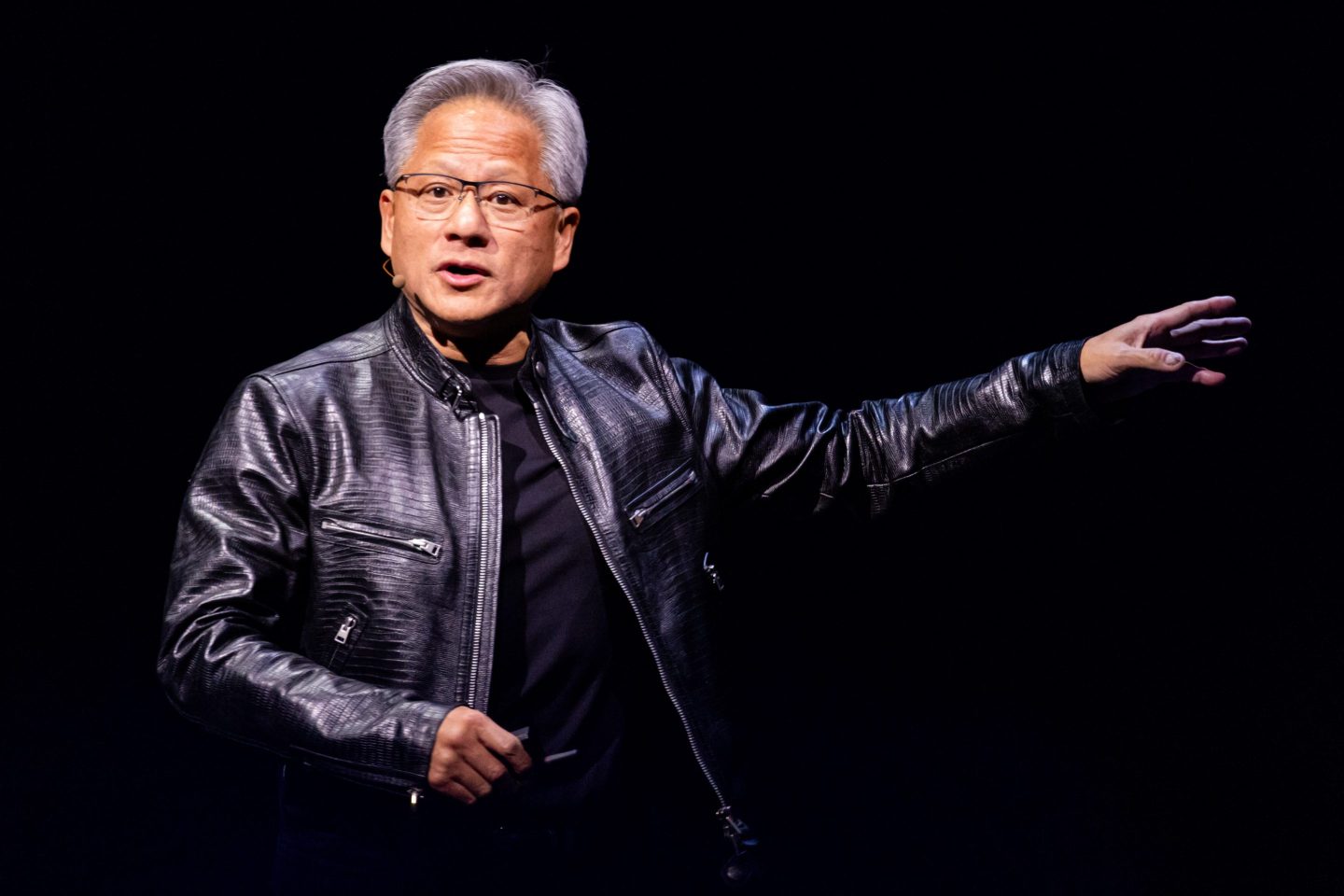

Interest remains strong in AI and Nvidia, which is still up 150% this year after reporting a minor production snag amid strong earnings yesterday, and up almost 3,000% in the past five years. But the mood around the speed of disruption and the immediate impact on business has shifted. More familiarity with generative AI has brought more comfort in understanding how to use it. There’s also more awareness of AI’s limitations, from the softball questions at a Google staff meetings and bots spreading disinformation to employee distrust and regulation.

When I’m speaking to leaders, I often ask how they’re doing in AI. One CEO in the finance sector recently told me that he felt relieved when a new AI tool didn’t quite work as planned: “It gave us some breathing room to go at a more human pace.” Another told me they’re doing smaller projects to incorporate customer feedback before making whole scale changes. Add in the time and expense needed to label data and train workers.

That doesn’t diminish the long-term impact of AI or its leading player. Nvidia CEO Jensen Huang said yesterday that he’s “seeing the momentum of generative AI accelerate.” We’re seeing a company that’s doing well but looking a little more down-to-earth, beset with the same employee issues and production snafus as the rest of us.

The person who first put Nvidia on my radar screen is John Chambers, the former CEO of Cisco. When I helped him write a book several years ago, he said Nvidia was well-positioned to be a leader in AI. He ought to know: Cisco became the most valuable company on the planet during his tenure. Then the dot.com bubble burst, Cisco shares dropped almost 90% from their high, and Chambers had to rebuild. Today, Cisco is a successful company with numerous competitors. Some wonder if that could be the trajectory of this era’s tech superstars.

More news below.

Diane Brady

diane.brady@fortune.com

Follow on LinkedIn

TOP NEWS

Crowdstrike's 'resilience'

Crowdstrike CEO George Kurtz emphasized the "resilience" of his staff after the cybersecurity company reported $969.3 million in second quarter earnings on Wednesday, only slightly below analyst predictions. The company previously cautioned that their earnings would be lower than expected after an update to its software last month caused 8 million computer systems to malfunction. Fortune

Berkshire Hathaway hits $1 trillion

Berkshire Hathaway officially became the first non-tech company in the U.S. to reach a market cap of $1 trillion on Wednesday. Class A shares in the conglomerate, run by 93-year-old Warren Buffett, were selling for a record of more than $699,000. Fortune

No coffee runs

Mineral Resources CEO Chris Ellison has already banned working from home. Now he's urging employees to stay parked at their desk inside the Australian company's HQ, which is outfitted with a cafe, restaurant, and gym. “I don’t want them leaving the building," he says. "So I don’t want them walking down the road for a cup of coffee. We kind of figured out a few years ago how much that costs.” Fortune

AROUND THE WATERCOOLER

Wall Street’s AI darling Super Micro postponed earnings while under short seller’s microscope by Will Daniel

Gen Z is actually taking sick days, unlike their older coworkers. It’s redefining the workplace by Sasha Rogelberg

Klarna has 1,800 employees it hopes AI will render obsolete by Ryan Hogg

Meta has abandoned efforts to make custom chips for its upcoming AR glasses by Kali Hays

Temu’s billionaire founder lost his title as China’s richest person just 20 days after winning it by Sydney Lake

Why Honeywell has placed such a big bet on Gen AI by John Kell

Google now uses AI to moderate staff meetings and employees say it asks softball questions by Marco Quiroz-Gutierrez

This edition of CEO Daily was curated by Joey Abrams.