Ivan Boesky, who reached the pinnacle of fame and fortune as a high-flying Wall Street arbitrageur in the 1980s only to be exposed as a cheat in the insider-trading scandal that defined the era, has died. He was 87.

The New York Times reported his death, citing his daughter, Marianne Boesky. No details were immediately available.

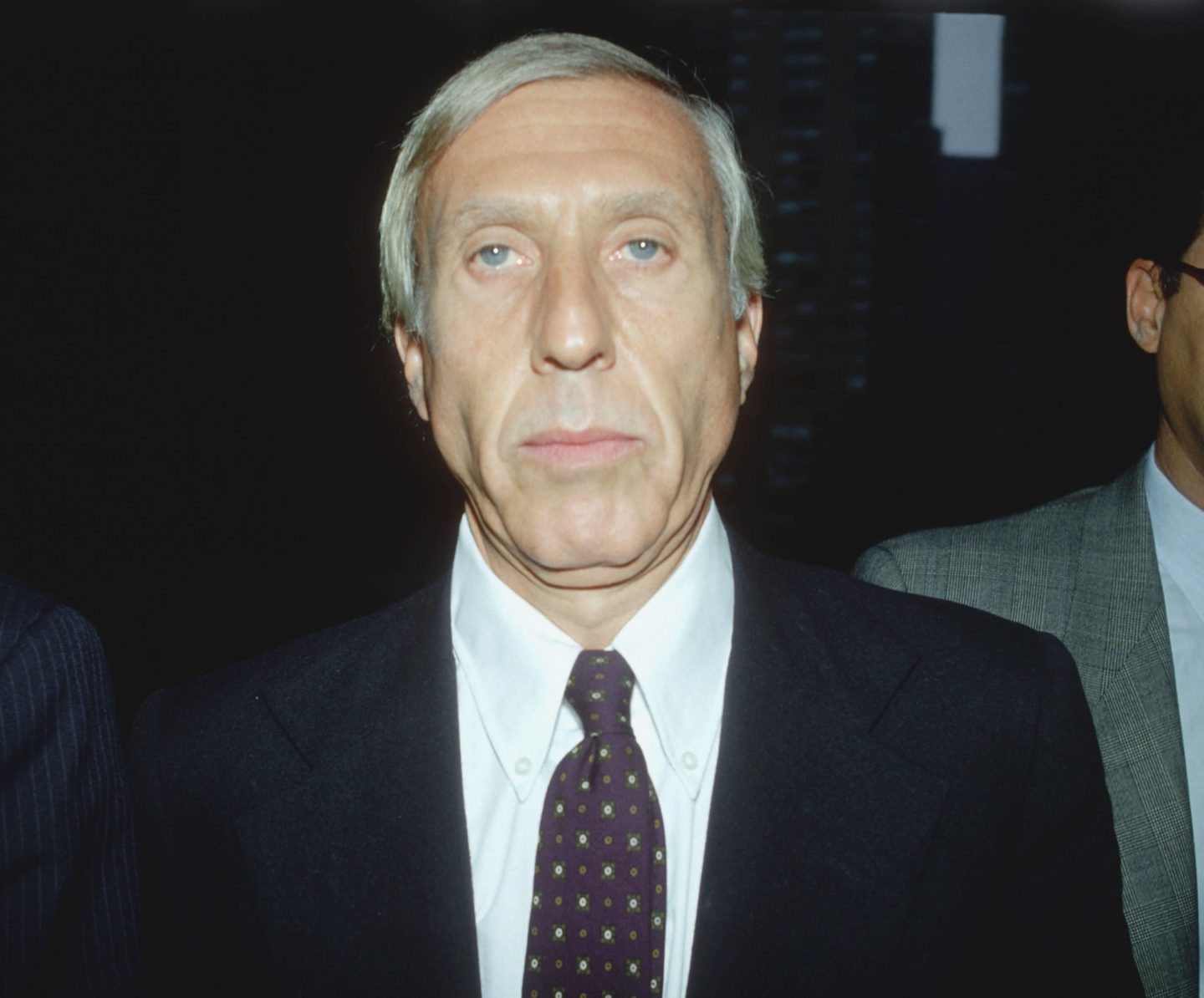

As junk bonds fueled a wave of hostile acquisitions, Boesky became the archetype of the savvy speculator, reaping hundreds of millions of dollars in profits on takeover bets. Then, after admitting to insider trading, Boesky became the poster child for Wall Street greed, his elongated face and toothy smile on the cover of Time magazine with the headline, “Ivan the Terrible.” He spent two years in prison.

Boesky’s case set off shock waves not only on Wall Street but across the US, confirming some investors’ worst fears about how capital markets worked. He was believed to have been the model for the character of Gordon Gekko, the rapacious villain played by Michael Douglas in the 1987 film Wall Street. Gekko’s speech in the movie, declaring that “greed is good,” echoed Boesky’s own assessment.

“Greed is all right, by the way,” Boesky told graduates of the University of California at Berkeley’s business school in 1986, months before his downfall. “I want you to know that. I think greed is healthy. You can be greedy and still feel good about yourself.”

Michigan Bars

Ivan Frederick Boesky was born on March 6, 1937, in Detroit, the second child of William and Helen Boesky. His father ran a chain of local bars, called the Brass Rail.

At age 12, Boesky attended Cranbrook, a prestigious private academy in Bloomfield Hills, a Detroit suburb, where he became fanatical about wrestling and received a trophy as “wrestler of the year.” Despite the athletic success, he left Cranbrook abruptly before graduating and transferred to a public school.

Boesky attended Wayne State University in Detroit, the University of Michigan and Eastern Michigan University. He didn’t finish but attended Detroit College of Law, where he earned a degree in 1964.

By that time, Boesky had married Seema Silberstein, daughter of Detroit real estate developer Ben Silberstein, whose properties included the Beverly Hills Hotel. He clerked for a federal judge in Detroit, a Silberstein relative, but was unable to land a job at one of the city’s top law firms.

After his father’s death in 1964, Boesky took over the last remaining Brass Rail bar, which by then featured topless dancers, and re-named it Le Club a-Go-Go, according to a 1993 Vanity Fair article. Two years later it went bankrupt and Boesky moved to New York, where he started a new career on Wall Street.

After several years working at financial firms where he learned the business of risk arbitrage, Boesky started his own investment fund in 1975 with $700,000 from his in-laws.

After six years of betting on the stocks of companies that were in play, he formed a new fund, just in time for a wave of takeovers that changed the landscape of corporate America.

In 1984, Boesky earned more than $100 million from Texaco Inc.’s acquisition of Getty Oil Co. and Chevron Corp.’s purchase of Gulf Oil Co., according to a 1984 Atlantic magazine story. The following year, he earned an estimated $50 million when Philip Morris Cos. acquired General Foods Corp.

Unlike other arbitragers who generally avoided publicity, Boesky embraced it. He hired a publicist to get him quoted in the media, wrote a 1985 book about his experiences in high finance called “Merger Mania” and traveled the country to promote it in speeches.

SEC Probe

By the mid-1980s, the bull market on Wall Street that allowed savvy investors to make millions also led regulators to suspect the markets were rigged in favor of those with inside information.

The Securities and Exchange Commission in mid-1985 opened a probe into suspicious trading by two Venezuela-based employees of Merrill Lynch & Co. that led them on a tangled path into cheating on Wall Street that ensnared Dennis Levine, an investment banker at Drexel Burnham Lambert Inc.

One year later, in June 1986, shortly after he was arrested for insider trading, Levine pleaded guilty and agreed to co-operate with the U.S. Attorney in Manhattan, Rudy Giuliani. Levine told federal prosecutors he had provided Boesky with nonpublic information about potential deals. Accused of making about $12 million from illegal trades, Levine was later sentenced to two years in prison.

A few months later, Boesky cut a deal with the government. He would plead guilty to one felony charge of conspiring to file false trading records, pay $100 million in penalties and cooperate with federal authorities.

As part of the agreement, Boesky secretly recorded his conversations with traders to help the government build cases against other Wall Street figures. The most notable of them was Michael Milken, Drexel Burnhan’s head of high-yield junk bond trading, who helped finance many of the era’s corporate takeovers. Milken, who served almost two years in prison for violating securities laws, was pardoned in 2020 by then-President Donald Trump.

Boesky faced a maximum of five years in prison but based on his cooperation with authorities, he was sentenced to three years. In April 1990, after serving about two years, he was released.

In a letter to a federal judge supporting the reduced sentence, prosecutors credited the financier for helping them to understand the extent of Wall Street abuses: “What Boesky has given the government is a window on the rampant criminal conduct that has permeated the securities industry in the 1980s, to an extent unknown to this office before Boesky began cooperating.”

Unlike Milken, who spent much of his post-prison life engaged in philanthropy, Boesky largely disappeared from public view after his release. In 1991, Seema Boesky filed for divorce, which was finalized two years later. The couple had four children: William, Marianne, Theodore and John. He subsequently lived with his second wife, Ana.