The Global Financial Crisis threw millions of Americans out of their homes and jobs, upending the entire economy. But for the private credit industry, it was actually an awakening of sorts.

Over the past few decades, U.S. banks’ problems have signaled opportunity for the private credit market, and that’s particularly true of the Global Financial Crisis and the collapse of Silicon Valley Bank last March. When banks have issues, U.S. businesses’ desire for capital rarely wanes dramatically, and that leaves room for alternate lenders.

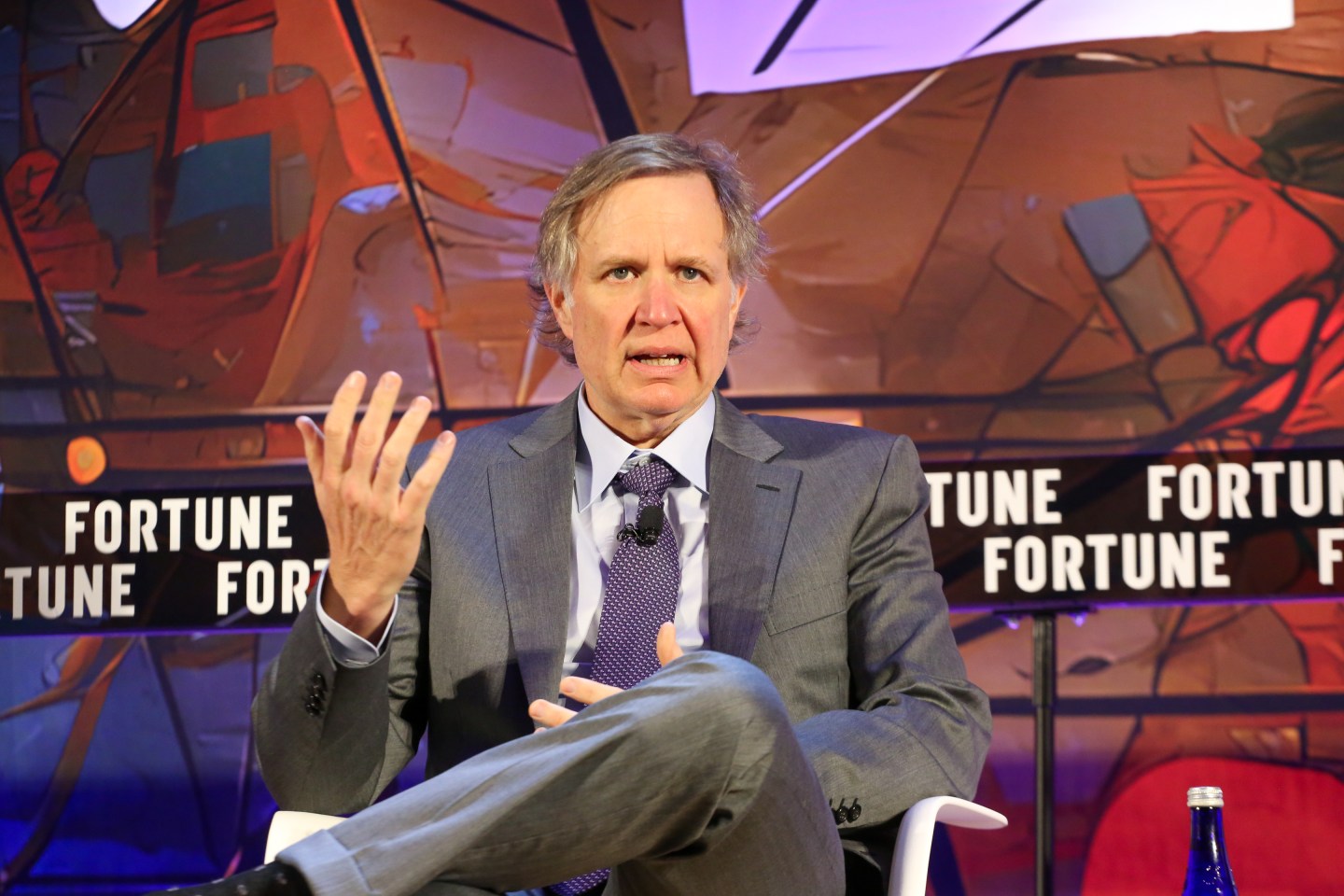

At the Fortune Future of Finance conference on Thursday, Joshua Easterly, co-CIO and co-president of the global investment firm Sixth Street, explained how he was working at Goldman Sachs after the Global Financial Crisis in 2009, running a team that did public and private market transactions in distressed debt and special situations, when he came to the realization that the lending industry had changed forever.

“It was the intended consequence, not the unintended consequence of regulations after the Crisis,” he said of the private credit boom. “Policymakers…wanted to figure out how to diffuse risk away from the taxpayer, but you couldn’t crush the economy by reducing credit, and so private credit history grew.”

Easterly argued that the private credit industry has a “better model” than the banking industry when it comes to lending risk, because it holds more capital for loans on balance sheets. And that made him come to a startling realization in 2009. “Huh? I think I need to go find a new job,” he recalled saying to a colleague. “So [the move to private credit] was a little bit about necessity.”

Carey Lathrop, partner and chief operating officer of credit at Apollo Global Management, echoed Easterly’s comments, noting that when he started in the private credit industry “it was clear how hard it was to get things done that made economic sense” in public markets after the GFC.

The rise of private credit since 2008 has been historic, to say the least. Before the crisis, there was under $400 billion in total assets and committed capital in private credit. In 2023, that number jumped to $2.1 trillion, according to the International Monetary Fund. But it wasn’t just the Crisis that spurred the private credit boom. After the collapse of several regional banks in March 2023, headlined by the tech startup focused Silicon Valley Bank, businesses nationwide once again turned to private credit amid a liquidity crunch.

While SVB struggled after rapidly rising interest rates devalued its long-dated bonds, leading to a run on deposits from its list of influential and well-connected clientele, the manner in which private credit operates can lead to more stability in trying times.

Apollo’s Lathrop explained that banks like SVB “had this mismatch with a lot of long-term assets with assets with short term liabilities” that led to unrealized loan losses on their books as rates soared. But private credit doesn’t have this same issue. “We don’t run the [private credit] business that way,” he noted. “We were much more match funded.”

To his point, unlike banks, which fund a majority of their lending through customer deposits (and often uninsured deposits), private credit funds tend to use money from wealthy investors and institutions to make loans, leaving them less exposed to rising interest rates.

Sixth Street’s Easterly said the SVB drama essentially showed “the robustness” of the private credit] business model, leading a raft of new clientele. “I think it was a watershed moment for the value of the asset class.”

[This report’s photo caption has been corrected, with regard to its depiction of Joshua Easterly.]